Beware: Bank of America Cashier's Check Scams - Protect Yourself

Have you ever received an unexpected cashier's check, seemingly from Bank of America, promising a windfall? While it might feel like a stroke of luck, it could be a sophisticated scam. This article dives deep into the world of Bank of America cashier's check fraud, equipping you with the knowledge to protect yourself and your finances.

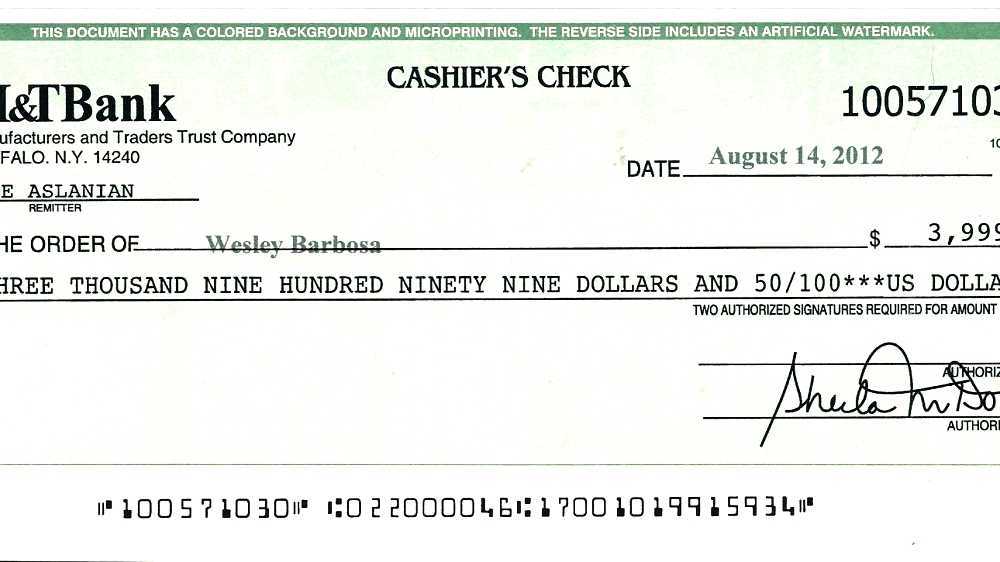

Fake cashier's checks, often purporting to be from Bank of America, are a common tool used by scammers. These fraudulent checks can look incredibly authentic, making it difficult for even seasoned banking customers to spot the difference. The scam often involves receiving a check for a surprisingly large amount, with instructions to deposit it and then wire a portion of the funds back to the sender. The catch? The cashier's check is counterfeit, and once the bank discovers the fraud, you're liable for the wired funds.

The history of cashier's check fraud predates online banking, but the internet has amplified its reach and sophistication. Initially, these scams relied on physical mail, but now they often originate through online marketplaces, phishing emails, and even social media. The rise in online transactions has provided fertile ground for these fraudulent schemes to flourish.

Understanding the mechanisms of these scams is crucial. Scammers often create elaborate scenarios, such as overpayment for goods sold online or lottery winnings. They pressure victims to act quickly, creating a sense of urgency that discourages careful scrutiny. This pressure tactic plays a key role in the success of these fraudulent schemes.

Protecting yourself from Bank of America cashier's check scams involves a combination of vigilance and skepticism. Never deposit a cashier's check from an unknown source, especially if it's accompanied by unusual requests. Verify the authenticity of the check directly with Bank of America, and avoid wiring funds back to anyone you don't know and trust implicitly.

While there are no actual benefits to Bank of America cashier's check scams (for the victim), understanding the scammer's perspective can shed light on their motivations. They exploit trust in established institutions like Bank of America, prey on financial vulnerability, and capitalize on the perceived legitimacy of cashier's checks.

If you suspect you've encountered a fraudulent Bank of America cashier's check, immediately contact the bank and report the incident to the appropriate authorities. Document all communication with the scammer and retain any physical evidence, such as the check itself. This information can be crucial in investigating and potentially recovering your funds.

Advantages and Disadvantages of Knowing About Cashier's Check Scams

| Advantages | Disadvantages |

|---|---|

| Increased awareness and ability to protect yourself. | Increased anxiety about financial transactions. |

| Ability to educate others about these scams. | Potential for over-caution and missed legitimate opportunities. |

Fake check scams, involving not just Bank of America but other institutions as well, are continually evolving. Stay informed about the latest scam tactics by regularly reviewing consumer protection resources and security alerts issued by banks. Knowledge is your best defense against these fraudulent activities.

Frequently Asked Questions:

1. What should I do if I receive a suspicious cashier's check? Contact Bank of America directly to verify its authenticity.

2. How can I tell if a cashier's check is fake? Look for inconsistencies, such as blurry logos or incorrect bank information. Contact the issuing bank to confirm the check's validity.

3. Are cashier's checks guaranteed? While generally considered safe, counterfeit cashier's checks exist. Always verify the check's legitimacy.

4. Can I be held responsible for depositing a fake cashier's check? Yes, you are liable for the funds deposited, even if you were unaware it was counterfeit.

5. What information should I provide to the bank if I suspect fraud? Provide all details of the transaction, including the sender's information and any communication you've had with them.

6. How can I avoid becoming a victim of a cashier's check scam? Be wary of unsolicited offers, never wire money to strangers, and always verify the authenticity of cashier's checks.

7. Where can I report a cashier's check scam? Report it to Bank of America, the Federal Trade Commission (FTC), and your local law enforcement agency.

8. Are there other similar scams to watch out for? Yes, be aware of scams involving money orders, personal checks, and wire transfers.

Tips and Tricks: Remember, if something sounds too good to be true, it probably is. Trust your instincts and exercise caution in all financial dealings.

In conclusion, Bank of America cashier's check scams are a serious threat to your financial well-being. By understanding how these scams operate and taking proactive steps to protect yourself, you can significantly reduce your risk of becoming a victim. Staying informed, verifying information, and reporting suspicious activity are crucial in combating this form of fraud. Remember that vigilance and skepticism are your strongest allies in navigating the complex world of online and financial transactions. Don't hesitate to contact Bank of America or the appropriate authorities if you suspect fraudulent activity. Protecting your financial security is a continuous effort, and staying informed is the first step towards safeguarding your hard-earned money. Share this information with your friends and family to help them stay protected as well. Knowledge is power, and in this case, it's the power to protect yourself from financial harm.

Jacaranda trees unveiling their tropical homeland

Po box 5332 sioux falls sd 57117

The humble power of a 60 piece tool set unveiling the husky mechanics kit