The Ephemeral Life of a Check: Understanding Wells Fargo Check Validity

In the increasingly digital age of instant transfers and virtual currencies, the humble paper check persists as a tangible remnant of a slower, more deliberate financial era. But how long does this paper promise hold its value? Specifically, how long are checks valid at Wells Fargo, and what implications does this timeframe have for both the check writer and the recipient?

The validity period of a check is a crucial, often overlooked, aspect of personal finance. While the physical check itself may endure, its financial potency has a shelf life. Understanding this lifecycle can prevent frustrations, protect against potential financial losses, and ensure smooth transactions. This exploration delves into the nuances of Wells Fargo check validity, offering practical guidance and illuminating the often-unseen mechanisms of this seemingly simple financial instrument.

The journey of a check, from its initial inscription to its final redemption, is a delicate dance of trust and timing. The writer entrusts a portion of their funds to the recipient, with the understanding that these funds will be claimed within a reasonable timeframe. This “reasonable timeframe” is where the concept of check validity comes into play. Wells Fargo, like other financial institutions, adheres to certain guidelines regarding how long a check remains negotiable.

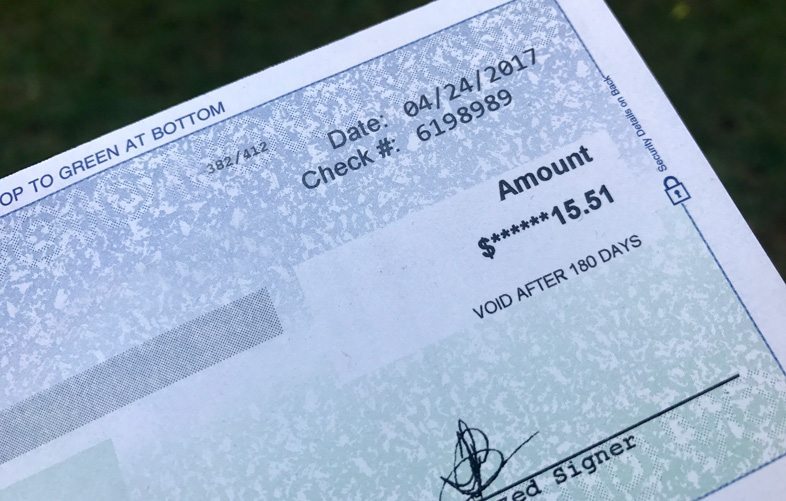

While the standard timeframe for check validity is often cited as six months, the reality can be more nuanced. Certain types of checks, such as cashier's checks or money orders, may have different validity periods. Additionally, state laws and individual bank policies can introduce variations to this general rule. Understanding these subtle distinctions is essential for effectively managing one's finances and avoiding potential complications.

Beyond the mere timeframe, the validity of a Wells Fargo check is interwoven with a network of interconnected factors, including the date of issue, the type of check, and the policies of both the issuing and receiving banks. This exploration aims to untangle these complexities, providing clarity and actionable insights for navigating the world of check validity.

Historically, checks served as a crucial instrument for facilitating commerce before the advent of electronic banking. Their validity period offered a balance between allowing sufficient time for processing and mitigating the risks associated with lost or stolen checks. Today, while electronic transactions dominate the financial landscape, checks still hold a place for specific situations, making an understanding of their validity period persistently relevant.

