Unlocking Tax Savings: A Guide to Income Tax Deductions Calculation (Pengiraan Potongan Cukai Pendapatan)

Tax season. Two words that can send shivers down the spine of even the most organized individual. But what if you could approach it with a sense of confidence, knowing you've maximized every possible deduction to minimize your tax liability? That's where understanding income tax deductions calculation, or as it's known in Malay, "pengiraan potongan cukai pendapatan," becomes essential.

Imagine this: you diligently file your taxes, only to realize later you could have saved a significant sum by claiming deductions you were eligible for. It's a frustrating scenario many taxpayers experience, highlighting the critical need to understand how deductions work and how to calculate them accurately.

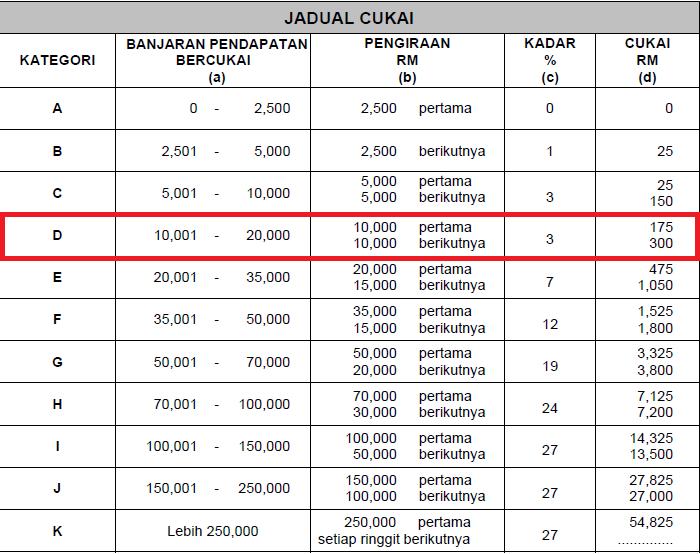

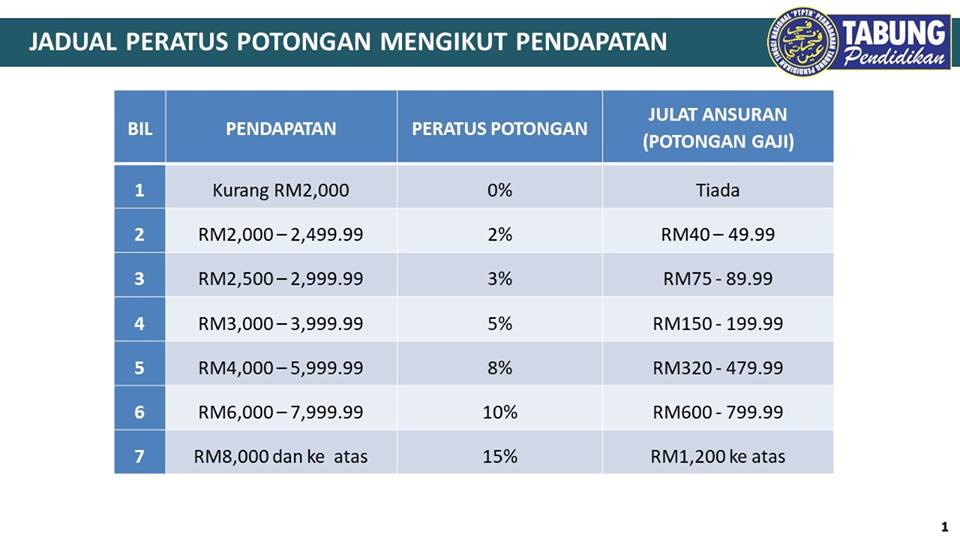

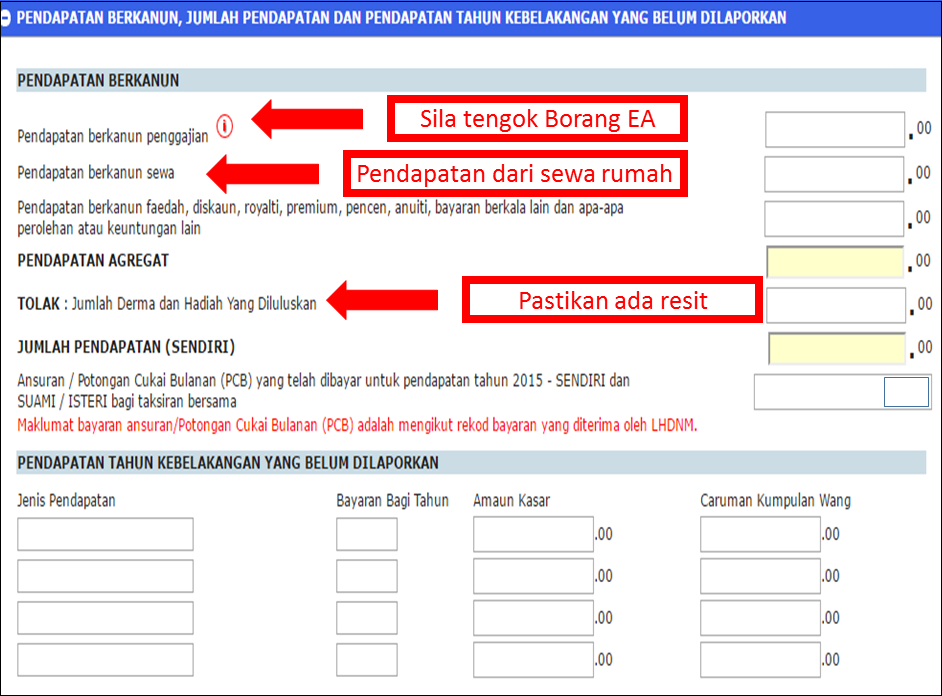

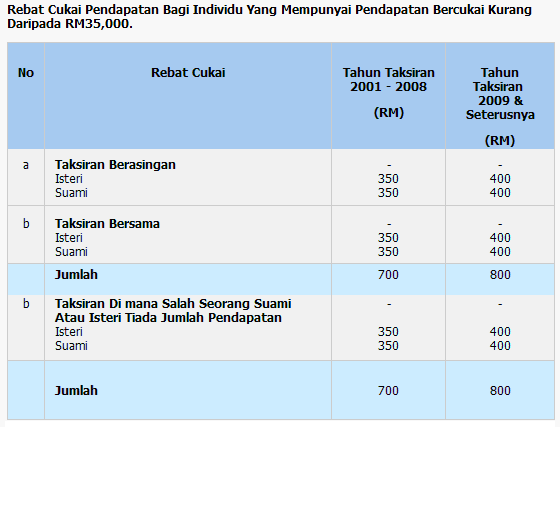

In essence, "pengiraan potongan cukai pendapatan" refers to the process of determining the amount of money you can legally subtract from your total taxable income, thereby reducing the amount of tax you owe. This process can be straightforward for some, particularly those with simple income sources and minimal deductible expenses. However, for many others, navigating the labyrinth of eligible deductions, understanding their limitations, and accurately calculating their impact can quickly become complex.

This complexity is often compounded by ever-evolving tax laws and regulations, making it challenging for individuals to stay informed and ensure they're claiming all eligible deductions. Yet, the potential benefits are undeniable. Accurately calculating your income tax deductions can lead to substantial savings, freeing up your hard-earned money for investments, savings, or simply enjoying life's pleasures.

This comprehensive guide will demystify the world of "pengiraan potongan cukai pendapatan," providing you with the knowledge and tools to navigate the process confidently. We'll delve into various deduction categories, explore their eligibility criteria, and equip you with practical strategies to maximize your tax savings. Let's embark on this journey to unlock the full potential of income tax deductions and keep more money where it belongs – in your pocket.

