Unraveling the Mystery of "Contoh Pengiraan Cukai Pendapatan"

Let's talk about taxes. We know, we know – not the most exhilarating topic. But what if we told you that understanding a key phrase, "contoh pengiraan cukai pendapatan," could be the difference between confidently navigating your finances in Malaysia and feeling utterly lost? Stay with us, because this is important.

Imagine this: you've just landed your dream job in Malaysia. Congratulations! You're excited, maybe a little overwhelmed, and then it hits you – taxes. Specifically, Malaysian income tax. Suddenly, "contoh pengiraan cukai pendapatan" doesn't seem like just a mouthful of foreign words, does it?

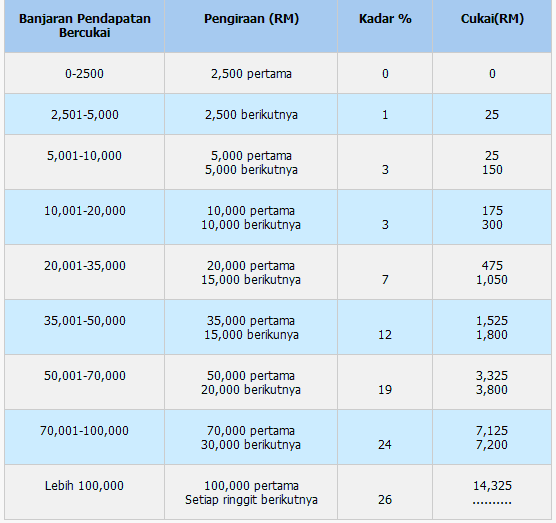

In essence, "contoh pengiraan cukai pendapatan" translates to "income tax calculation examples" in Malay. This seemingly simple phrase opens the door to a world of financial understanding in the Malaysian context. It's the key to deciphering how much income tax you owe, ensuring you're paying the correct amount, and potentially even finding ways to legally reduce your tax burden.

But it's more than just numbers on a page. "Contoh pengiraan cukai pendapatan" represents a system – a system designed to ensure fairness and support the Malaysian economy. By understanding these examples, you gain insight into how the system works, your role within it, and how to make it work for you.

Think about it – wouldn't it be empowering to confidently approach your tax obligations, knowing that you have a grasp on the fundamental principles behind those calculations? That's the power of "contoh pengiraan cukai pendapatan." It's about taking control of your financial well-being and navigating the Malaysian tax landscape with knowledge and confidence. So, let's dive deeper into this essential concept and demystify the world of Malaysian income tax calculation.

Now, while we can't provide specific financial or tax advice (we're writers, not accountants!), we can certainly explore the significance of "contoh pengiraan cukai pendapatan" and why it matters. Let's break down some key aspects:

Advantages and Disadvantages of Understanding "Contoh Pengiraan Cukai Pendapatan"

| Advantages | Disadvantages |

|---|---|

| Improved financial literacy and awareness | Can be time-consuming to initially learn and understand |

| Potential for identifying tax savings and deductions | Tax laws and regulations can change, requiring ongoing updates |

| Increased confidence in managing personal finances | Misinterpretation of examples could lead to errors in tax filing |

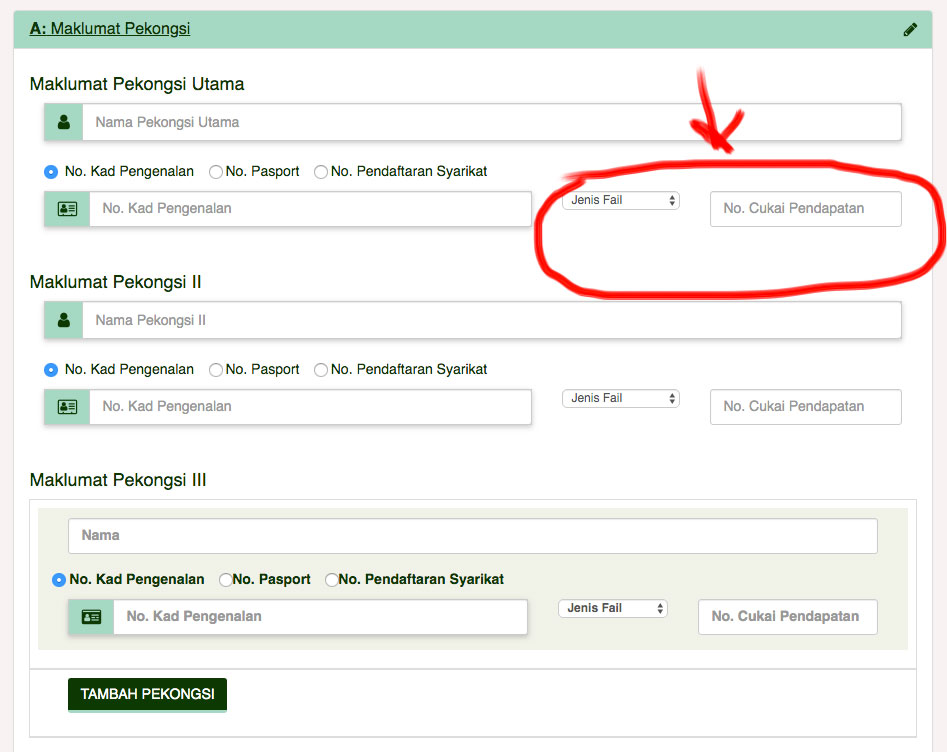

For those seeking a deeper understanding, numerous resources are available online and offline. The Lembaga Hasil Dalam Negeri Malaysia (LHDN), the Malaysian Inland Revenue Board, is an excellent starting point. Their website offers comprehensive information, guides, and even online calculators related to income tax in Malaysia.

Remember, understanding "contoh pengiraan cukai pendapatan" is not about becoming a tax expert overnight. It's about empowering yourself with the knowledge to approach your financial obligations with clarity and confidence.

Upgrade your bathroom the allure of bathtub shower combos with glass doors

Crafting the perfect graduation speech examples and inspiration

The eloquent space above your king a guide to art sizing