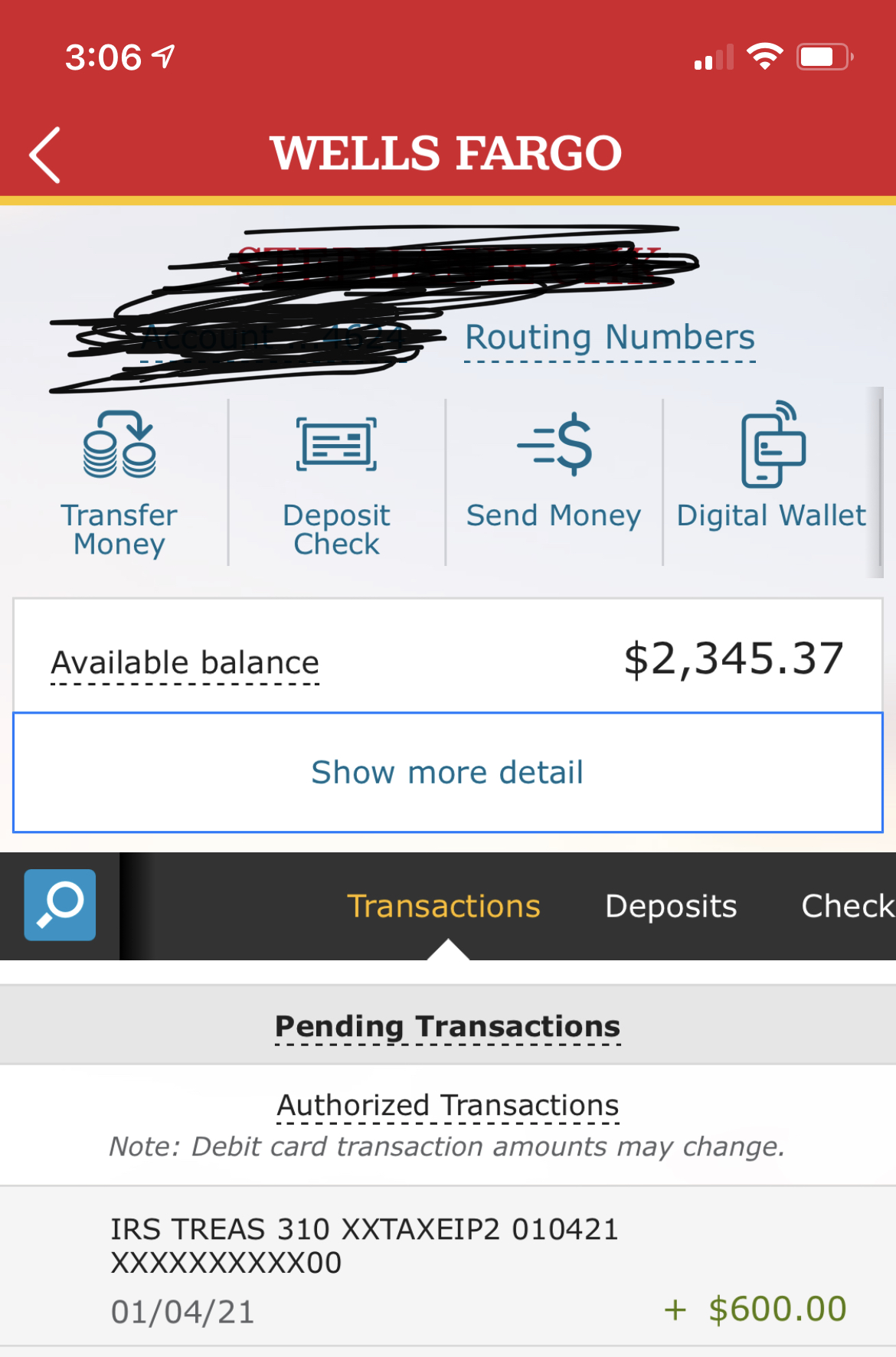

Wells Fargo generally considers personal checks valid for six months from the date of issue. However, it's essential to confirm with Wells Fargo directly for the most current information. Stale-dated checks – those older than six months – may be refused by the bank. Cashier's checks and money orders, being guaranteed funds, may have extended validity periods or, in some cases, no expiration date.

One benefit of understanding check validity is avoiding the frustration of a bounced check. For example, if you issue a check and the recipient delays depositing it beyond the validity period, the check may be returned unpaid. Knowing the timeframe allows you to proactively address the situation, either by issuing a new check or using an alternative payment method.

Another advantage is managing your account balance effectively. While a check is outstanding, the funds remain earmarked for that payment. Understanding the validity period helps you accurately track your available balance and prevent overdrafts, as you know when those funds may be claimed.

A third benefit is mitigating the risk of fraud. If a check is lost or stolen, its limited validity period reduces the window of opportunity for fraudulent use. This timeframe provides a layer of security against unauthorized access to your funds.

Advantages and Disadvantages of Check Validity Periods

| Advantages | Disadvantages |

|---|---|

| Reduced fraud risk | Potential for bounced checks if not deposited timely |

| Improved account balance management | Administrative burden of tracking check validity |

| Avoidance of payment delays | Limited flexibility compared to electronic payments |

Best Practice: Always date your checks accurately and legibly. This ensures clarity regarding the validity period and prevents potential disputes.

Best Practice: Advise recipients to deposit checks promptly. While you can't control their actions, encouraging timely deposit helps avoid issues with stale-dated checks.

Best Practice: Keep records of issued checks, including the date, amount, and payee. This enables you to track outstanding checks and manage your account effectively.

FAQ: How long are Wells Fargo checks valid? Generally, six months from the date of issue.

FAQ: What happens if a check is deposited after its validity period? It may be returned unpaid.

FAQ: Do cashier's checks expire? Their validity periods can vary; contact Wells Fargo for specific information.

FAQ: Can I stop payment on a stale-dated check? Yes, you can typically still place a stop payment on a stale-dated check.

FAQ: What should I do if I receive a stale-dated check? Contact the check writer to request a new check or alternative payment.

FAQ: Does the validity period restart if a check is re-deposited? No, the original issue date determines the validity period.

FAQ: How can I confirm the current Wells Fargo check validity policy? Contact Wells Fargo customer service or visit their website for the most up-to-date information.

FAQ: Are there legal implications related to stale-dated checks? While not illegal to hold onto a stale-dated check, its negotiability is affected.

Tip: Consider using online banking tools to track your issued checks and monitor their status.

In conclusion, understanding the validity period of a Wells Fargo check, or any check for that matter, is an essential aspect of responsible financial management. While the seemingly simple act of writing a check might feel like a relic of the past, its intricacies remain relevant in today’s financial landscape. Knowing how long checks are valid, the factors that influence this timeframe, and the potential consequences of exceeding this period, empowers both the check writer and the recipient to navigate financial transactions smoothly. By remaining informed and adopting proactive strategies, individuals can harness the enduring utility of the check while mitigating potential pitfalls. This knowledge empowers us to navigate the financial world with greater confidence, ensuring that even in the age of digital transactions, the humble check continues to serve its purpose effectively and securely. Contact Wells Fargo for the most up-to-date information regarding their check validity policies and best practices.

The enduring appeal of parker rollerball pens on amazon uk

Navigating your home financing journey with planet home lending mortgage

The enduring appeal of 1980s womens fashion