Unlocking Bill-Paying Power: The Guide to Authorization Letters

Imagine this: you're relaxing on a tropical beach, sipping a cool drink, completely detached from the mundane world… and yet, your bills are getting paid. Sounds like a dream, right? Well, with the power of a bill payment authorization letter, this dream can become reality. This unassuming document can be your key to financial freedom and peace of mind, allowing you to delegate the often tedious task of bill payment to a trusted individual.

So, what exactly is this magical document? A bill payment authorization letter, sometimes referred to as a letter of authorization for paying bills, is a legally binding document that grants a designated person the authority to manage your financial obligations. It's like giving someone the keys to your financial car, allowing them to navigate the roads of bills and payments on your behalf. This powerful tool can be a lifesaver in various situations, from temporary incapacitation to simply needing an extra pair of hands to manage complex finances.

The need for such a mechanism has existed for as long as bills themselves. Historically, informal arrangements between family members or trusted individuals sufficed. However, with the increasing complexity of financial systems, the need for a formalized, legally sound process became apparent. The modern bill payment authorization letter emerged as a solution, providing a clear and unambiguous way to delegate financial responsibility.

The importance of a well-drafted authorization letter cannot be overstated. It protects both the grantor and the authorized individual by clearly outlining the scope of authority granted. This clarity minimizes the potential for misunderstandings, misuse, or legal disputes. A poorly worded or incomplete letter can lead to unauthorized transactions, financial mismanagement, and even identity theft.

Crafting a comprehensive authorization letter requires careful consideration of several key elements. These include the specific bills to be paid, the duration of the authorization, the authorized individual's details, and any limitations or restrictions. Omitting crucial details can create ambiguity and potentially expose both parties to risk. For example, a vague authorization could be misinterpreted, allowing the authorized person to access accounts or make payments beyond the intended scope.

Let's explore some practical benefits. First, it provides peace of mind, especially during travel or illness. Second, it assists those who might struggle with managing their finances due to age or disability. Third, it can be a helpful tool for businesses, allowing designated employees to handle bill payments.

