Unlocking Global Finance: Your Guide to JPMorgan Chase Wire Instructions

Ever wondered how money magically traverses the globe in seconds? In our increasingly interconnected world, moving funds across borders often hinges on a crucial piece of information: the wire transfer instructions. And when it comes to a financial giant like JPMorgan Chase, understanding their specific wire instructions is paramount.

So, what exactly are JPMorgan Chase wire instructions? Think of them as the GPS coordinates for your money. They're a set of specific details that tell JPMorgan Chase exactly where to send your funds electronically. This includes information like the recipient's bank name and address, their account number, and specific identifying codes like the SWIFT code. Without accurate instructions, your transfer could be delayed, returned, or even lost.

Navigating the world of international finance can feel daunting, but understanding the intricacies of JPMorgan Chase's wire transfer process can empower you to move money efficiently and securely. This comprehensive guide will delve into everything you need to know, from finding the correct instructions to ensuring the security of your transactions.

Let's start with the basics. JPMorgan Chase, one of the largest banks in the world, facilitates countless wire transfers daily. Whether you're sending money for business, personal reasons, or investments, accessing and understanding their wire instructions is the first step.

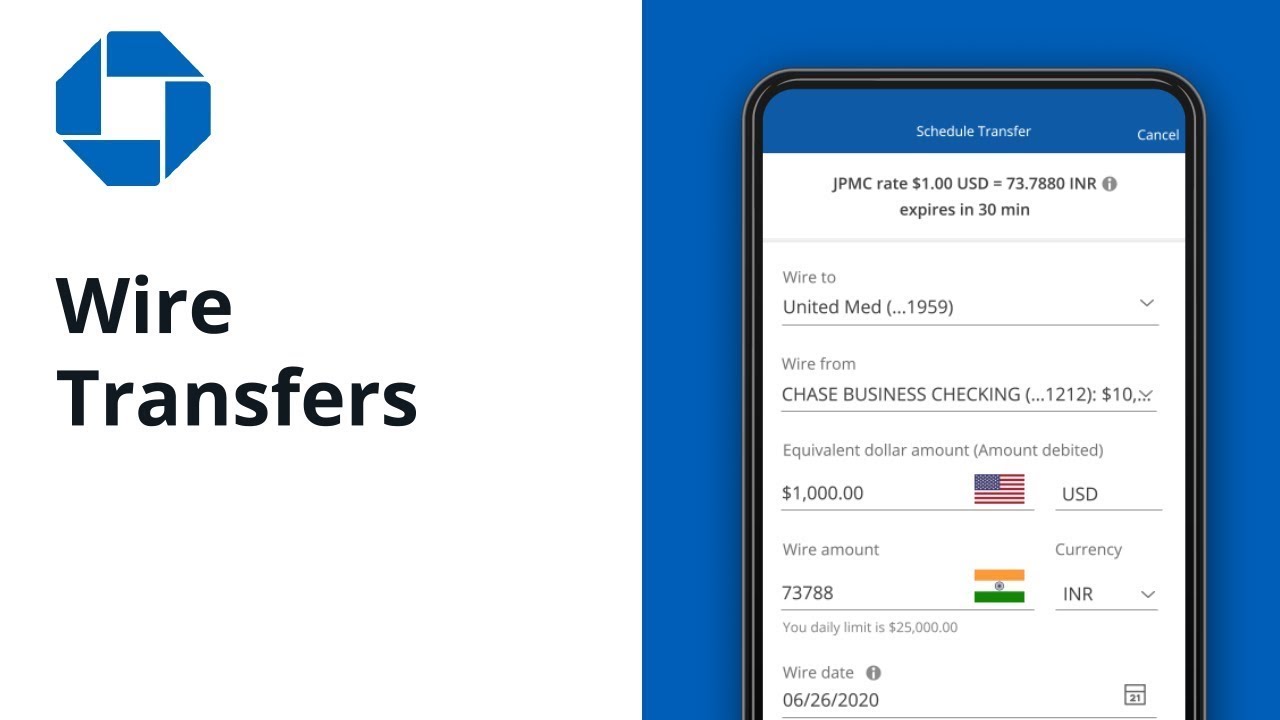

Finding these instructions usually involves logging into your JPMorgan Chase online banking account or contacting your branch directly. The exact format and details within the instructions might vary slightly depending on the destination country and currency. However, certain core components remain consistent, such as the SWIFT code for JPMorgan Chase and the specific branch handling the transfer.

The history of wire transfers is closely tied to the development of telegraphy in the 19th century. Over time, these methods evolved from simple telegraphic messages to the sophisticated electronic systems we use today. JPMorgan Chase, with its long history in finance, has played a significant role in shaping these developments.

JPMorgan Chase wire instructions are crucial for a variety of reasons. They enable businesses to make international payments, individuals to send money to family abroad, and investors to participate in global markets. Without these detailed instructions, the seamless flow of global commerce would be significantly disrupted.

One key issue associated with wire transfers is security. It's crucial to verify the accuracy of the JPMorgan Chase wire instructions you receive to prevent fraud. Always confirm the details with a trusted source, such as your bank representative, before initiating a transfer. Never rely on instructions received via email from unverified sources.

Benefits of using JPMorgan Chase for wire transfers include its global reach, sophisticated security measures, and established reputation. They offer a robust platform for moving funds securely and efficiently.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible Nature |

| Global Reach | Potential for Fraud |

Frequently Asked Questions:

1. Where can I find my JPMorgan Chase wire instructions? - Contact your branch or log into your online banking.

2. What is a SWIFT code? - A unique identifier for banks involved in international transfers.

3. How long does a wire transfer take? - Typically 1-2 business days.

4. Are wire transfers secure? - Generally secure, but vigilance is key to preventing fraud.

5. What happens if I provide incorrect wire instructions? - The transfer could be delayed, returned, or lost.

6. How much does a wire transfer cost? - Fees vary depending on the amount and destination.

7. Can I cancel a wire transfer? - Difficult, if not impossible, once initiated.

8. What should I do if I suspect fraud? - Contact JPMorgan Chase immediately.

Tips and Tricks: Double-check all details, use strong passwords for your online banking, and be wary of unsolicited requests for wire transfer information.

In conclusion, understanding JPMorgan Chase wire instructions is essential for anyone participating in global finance. Whether you're a business owner making international payments or an individual sending money abroad, knowing how to access and use these instructions correctly is crucial for smooth and secure transactions. By familiarizing yourself with the process, prioritizing security, and staying informed about best practices, you can navigate the world of wire transfers with confidence and efficiency. Remember to always verify instructions with a trusted source and report any suspicious activity immediately to protect your financial well-being. JPMorgan Chase offers a robust platform for wire transfers, but the responsibility for ensuring accurate information and secure practices ultimately rests with the individual. Take the time to learn the intricacies of the system, and you'll be well-equipped to manage your international funds effectively.

Unveiling the moons purpose tides time and more

The echoes of our lives exploring the significance of music selection in funeral services

Charming colonial home exterior paint colors