Unlocking JP Morgan Chase Wire Transfer Secrets: Your Guide to Seamless Transactions

So, you're looking into JP Morgan Chase wire transfer details? Maybe you're sending money overseas, receiving a large payment, or just curious about how it all works. Whatever the reason, navigating the world of wire transfers can feel like deciphering a secret code. This guide will break down everything you need to know about JP Morgan Chase wire information, from the basics to the nitty-gritty details, so you can make informed decisions and transfer your money with confidence.

Wire transfers, often considered the fastest way to move large sums of money, are a cornerstone of modern banking. For JP Morgan Chase customers, understanding the specifics of their wire transfer system is crucial. Whether it's for business transactions, personal payments, or international remittances, knowing the ins and outs of Chase wire transfer details can save you time, money, and potential headaches. This includes everything from locating necessary information like SWIFT codes and routing numbers to understanding the associated fees and security measures.

JP Morgan Chase wire instructions are readily available online and through your local branch. However, simply having the information is often not enough. Understanding what each piece of information means and how it applies to your specific transfer is key. This guide aims to equip you with a thorough understanding of the process, ensuring you have a smooth and hassle-free experience. We'll cover everything from domestic wire transfers to international transfers, highlighting the nuances and potential pitfalls to look out for.

The history of wire transfers is intertwined with the evolution of banking itself. From its early beginnings with telegraphs to the modern digital systems we use today, the technology has continuously adapted to meet the growing needs of global finance. For JP Morgan Chase, a major player in the financial world, facilitating seamless and secure wire transfers is a critical component of their service offerings. Understanding the evolution of these systems can provide context for the current processes and regulations surrounding Chase bank wire instructions.

One of the most crucial aspects of initiating a wire transfer with Chase is ensuring the accuracy of your JP Morgan Chase wire information. Incorrect details can lead to delays, returned funds, and even lost money. This is particularly important for international transfers, where SWIFT codes, IBANs, and other specific details are essential for proper routing. We'll delve into the importance of accurate information and provide tips for double-checking everything before you hit "send."

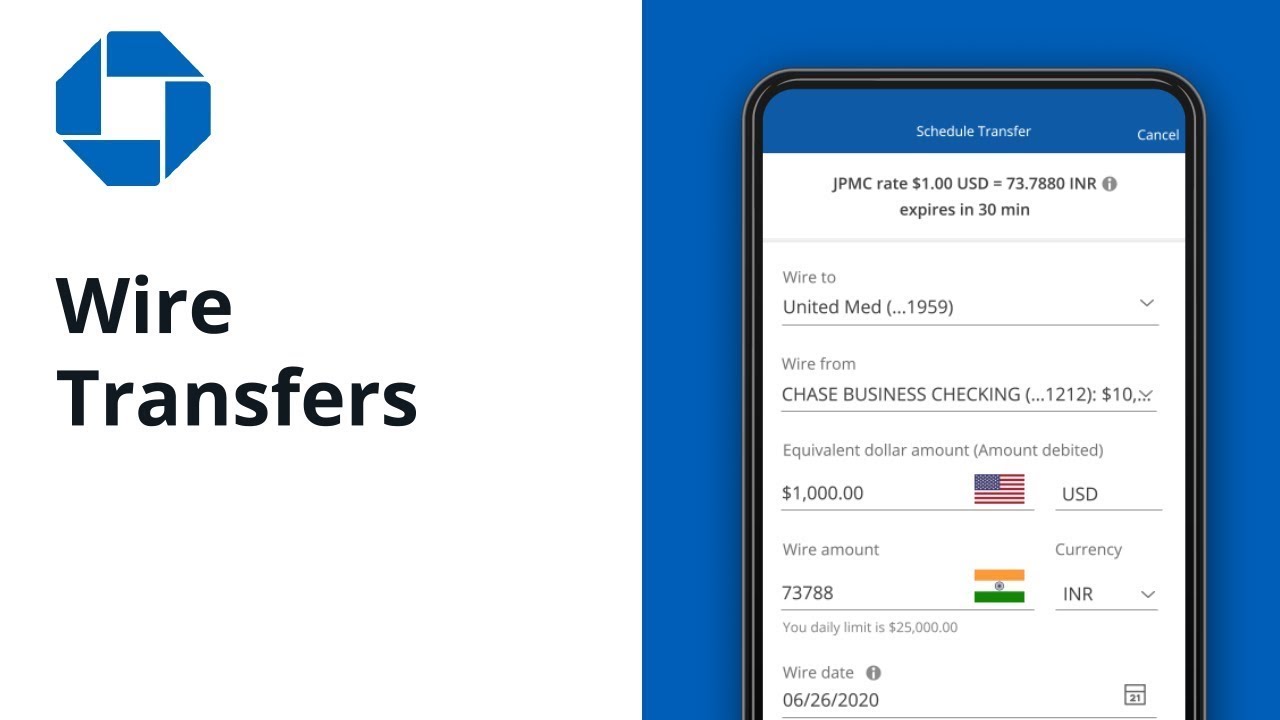

JP Morgan Chase wire transfers allow you to send and receive money electronically, domestically and internationally. To initiate a wire transfer, you'll typically need the recipient's name, bank name and address, account number, and the bank's routing number (for domestic transfers) or SWIFT code (for international transfers). For incoming wires, you'll need to provide your account details and JP Morgan Chase's SWIFT code to the sender.

Benefits of using JP Morgan Chase wire transfers include speed, security, and the ability to transfer large sums of money. For example, if you need to quickly send a down payment for a house purchase, a wire transfer is often the preferred method.

Advantages and Disadvantages of JP Morgan Chase Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible |

| Large Sum Transfers | Potential for Delays with Incorrect Information |

Frequently Asked Questions:

1. What are the fees associated with JP Morgan Chase wire transfers? - Fees vary depending on the type and destination of the transfer.

2. How long does a JP Morgan Chase wire transfer take? - Domestic transfers typically take 1-2 business days, while international transfers can take longer.

3. How do I track my JP Morgan Chase wire transfer? - You can typically track your transfer through your online banking portal or by contacting customer service.

4. What is the JP Morgan Chase SWIFT code? - The SWIFT code varies depending on the branch. You can find it on the Chase website.

5. What should I do if my JP Morgan Chase wire transfer is delayed? - Contact customer service immediately to investigate the issue.

6. How can I cancel a JP Morgan Chase wire transfer? - Contact customer support as soon as possible.

7. What security measures does JP Morgan Chase have in place for wire transfers? - Chase uses various encryption and authentication methods to protect your transactions.

8. How do I find my Chase bank wire instructions? - You can find them online or by visiting your local branch.

In conclusion, navigating the landscape of JP Morgan Chase wire transfers can seem daunting at first, but armed with the right information, you can make informed decisions and execute your transactions with confidence. Understanding the key details, from SWIFT codes to associated fees, empowers you to leverage this efficient and secure method of transferring funds. By taking the time to familiarize yourself with the processes and best practices outlined in this guide, you can avoid potential pitfalls and ensure your wire transfers go smoothly. Remember to always double-check your information, keep your account details secure, and don't hesitate to reach out to Chase customer service if you have any questions or concerns. Taking these steps will ensure a positive and hassle-free experience when utilizing JP Morgan Chase wire transfer services. Whether you're sending or receiving funds, understanding the intricacies of this system is vital in today’s interconnected financial world.

Unraveling william aftons family how many children did he have

Mensaje para la abuela bridging the generational divide

Decoding white spots on upper arms causes treatments and more