Unlocking Your Paycheck: A Guide to Indonesian Monthly Income Tax Deductions

Ever wonder where a chunk of your hard-earned rupiah disappears to each month? No, it’s not just the delicious street food you can’t resist (though that plays a role). We’re talking about your monthly income tax deductions – the silent partner in your financial journey. Just like that friend who always insists on splitting the bill evenly despite having only a salad, these deductions are a non-negotiable part of being an employed citizen in Indonesia. But unlike that friend, these deductions actually contribute to something worthwhile – funding public services, infrastructure, and other important government initiatives.

In Indonesia, this system is known as "Potongan Pajak Gaji Bulanan," which directly translates to "monthly salary tax deductions." It’s a progressive system, meaning the more you earn, the more you contribute (tax brackets, anyone?). Now, before you start seeing red and plotting your escape to a tax haven, let's take a deep dive into the fascinating world of Indonesian income tax and uncover how you can not only survive but thrive in this financial landscape.

The history of income tax in Indonesia dates back to the Dutch colonial era, but the current system took shape in 1984. Initially, it was a complex beast with multiple rates and confusing regulations. However, over the years, the government has implemented reforms to simplify the system and promote transparency. The importance of this tax revenue for Indonesia cannot be overstated – it's the lifeblood of the nation's budget, funding everything from education and healthcare to infrastructure development and national defense.

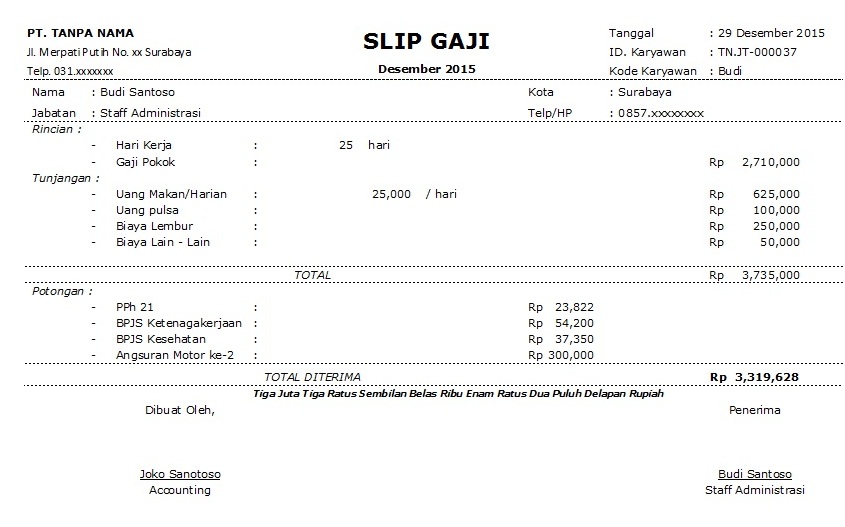

Understanding how your income tax is calculated is crucial for managing your finances effectively. It all starts with your "Penghasilan Tidak Kena Pajak" (PTKP) or non-taxable income. This is the amount of your income that the government considers essential for basic needs and is therefore exempt from tax. After deducting the PTKP, you are left with your taxable income. This is then subjected to a progressive tax rate, ranging from 5% to 30% depending on your income bracket.

Let's illustrate this with a simple example. Imagine you're a fresh graduate earning Rp 6,000,000 per month. Assuming your PTKP is Rp 4,500,000 annually (Rp 375,000 monthly), your taxable income would be Rp 2,625,000. This amount falls within the 5% tax bracket, resulting in a monthly income tax deduction of Rp 131,250.

Advantages and Disadvantages of Indonesian Monthly Income Tax Deductions

While no one enjoys seeing their salary shrink before it even hits their bank account, Indonesian monthly income tax deductions, like any well-established system, come with their own set of pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

While the Indonesian tax system may appear complex, arming yourself with knowledge is the first step to conquering your finances. Understanding your tax obligations, exploring available deductions, and planning your finances accordingly are essential for maximizing your earnings and achieving your financial goals. Remember, knowledge is power – and in this case, financial freedom!

Unveiling the pisces personality a look at the fish of the zodiac

Unveiling the mystery what is the muneca de la mano

Unlocking creativity bluey family png transparent images