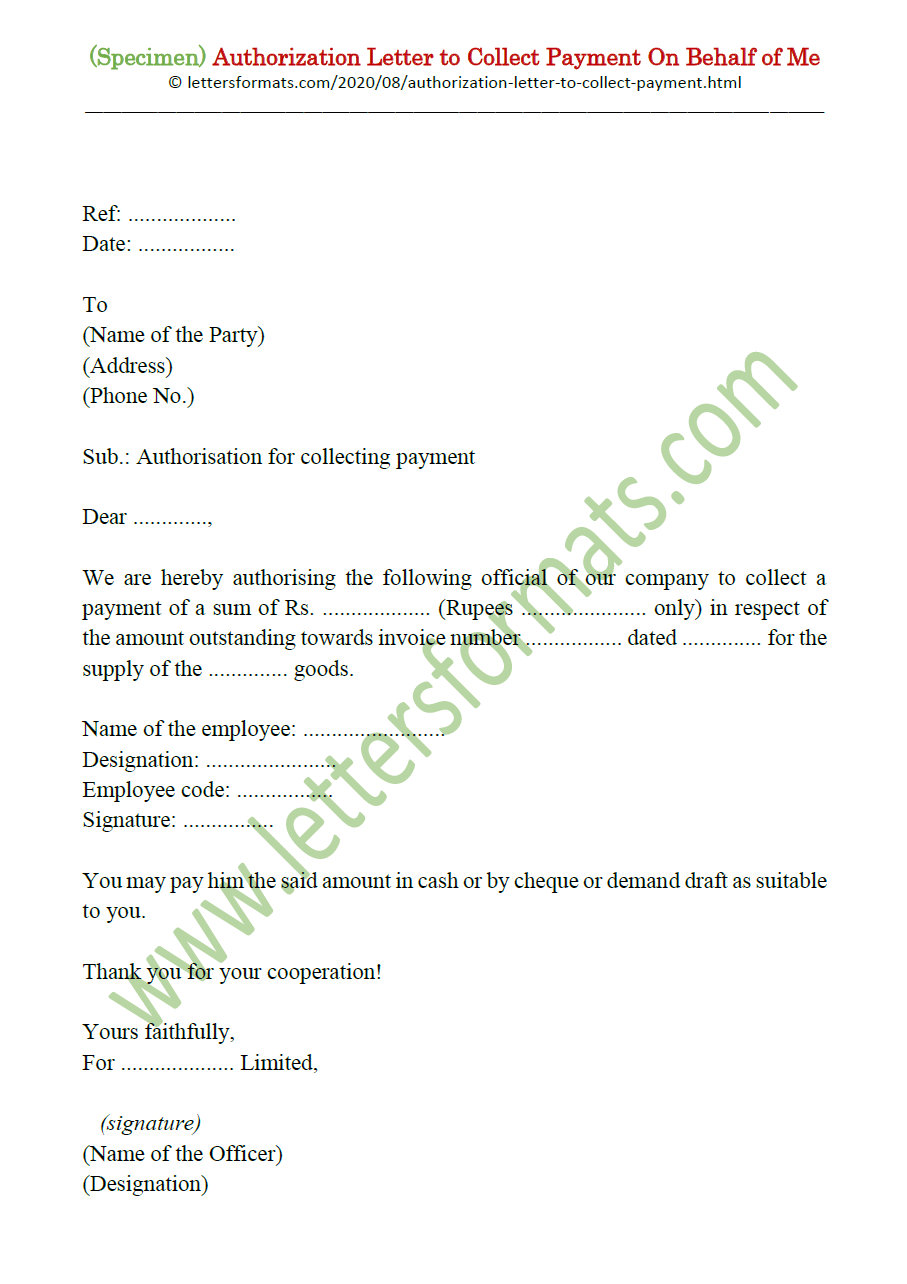

Creating an effective authorization letter involves several key steps: clearly identifying yourself and the authorized individual, specifying the accounts and bills covered, defining the authorization period, outlining any limitations, and including signatures from both parties. A successful example might involve an elderly parent authorizing a child to manage their utility bills.

A simple checklist includes: grantor and authorized individual's information, specific bills and accounts, authorization period, limitations, and signatures.

A step-by-step guide would include: 1) Gather necessary information. 2) Draft the letter using clear language. 3) Review and revise for accuracy. 4) Sign and date the letter. 5) Provide copies to relevant institutions.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Convenience and peace of mind | Potential for misuse if not carefully drafted |

| Assistance for the elderly or disabled | Risk of unauthorized transactions |

| Efficient business operations | Requires trust in the authorized individual |

Five best practices include: be specific, limit the scope, set a timeframe, regularly review the arrangement, and maintain clear communication.

Examples: managing bills during travel, assisting an elderly parent, handling business expenses, managing finances during illness, and authorizing a family member during a temporary relocation.

Challenges include misuse and solutions like limiting the scope and regular monitoring. Other challenges include lost authorization letters, revoked authorizations, disputes over transactions, changes in financial circumstances, and the death of the grantor, all of which have specific legal and practical solutions.

FAQs include questions about the required information, duration, revocation process, legal validity, handling disputes, acceptable formats, applying to different institutions, and protecting against fraud.

Tips: Keep a copy of the letter. Regularly review the arrangement. Communicate clearly with the authorized individual.

In conclusion, a bill payment authorization letter is a powerful tool for managing your finances. It offers flexibility, convenience, and peace of mind, enabling you to delegate the responsibility of bill payment to a trusted individual. While there are potential risks associated with granting such authority, careful planning and clear communication can mitigate these challenges. By understanding the key elements, best practices, and potential pitfalls, you can harness the power of this document to simplify your financial life and achieve true peace of mind. Take control of your financial well-being and explore the possibilities of a bill payment authorization letter today. It's a small step that can make a big difference in your financial journey.

Unlocking excels elegance mastering column width for perfect text fit

Shoulder skimming chic the allure of mid length bobs with side swept fringe

The end of an era reflecting on the fallecimiento de la reina isabel