Unlocking the Marina: Decoding Credit Scores for Boat Ownership

Dreaming of open water, the wind in your hair, and the sun on your face? Boat ownership represents freedom and adventure, but before you set sail, understanding the financial currents is crucial. One of the biggest questions aspiring boat owners have is: what credit score do I need to buy a boat? Let's dive into the depths of this crucial aspect of boat financing.

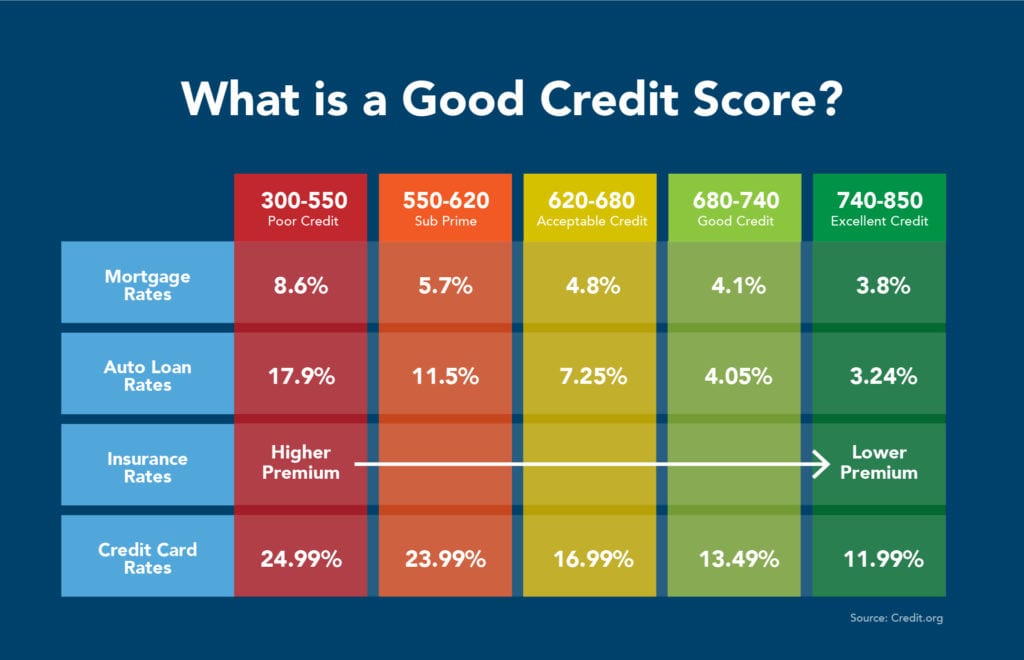

While there's no magic number guaranteeing boat loan approval, your credit score plays a significant role in determining your eligibility and the terms you'll receive. Think of your credit score as your financial passport. A good score unlocks better interest rates, favorable loan terms, and a smoother overall process. A lower score might mean a rockier journey, including higher interest rates, larger down payments, or even loan denial. Knowing where you stand is the first step in charting your course towards boat ownership.

The necessity of a good credit score for securing a boat loan stems from the lender's need to assess risk. A higher credit score signifies responsible financial behavior, indicating a lower likelihood of defaulting on the loan. This translates to lower risk for the lender, allowing them to offer more attractive loan terms. Conversely, a lower credit score suggests a higher risk profile, potentially leading to less favorable loan conditions or even rejection.

The concept of credit scores for lending isn't unique to boat purchases. It's a fundamental part of the financial system, used for everything from mortgages and auto loans to credit cards. For boat loans specifically, lenders generally look for a score in the good to excellent range. This typically means a FICO score of 660 or higher. However, some lenders may consider applicants with lower scores, often requiring a larger down payment or a co-signer to mitigate the perceived risk.

Navigating the world of boat financing can feel like navigating unfamiliar waters. However, understanding the importance of credit scores provides a crucial navigational tool. By knowing the required credit rating for buying a boat, you can assess your financial readiness and take steps to improve your creditworthiness before applying for a loan.

A strong credit history is essential when considering purchasing a boat. Just as with car loans or mortgages, your creditworthiness plays a pivotal role in securing favorable financing. Lenders see a higher score as a sign of responsible financial management, suggesting a lower likelihood of loan default.

Improving your credit score before purchasing a boat can significantly impact your loan terms. Paying bills on time, reducing credit card balances, and addressing any errors on your credit report can all contribute to a better score. Even a small increase can translate to thousands of dollars saved over the life of your boat loan.

Advantages and Disadvantages of Having a Good Credit Score for Boat Purchases

| Advantages | Disadvantages |

|---|---|

| Lower interest rates | Building good credit takes time |

| Better loan terms | Past financial mistakes can impact current score |

Best Practices for Improving Your Credit Score:

1. Pay Bills On Time: Consistent on-time payments demonstrate responsible financial behavior.

2. Reduce Credit Card Balances: Lowering your credit utilization ratio improves your creditworthiness.

3. Check Your Credit Report: Regularly review your credit report for errors and inaccuracies.

4. Avoid Opening New Credit Accounts: Too many new credit inquiries can negatively impact your score.

5. Maintain a Mix of Credit: Having a diverse credit portfolio can positively influence your credit score.

FAQ:

1. What is the minimum credit score needed? While it varies, 660 is often considered a good starting point.

2. Can I buy a boat with bad credit? It's more challenging, but some lenders specialize in subprime loans.

3. How can I check my credit score? AnnualCreditReport.com provides free access to your credit reports.

4. Does pre-qualification hurt my credit? Soft inquiries don't affect your credit score.

5. What are typical boat loan interest rates? Rates vary based on credit score, loan term, and boat type.

6. How much can I borrow for a boat? This depends on your income, debt, and the lender's criteria.

7. What is the typical loan term for a boat? Boat loans often range from 10 to 20 years.

8. What documents do I need for a boat loan? Typically, proof of income, identification, and boat details.

Tips and Tricks:

Shop around for the best loan rates from different lenders, including banks, credit unions, and marine finance companies. Consider getting pre-approved for a loan before you start boat shopping to know your budget. Negotiate the boat price and loan terms to secure the best possible deal.

Securing the right financing is a critical step in the journey to boat ownership. Understanding the credit score needed to buy a boat empowers you to take control of the process. By improving your credit score, comparing loan options, and understanding the various financing requirements, you can navigate the financial waters with confidence and set sail towards your dream of owning a boat. Start your journey today by checking your credit report and exploring financing options. Don't let your dream boat stay anchored in the harbor of "someday." Make it a reality.

Mastering flange bolt torque calculation

Unlock your potential the vitamin powerhouse found in beef

Powering up the future 200 amp subpanel wiring