Unclaimed Money Registration (Pendaftaran Wang Tak Dituntut): Could You Be Owed?

Have you ever wondered if there's money out there with your name on it? It might sound too good to be true, but unclaimed money is a real phenomenon, and many people are unaware they're owed funds. In Malaysia, this issue is addressed through a system called "pendaftaran wang tak dituntut," which translates to "unclaimed money registration." This system aims to reunite rightful owners with their forgotten assets.

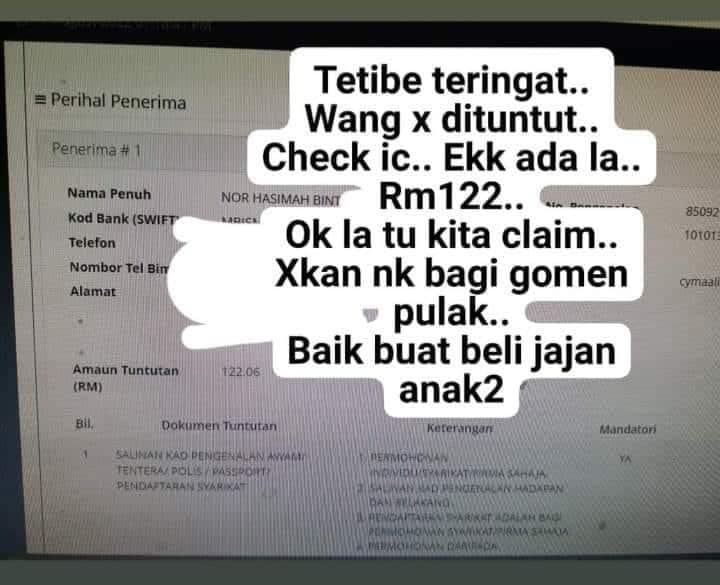

Unclaimed money can come from various sources, such as dormant bank accounts, forgotten insurance policies, uncashed checks, and unclaimed dividends. These funds often end up being held by the government or financial institutions for safekeeping until the rightful owner comes forward to claim them. However, over time, individuals might relocate, change their names, or simply forget about these assets, leading to a significant accumulation of unclaimed funds.

The concept of unclaimed money registration is crucial for both individuals and the economy. For individuals, it presents an opportunity to recover funds that rightfully belong to them, potentially providing a much-needed financial boost. For the economy, returning these unclaimed funds to their owners can stimulate spending and investment, contributing to overall economic growth.

However, despite the potential benefits, navigating the process of claiming unclaimed money can seem daunting. Many people are unaware of the existence of such schemes or are unsure how to initiate a claim. This is where understanding the "pendaftaran wang tak dituntut" system becomes crucial.

This article delves into the intricacies of "pendaftaran wang tak dituntut" in Malaysia, exploring its history, importance, and the steps involved in claiming your unclaimed funds. We'll explore the various sources of unclaimed money, provide practical tips for checking if you have any unclaimed assets, and guide you through the registration process. Additionally, we'll address common challenges and provide solutions to help you successfully reclaim what's rightfully yours. Whether you're looking to recover a small forgotten deposit or a significant sum, this comprehensive guide aims to empower you with the knowledge and tools needed to navigate the world of unclaimed money in Malaysia.

Advantages and Disadvantages of Pendaftaran Wang Tak Dituntut

| Advantages | Disadvantages |

|---|---|

| Potential to recover lost or forgotten funds. | Time-consuming process and potential for frustration. |

| Relatively straightforward process with online resources available. | Requires meticulous record-keeping and documentation. |

| Government-backed system ensures legitimacy and security. | Possibility of encountering scams or fraudulent schemes. |

Best Practices for Pendaftaran Wang Tak Dituntut

While the process might seem straightforward, there are best practices to increase your chances of success:

- Thorough Record Keeping: Maintain organized financial records, including old bank statements, insurance policies, and investment documents.

- Regularly Check for Unclaimed Funds: Make it a habit to check for unclaimed money periodically using official government websites or databases.

- Respond Promptly to Notifications: If you receive a notification about potential unclaimed funds, respond promptly and provide the necessary documentation.

- Be Wary of Scams: Exercise caution and avoid sharing personal information with unverified sources. Legitimate organizations will never ask for payment to claim your funds.

- Seek Professional Assistance: If you encounter difficulties or have complex cases, consider seeking help from financial advisors or legal professionals specializing in unclaimed assets.

Common Questions and Answers about Pendaftaran Wang Tak Dituntut

Navigating the world of unclaimed money can lead to many questions. Here are some common queries and their answers:

Q1: How do I know if I have unclaimed money in Malaysia?

