Unlocking Market Cap: Understanding Company Value

Ever wondered how investors gauge the size and value of a company? The answer lies in a crucial metric known as market capitalization, often shortened to "market cap." This concept is fundamental to understanding the financial landscape and making informed investment choices. It's a powerful tool, but it's important to grasp its nuances to effectively utilize it.

Market capitalization represents the total dollar market value of a company's outstanding shares. It provides a snapshot of a company's worth at a specific point in time, reflecting the collective opinion of investors. Understanding how market cap is calculated and interpreted is essential for both novice and seasoned investors.

Calculating market cap is straightforward: multiply the current market price of a single share by the total number of outstanding shares. For example, if a company's stock trades at $50 and there are 100 million shares outstanding, the market cap is $5 billion. This simple calculation offers valuable insight into a company's size and standing within the market.

The importance of understanding market cap cannot be overstated. It allows investors to categorize companies into different size segments (small-cap, mid-cap, large-cap), providing a framework for assessing risk and potential returns. Generally, large-cap companies are considered more established and stable, while smaller companies might offer higher growth potential but also carry greater risk. Understanding these dynamics helps investors align their investments with their risk tolerance and financial goals.

While market cap provides a convenient yardstick for company valuation, it's crucial to recognize its limitations. Market cap is influenced by stock price, which can be volatile and subject to market sentiment. It doesn't reflect the underlying assets or liabilities of a company. Furthermore, manipulating the number of outstanding shares can artificially inflate or deflate market cap, making it crucial to consider other financial metrics alongside market capitalization.

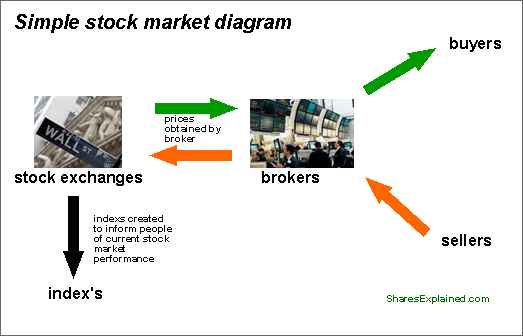

The concept of market capitalization has its roots in the emergence of publicly traded companies and stock exchanges. As businesses began issuing shares to raise capital, the need arose for a standardized measure to assess their overall value in the marketplace. Over time, market cap became the dominant metric for this purpose.

One key benefit of using market capitalization is its simplicity and ease of calculation. This accessibility allows investors of all levels to quickly assess a company's size and compare it to others within the same industry or across different sectors.

Another advantage is its usefulness in portfolio diversification. By understanding market cap, investors can strategically allocate their investments across companies of varying sizes, potentially mitigating risk and optimizing returns.

Lastly, market capitalization plays a significant role in index construction. Many major stock market indices, such as the S&P 500, are weighted by market cap, meaning that larger companies have a greater influence on the index's performance.

Advantages and Disadvantages of Relying on Market Cap

Using market cap has both pros and cons:

Frequently Asked Questions about Market Capitalization:

1. What does market capitalization tell us? It tells us the total market value of a company's outstanding shares.

2. How is market cap calculated? It's calculated by multiplying the current share price by the total number of outstanding shares.

3. Why is market cap important? It helps investors gauge a company's size and relative value.

4. What are the limitations of market cap? It can be influenced by market sentiment and doesn't reflect a company's underlying assets or liabilities.

5. What is the difference between large-cap, mid-cap, and small-cap companies? These classifications are based on market cap ranges and indicate different levels of risk and growth potential.

6. Does a higher market cap always mean a better company? Not necessarily. Other factors, like profitability and financial health, are equally important.

7. Can market cap be manipulated? Yes, by changing the number of outstanding shares.

8. Where can I find market cap information? On financial websites like Yahoo Finance, Google Finance, and Bloomberg.

Tips and tricks related to using market cap include comparing companies within the same industry and considering other financial metrics in conjunction with market capitalization to get a more comprehensive view of a company's value.

In conclusion, understanding how market capitalization works is fundamental to navigating the investment world. It provides a valuable snapshot of a company's size and market value, enabling investors to make more informed decisions. While market cap is a useful tool, it's essential to be aware of its limitations and use it in conjunction with other financial metrics. By grasping the nuances of market cap, investors can gain a deeper understanding of company valuation and build a stronger foundation for their investment strategies. Remember to always conduct thorough research, consider your risk tolerance, and seek professional advice when needed. Continuously learning about market dynamics and financial indicators will empower you to make smarter investment choices and achieve your financial goals. By using market cap effectively, you can gain a significant advantage in the complex world of finance.

Stylish autumn attire finding the perfect fall dresses for women over 60

The thrill of the trials chasing olympic dreams on the track

M12 to standard size decoding the mysteries of thread conversion

:max_bytes(150000):strip_icc()/Term-Definitions_Market-economy-Final-v2-2617a685cf7841249347d9cc37b65580.jpg)