TD Bank Account Closure Declassified

So, you're ready to bid adieu to your TD Bank account? Maybe you've found a better deal elsewhere, or perhaps you're simplifying your finances. Whatever your reason, severing ties with a bank can feel like a surprisingly big deal. But fear not, intrepid financial navigator! This guide will illuminate the path to TD Bank account closure, providing you with the knowledge and tools to accomplish this mission with minimal fuss.

Closing a bank account isn't just clicking a button (though wouldn't that be nice?). It's a process that requires a little planning and understanding. But why is it important to know the proper procedure for terminating your TD Bank account online? Mishandling the closure could lead to returned payments, unexpected fees, or even difficulty accessing your funds in the future.

The rise of online banking has revolutionized how we manage our finances, including account closures. While traditionally, closing an account meant a trip to a physical branch, many banks, including TD Bank, now offer online closure options. This shift offers convenience and speed, eliminating the need for appointments and in-person interactions.

However, the digital age also presents its own challenges. Security concerns, navigating online interfaces, and ensuring all the necessary steps are followed correctly can be daunting. This guide aims to demystify the process of closing your TD Bank account online, addressing common concerns and providing clear, actionable steps.

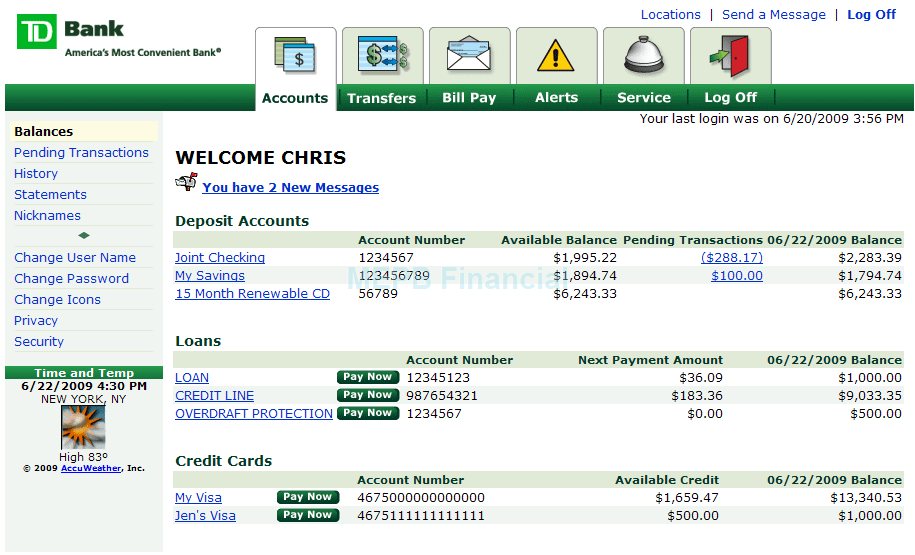

Before diving into the specifics, it's essential to understand that TD Bank may have different procedures for various account types. For example, closing a basic checking account might differ slightly from closing a savings account or a joint account. Always refer to TD Bank's official website or contact their customer service for the most up-to-date and accurate information specific to your account type.

Terminating a TD Bank account online can offer several benefits. First, it's incredibly convenient, saving you time and effort. Second, it allows you to manage your finances from anywhere with an internet connection. Third, it can provide a clearer audit trail of your closure request compared to phone conversations or in-person visits.

While TD Bank doesn't explicitly offer a fully online account closure for all account types, certain steps can be initiated online. For example, you might be able to submit a closure request through secure messaging or initiate the process through their website, which may then require a follow-up phone call.

Before initiating the closure, gather all relevant information, such as your account number, routing number, and any outstanding balances. Ensure you have an alternative account set up to transfer any remaining funds. Contact TD Bank customer service to confirm the exact steps for your specific account type.

Advantages and Disadvantages of Online Account Closure

| Advantages | Disadvantages |

|---|---|

| Convenience | Potential for technical issues |

| Time-saving | May not be available for all account types |

| Accessibility | Requires internet access |

Best practices for closing your account include verifying zero balance, setting up automatic payments to your new account, and keeping records of the closure confirmation.

Frequently Asked Questions include: What if I have automatic payments linked to my account? How long does it take to close the account? What do I do with my remaining balance?

In conclusion, closing a TD Bank account online can be a straightforward process when armed with the right information. By understanding the steps involved, potential challenges, and best practices, you can navigate this financial transition smoothly. Take control of your finances and ensure a seamless closure process. Don't hesitate to contact TD Bank customer service for personalized guidance. Start planning your account closure today!

High kings irish pub a deep dive

Unlock serenity with chinese jade behr paint

Missed ndr show yesterday heres what you need to know

.png)