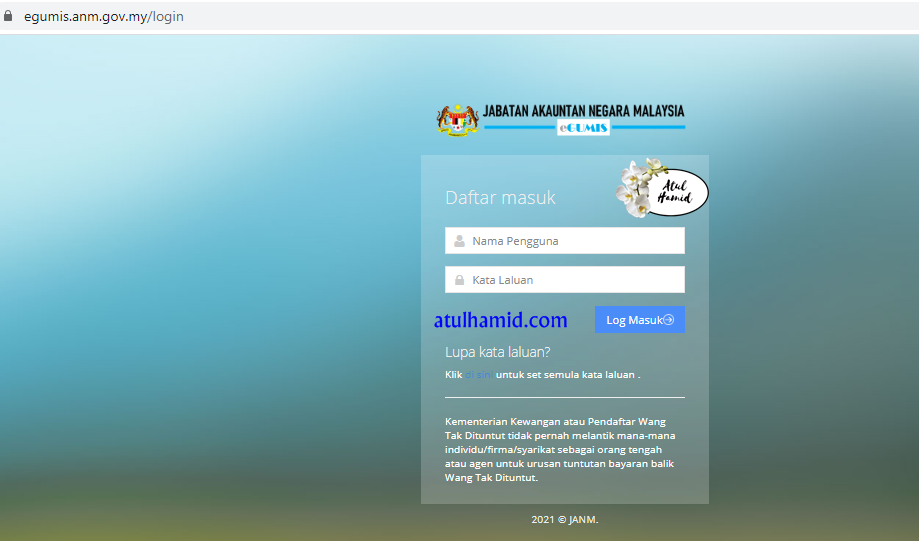

A1: You can begin your search by visiting the official website of the Accountant General's Department of Malaysia (AGD) or utilize dedicated online portals like eGumis. These platforms allow you to input your personal details and check for any matches in their databases.

Q2: Is there a deadline for claiming unclaimed money?

A2: Generally, there is no time limit for claiming unclaimed money in Malaysia. However, it is advisable to initiate the process as soon as possible to avoid potential complications or delays.

Q3: What documents do I need to claim my unclaimed money?

A3: The required documents vary depending on the type of unclaimed money and the claiming procedure. Typically, you'll need valid identification, proof of address, and supporting documents related to the unclaimed funds, such as bank statements or policy documents.

Q4: Is there a fee for claiming unclaimed money through "pendaftaran wang tak dituntut"?

A4: The service itself is generally free of charge. However, be cautious of fraudulent individuals or companies that might attempt to charge fees for assisting with the claim process.

Q5: What happens if the original owner of the unclaimed money has passed away?

A5: In such cases, a designated beneficiary or the next-of-kin can initiate the claim process. They would typically need to provide relevant legal documents, such as a death certificate and proof of their relationship to the deceased, to substantiate their claim.

Q6: Can I claim unclaimed money on behalf of someone else?

A6: Yes, but you will need to provide legal documentation authorizing you to act on their behalf, such as a power of attorney.

Q7: What if my claim for unclaimed money is rejected?

A7: If your claim is rejected, you will typically receive a notification stating the reason for rejection. You might need to provide additional documentation or clarification to support your claim. In some cases, you may have the right to appeal the decision.

Q8: What are some common examples of unclaimed money?

A8: Unclaimed money can stem from various sources, including dormant bank accounts, uncashed checks, forgotten insurance policies, unclaimed dividends from stocks, security deposits, and matured fixed deposits.

Tips and Tricks for a Smooth Pendaftaran Wang Tak Dituntut Experience

To enhance your experience and increase your likelihood of success, consider these tips:

- Be Patient and Persistent: The process might take time, requiring follow-ups and additional documentation. Patience and persistence are crucial.

- Utilize Online Resources Effectively: Explore government websites and dedicated platforms for comprehensive information and updates.

- Don't Hesitate to Seek Help: If you encounter challenges, reach out to relevant authorities or professionals for guidance.

- Stay Informed About Updates and Changes: Remain updated on any modifications to regulations or procedures related to unclaimed money.

In conclusion, the "pendaftaran wang tak dituntut" system in Malaysia offers a valuable opportunity for individuals to reclaim their forgotten assets. By understanding the system, following the correct procedures, and remaining informed, you can navigate the process effectively and increase your chances of successfully reuniting with your unclaimed funds. Whether it's a small amount or a significant sum, taking the initiative to check for and claim your unclaimed money can positively impact your financial well-being. Remember, this money rightfully belongs to you, and taking action is the first step towards reclaiming what's yours.

Conquering week 8 your fantasy football cheat code

Hola buenas tardes mi nombre es russell mastering spanish greetings

Ming fai industrial co ltd a deep dive