Unlocking Your Home's Potential: A Guide to Bank of America Home Equity Loan Rates (Fixed)

Are you looking to tap into the equity you've built in your home? A home equity loan can be a powerful tool for funding major expenses, from home renovations to debt consolidation. When considering this option, understanding the nuances of fixed-rate home equity loans, particularly those offered by a major institution like Bank of America, becomes crucial. This comprehensive guide will delve into the world of Bank of America home equity loan rates, specifically focusing on the fixed-rate option, empowering you to make informed financial decisions.

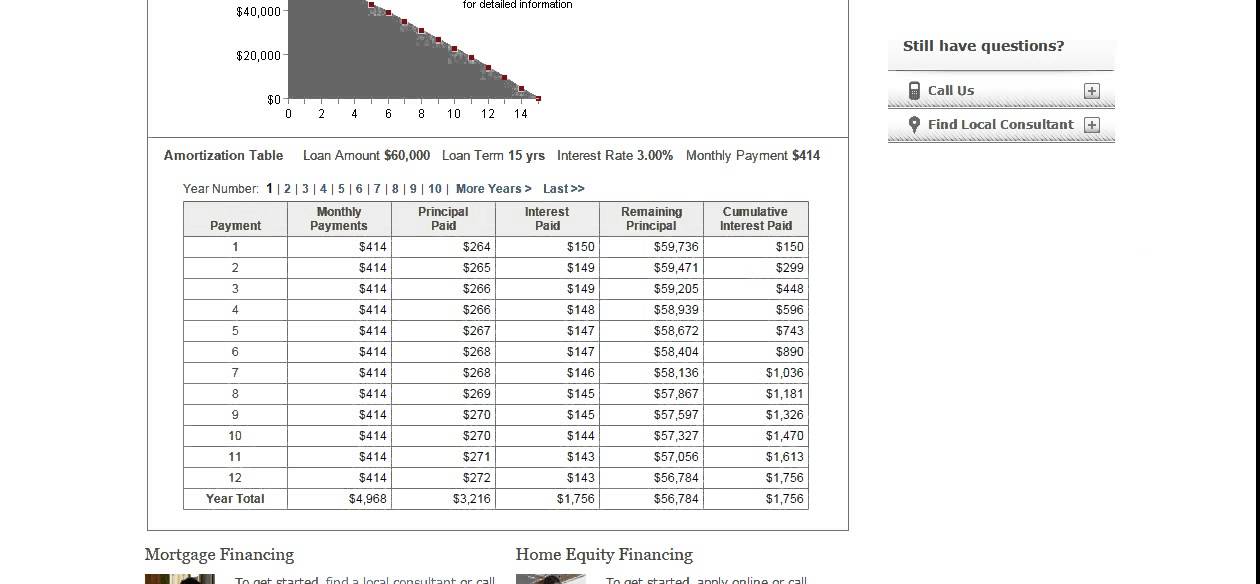

Home equity loans essentially allow you to borrow against the value of your home, using your property as collateral. With a fixed-rate loan, your interest rate remains constant throughout the loan term, resulting in predictable monthly payments. This stability can be particularly appealing in a fluctuating interest rate environment. Bank of America is a prominent lender in the home equity loan market, offering a range of options to suit various needs.

Navigating the world of home equity financing can feel overwhelming. This is where a clear understanding of Bank of America's fixed home equity loan rates becomes invaluable. By exploring the specifics of these loans, you can determine if they align with your financial goals and risk tolerance. We'll cover key aspects, from application requirements to potential benefits and drawbacks, providing you with the knowledge you need to make a confident decision.

Understanding the history and context of home equity loans is essential. These loans have become increasingly popular as homeowners seek accessible ways to finance significant expenses. The fixed-rate feature adds an element of predictability, allowing borrowers to budget effectively without worrying about fluctuating interest costs. Understanding the market trends and the role of major lenders like Bank of America is crucial for making informed decisions about your own finances.

Bank of America's fixed-rate home equity loan allows borrowers to access a lump sum of funds at a predetermined interest rate that remains constant for the life of the loan. This differs from a variable-rate loan where the interest rate fluctuates based on market conditions. The fixed rate provides stability, making it easier to budget and plan for repayment. Borrowers often prefer fixed rates when they anticipate interest rates to rise or when they value predictable monthly payments.

One benefit of a fixed-rate home equity loan is predictable monthly payments. Knowing exactly how much you'll owe each month simplifies budgeting. Another advantage is protection from rising interest rates. With a fixed rate, your payments won’t increase even if market rates climb. Finally, fixed rates can offer peace of mind, allowing you to focus on your financial goals without worrying about interest rate fluctuations.

Before applying for a Bank of America fixed-rate home equity loan, check your credit score and gather necessary financial documents. Then, research current Bank of America home equity loan fixed rates and compare them with other lenders. Finally, consult with a financial advisor to ensure a home equity loan aligns with your financial objectives.

Advantages and Disadvantages of Fixed-Rate Home Equity Loans

| Advantages | Disadvantages |

|---|---|

| Predictable monthly payments | Potentially higher initial interest rates compared to variable-rate loans |

| Protection against rising interest rates | Less flexibility if interest rates decline |

Best practices for implementing a fixed-rate home equity loan include budgeting for monthly payments, using the loan for responsible purposes like home improvements or debt consolidation, avoiding over-borrowing, regularly reviewing your loan terms, and maintaining a good credit score.

Frequently Asked Questions:

1. How do I apply for a Bank of America home equity loan? Contact Bank of America directly or apply online.

2. What are the current Bank of America home equity loan rates fixed? Contact Bank of America for the most up-to-date rates.

3. What are the eligibility requirements? Requirements vary, but typically include credit score, income, and home equity.

4. How long does the application process take? The processing time can vary.

5. What fees are associated with a home equity loan? Potential fees include application fees, appraisal fees, and closing costs.

6. Can I use a home equity loan for any purpose? While generally permissible, some restrictions may apply.

7. How can I manage my home equity loan account? Bank of America provides online and mobile banking options for account management.

8. What happens if I can't make my payments? Contact Bank of America immediately to discuss options.

Tips and tricks for securing a favorable fixed-rate home equity loan include improving your credit score, shopping around for the best rates, and understanding the terms and conditions before signing.

In conclusion, a Bank of America fixed-rate home equity loan can be a valuable tool for accessing funds while enjoying the stability of predictable monthly payments. By understanding the intricacies of these loans, comparing rates, and implementing best practices, you can leverage your home's equity strategically. Remember to thoroughly research current Bank of America fixed home equity loan rates and consult with a financial advisor to ensure this financial product aligns with your long-term financial goals. Taking the time to make informed decisions is crucial to your financial well-being and the successful utilization of a home equity loan. Don't hesitate to reach out to Bank of America directly for personalized guidance and the most up-to-date information on their home equity loan products. Empower yourself with knowledge and take control of your financial future.

Navigating divorce essential questions for your attorney

Torn between two lovers music exploring divided hearts

Electric lug nut torque wrenches your wheels new best friend probably

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)