Unlocking Your Health Coverage: A Guide to Federal Health Benefits Qualifying Life Events

Life throws curveballs, right? A new job, marriage, a baby – these are all exciting milestones, but they can also shake up your health insurance. If you're a federal employee or retiree, you've got a safety net: federal health benefits qualifying life events. These events provide you with a specific window of time to adjust your health insurance plan outside of the annual Open Season.

Think of it like this: Open Season is like a yearly check-up for your benefits, but qualifying life events are like an emergency room visit – you use them when you need to make immediate changes due to a major life change.

We're going to delve into the ins and outs of these qualifying life events – what they are, why they're important, and how you can make the most of them to ensure you and your family have the health coverage you need, precisely when you need it.

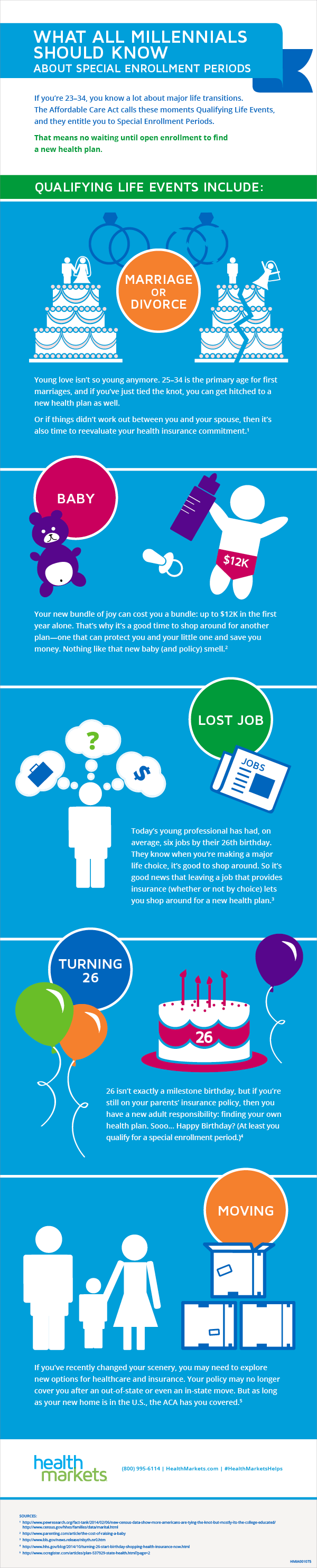

Imagine getting married and needing to add your new spouse to your health plan. Or welcoming a new baby into the family and wanting to ensure they're covered. These scenarios, and many others, fall under the umbrella of federal health benefits qualifying life events. These events trigger a Special Enrollment Period, a limited time when you can enroll in or make changes to your federal health, dental, and vision insurance.

Understanding these events and how they impact your benefits is crucial for maintaining continuous, adequate health coverage for yourself and your loved ones. The last thing you want during a major life change is to be grappling with healthcare uncertainties.

Advantages and Disadvantages of Federal Health Benefits Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage outside Open Season | Limited time frame to make changes |

| Ensures coverage during significant life transitions | Requires documentation to prove eligibility |

| Opportunity to choose the most suitable plan for your new circumstances | Can be complex to navigate |

Best Practices for Utilizing Federal Health Benefits Qualifying Life Events

1. Don't Procrastinate: Time is of the essence. Once a qualifying life event happens, act promptly. You typically have 31 days from the event (or 60 days in some cases) to make changes to your coverage.

2. Gather Your Documentation: Be prepared to provide proof of the qualifying event. This might include marriage certificates, birth certificates, or other legal documents.

3. Compare Plans Carefully: Take the time to evaluate your options and choose the plan that best fits your needs and budget.

4. Seek Guidance When Needed: Don't hesitate to reach out to your agency's Human Resources department or a benefits counselor if you have any questions or need assistance.

5. Stay Informed: Federal benefits rules and regulations can change. Stay updated on any modifications that might affect your coverage.

Common Questions about Federal Health Benefits Qualifying Life Events

1. What are some examples of qualifying life events?

Common examples include marriage, divorce, birth of a child, adoption, death of a spouse or dependent, and changes in employment status.

2. How do I know if I qualify for a Special Enrollment Period?

Review the list of qualifying events on the OPM (Office of Personnel Management) website or consult with your agency's benefits office.

3. What if I miss the deadline to make changes?

You might have to wait until the next Open Season to enroll or make changes, which could leave you without coverage or with a plan that no longer suits your needs.

4. Can I make changes to my coverage online?

Yes, in many cases, you can make changes through your agency's online benefits portal.

5. What if my life event isn't listed as qualifying?

Contact your agency's benefits office. There might be exceptions or other options available.

6. Can I drop my Federal health insurance coverage during a Special Enrollment Period?

Yes, if you experience a qualifying life event that makes you eligible to enroll in another plan (like through a spouse's employer), you can typically drop your Federal coverage.

7. What is the effective date of coverage if I enroll during a Special Enrollment Period?

The effective date varies depending on the qualifying event. It's usually retroactive to the date of the event, ensuring no gap in coverage.

8. Where can I find more information about Federal health benefits and qualifying life events?

The OPM website (www.opm.gov) is an excellent resource for detailed information on this topic.

Tips and Tricks

- Mark important dates like the end of your Special Enrollment Period on your calendar to avoid missing deadlines.

- Keep thorough records of all correspondence and documentation related to your benefits and qualifying life events.

Navigating the world of health insurance can be daunting, but by understanding the role of federal health benefits qualifying life events, you can approach your coverage with greater confidence. These events are designed to provide you with flexibility and support during times of change. Remember to stay informed, be proactive, and don't hesitate to ask for help when needed. Your health and peace of mind are worth it!

Unveiling the allure of rookwood jade by sherwin williams

Fedex field club level seats view

Dibujos de roblox para colorear e imprimir a world of creativity

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)