US Bank Check Endorsement: What You Need to Know Before You Sign (Probably on the Back)

Let's talk old-school finance, people. Yeah, you know, that thing with paper and signatures? Specifically, those rectangular slips of hope (or maybe dread) known as checks. They're still a thing, believe it or not, and if you bank with US Bank, you might just find yourself needing to navigate the surprisingly treacherous waters of check endorsement.

Because let's face it, signing on the dotted line isn't always as straightforward as it seems. One wrong move and you could be setting yourself up for a world of financial pain. Think bounced checks, frustrated phone calls to customer service, and maybe even a touch of identity theft. Fun times, right?

That's why we're diving deep into the wild world of US Bank check endorsements. We'll break down everything you need to know to conquer those little signature lines like a pro, from the different types of endorsements to common pitfalls to avoid. Consider this your guide to keeping your money where it belongs: safely in your account.

Because in this digital age, where Venmo and Apple Pay reign supreme, knowing the ins and outs of a good old-fashioned check endorsement can feel oddly empowering. It's like possessing a secret financial handshake, a nod to the days when banking was a bit more... analog.

So whether you're a seasoned check-casher or a digital native facing your first paper transaction, buckle up. We're about to demystify US Bank check endorsement and give you the knowledge you need to navigate the world of paper finance with confidence. (And hey, maybe impress that teller while you're at it.)

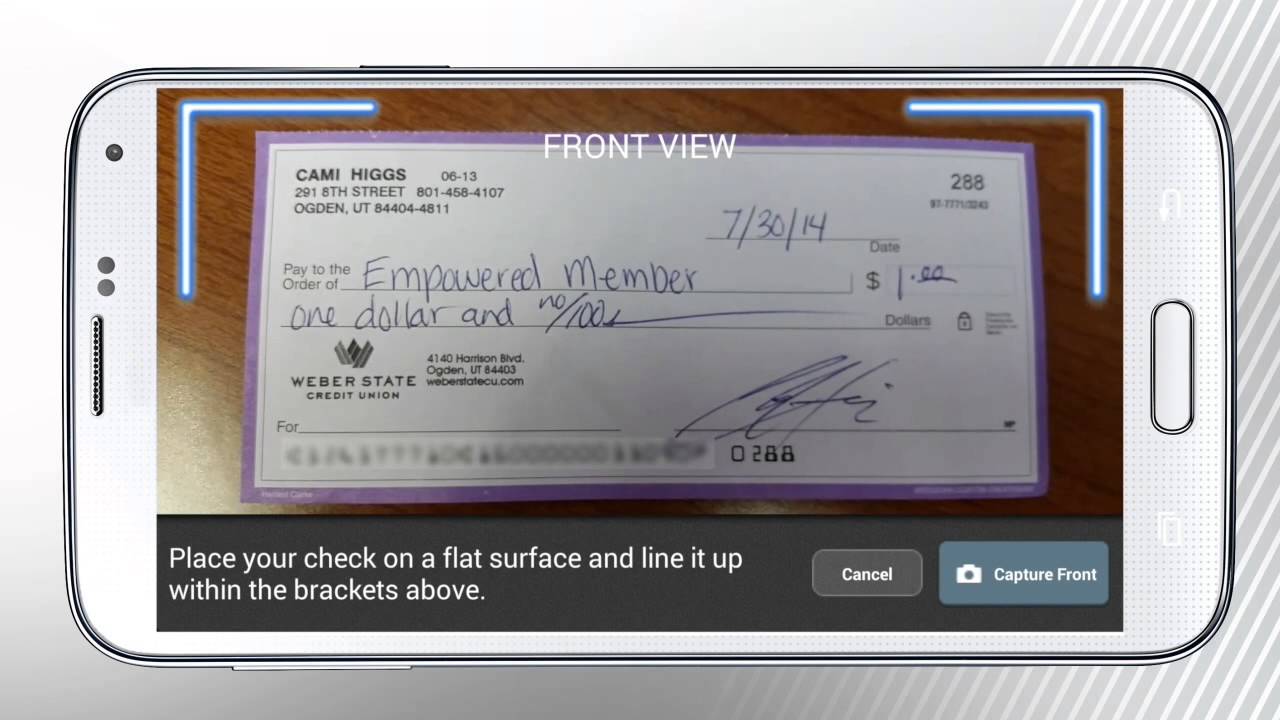

Endorsing a check, in the simplest terms, means signing it on the back to make it valid for deposit or cashing. Think of it as your official stamp of approval, letting the bank know you're the rightful owner of those precious funds. Seems simple enough, right? Well, it can get a little more complex when you factor in the different types of endorsements and the potential risks involved.

There are a few main types of endorsements you should be familiar with, each with its own set of rules and implications:

Blank Endorsement: This is the most basic type, where you simply sign your name on the back of the check. While easy-peasy, it's also the riskiest because anyone who gets their hands on the endorsed check can cash it.

Restrictive Endorsement: Playing it safe? This endorsement type allows you to add a restriction, typically "For Deposit Only" followed by your signature and account number. This limits the use of the check to only being deposited into your account.

Special Endorsement: This one's for the advanced players. A special endorsement allows you to transfer the check to someone else by writing "Pay to the order of [person's name]" above your signature. Just be sure you trust the person you're signing over your hard-earned cash to!

Now, let's talk about avoiding check fraud. Because as much as we'd like to think everyone has good intentions, the sad reality is that check fraud is still a thing. But don't worry, a few simple precautions can save you a whole lot of hassle:

Endorse checks immediately before depositing or cashing: An unendorsed check is an open invitation for fraudsters.

Use a pen with permanent ink: Those fancy erasable pens might seem cool, but they're a big no-no when it comes to checks. Make your signature permanent!

Double-check everything: Before handing over that endorsed check, make sure all the information is correct, and the endorsement matches the payee's name. A simple error can lead to delays and headaches.

Navigating the world of US Bank check endorsement might seem like stepping back in time, but trust us, it's a skill worth mastering. By understanding the different endorsement types and following some basic safety tips, you can ensure your financial transactions are smooth, secure, and hassle-free. So go forth and conquer those paper checks with the confidence of a true financial ninja!

Finding the perfect behr paint store near you

Unlocking financial wellness with new mexicos employee state credit union

Craigslist san jose kittens