Unlocking Your Wells Fargo Check Details: A Simple Guide

Need to find details about a specific check? Understanding your Wells Fargo check information is crucial for managing your finances. Whether you’re tracking expenses, verifying payments, or reconciling your account, knowing how to access and interpret this information is key. This guide will walk you through the process, providing clear and concise steps to help you navigate your Wells Fargo checking account with confidence.

Accessing your Wells Fargo check details doesn't have to be complicated. From online banking to mobile apps and in-person assistance, there are various ways to obtain the information you need. This guide aims to simplify the process, offering practical advice and answering common questions to make managing your check information as straightforward as possible.

In today's fast-paced world, managing our finances effectively is more important than ever. With the rise of online banking and digital transactions, understanding how to access and utilize your Wells Fargo check details is essential for maintaining a clear picture of your financial health. This guide will empower you with the knowledge and tools you need to take control of your checking account.

Staying informed about your Wells Fargo check activity can help prevent fraud and identify potential errors. Regularly reviewing your check information allows you to catch discrepancies early on and take appropriate action. This proactive approach can save you time, money, and unnecessary stress in the long run.

From reviewing recent transactions to understanding how to order copies of cleared checks, this guide offers a comprehensive overview of Wells Fargo check information management. Whether you're a seasoned Wells Fargo customer or new to the bank, this resource provides valuable insights and practical tips to help you navigate your checking account with ease.

Wells Fargo, a prominent financial institution with a long history, has offered checking accounts for generations. Understanding the history and development of check usage at Wells Fargo can provide context for how check information is managed today.

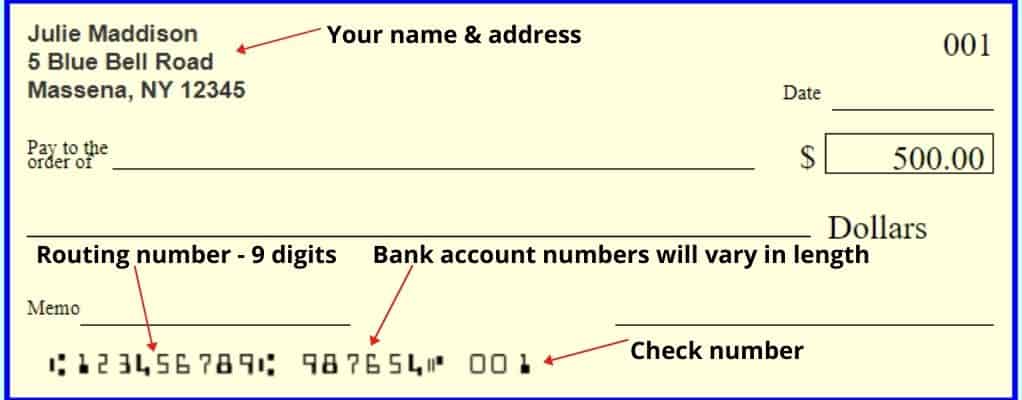

Wells Fargo check information encompasses various details related to your checks, including the check number, date, amount, payee, and transaction status. Accessing this information can help you verify payments, track expenses, and reconcile your account balance.

One of the primary benefits of readily available Wells Fargo check details is improved financial management. By tracking your spending through your check information, you can create a budget and identify areas where you can save. For example, reviewing your cleared checks can reveal recurring expenses that you might want to re-evaluate.

Another advantage is increased security. Regularly reviewing your Wells Fargo check information allows you to detect any unauthorized transactions or fraudulent activity. For instance, if you notice a check that you didn’t write, you can immediately report it to Wells Fargo and take steps to protect your account.

Accessing your Wells Fargo check information is typically straightforward. You can log in to your online banking account, use the Wells Fargo mobile app, or visit a local branch. Each method provides access to your check details, allowing you to view recent transactions, cleared checks, and other relevant information.

Tips for Managing Wells Fargo Check Information:

1. Regularly reconcile your account.

2. Keep your checkbook secure.

3. Review your check information frequently.

4. Report any discrepancies immediately.

5. Consider using online bill pay to reduce the number of paper checks you write.

Advantages and Disadvantages of Online Check Information Access

| Advantages | Disadvantages |

|---|---|

| 24/7 Access | Requires internet access |

| Convenient and fast | Security risks if not accessed through secure networks |

| Easy to track transactions | Potential technical issues |

Frequently Asked Questions:

1. How can I order copies of my cleared checks? Answer: You can typically order copies through online banking, the mobile app, or by contacting customer service.

2. What should I do if I notice a fraudulent transaction on my account? Answer: Immediately contact Wells Fargo to report the fraud and take necessary steps to secure your account.

3. Can I access my check information from my mobile device? Answer: Yes, through the Wells Fargo mobile app.

4. How far back can I view my check information? Answer: This depends on your account type and the method of access, but typically you can view several years of check history.

5. What if I lose my checkbook? Answer: Contact Wells Fargo immediately to report the loss and request a stop payment on any outstanding checks.

6. How can I set up alerts for my checking account activity? Answer: You can typically set up alerts through online banking or the mobile app.

7. Is there a fee to access my check information? Answer: Generally, there is no fee to access your check details through online banking or the mobile app.

8. How do I dispute a transaction on my checking account? Answer: Contact Wells Fargo customer service to initiate a dispute.

In conclusion, understanding and managing your Wells Fargo check information is fundamental to sound financial practices. From balancing your checkbook to detecting potential fraud, accessing your check details empowers you to take control of your finances. Utilizing the various tools and resources available, such as online banking, the mobile app, and customer service, can simplify the process and provide you with the information you need to make informed financial decisions. By actively engaging with your Wells Fargo check information, you can gain a clearer understanding of your spending habits, protect yourself from unauthorized activity, and maintain a healthy financial outlook. Take the time to familiarize yourself with the resources and options available to you, and remember that staying informed about your check details is an essential step in achieving your financial goals.

Han ye seul married unveiling the mystery

The secret sauce of great gamertags matching names for games decoded

Never wreck your wheels again mastering lug nut torque specs

/VoidedCheck-5a73c34bba6177003739388b.png)