Advantages and Disadvantages of Accurate "Pengiraan Potongan Cukai Pendapatan"

While the benefits of accurately calculating your income tax deductions are numerous, it's also essential to be aware of potential drawbacks. Understanding both sides of the coin will enable you to approach the process with a balanced perspective.

| Advantages | Disadvantages |

|---|---|

| Significant tax savings, leading to increased disposable income | Time and effort required to gather documentation and understand applicable deductions |

| Reduced risk of audits and penalties due to accurate reporting | Potential for errors if calculations are not performed correctly |

| Improved financial planning and budgeting due to predictable tax liability | May require seeking professional assistance, incurring additional costs |

Best Practices for Effective "Pengiraan Potongan Cukai Pendapatan"

To streamline the process and ensure accuracy, consider implementing these best practices:

- Maintain Meticulous Records: Keep thorough records of all income and expenses throughout the year. This practice not only simplifies the deduction calculation process but also proves invaluable during audits.

- Stay Informed about Tax Laws: Tax regulations are constantly evolving. Stay up-to-date on changes to ensure you're maximizing eligible deductions.

- Leverage Technology: Utilize tax software or online tools to simplify calculations and minimize the risk of errors.

- Seek Professional Guidance: For complex financial situations, consider consulting with a qualified tax advisor for personalized advice.

- Don't Wait Until the Last Minute: Start the deduction calculation process early to avoid rushing and making mistakes.

Mastering "pengiraan potongan cukai pendapatan" is an empowering financial skill that can significantly impact your financial well-being. By understanding the nuances of income tax deductions, staying organized, and seeking professional guidance when needed, you can confidently navigate the tax season and retain more of your hard-earned income. Remember, every Ringgit saved is a Ringgit earned!

Unveiling the legacy of mansur shah of malacca the golden age sultan

Hari raya backgrounds festive wallpapers for a joyous celebration

Unleash your inner space explorer a deep dive into sci fi battleship art