Streamlining Zakat Payments: Borang Potongan Gaji Zakat Perak Explained

In the heart of Islamic finance lies the principle of Zakat, a pillar that emphasizes social responsibility and wealth distribution. For Muslims in Perak, Malaysia, fulfilling this obligation is made easier with the "Borang Potongan Gaji Zakat Perak," a system that simplifies Zakat payments for employees. Let's delve into what this system entails and how it benefits both individuals and the community.

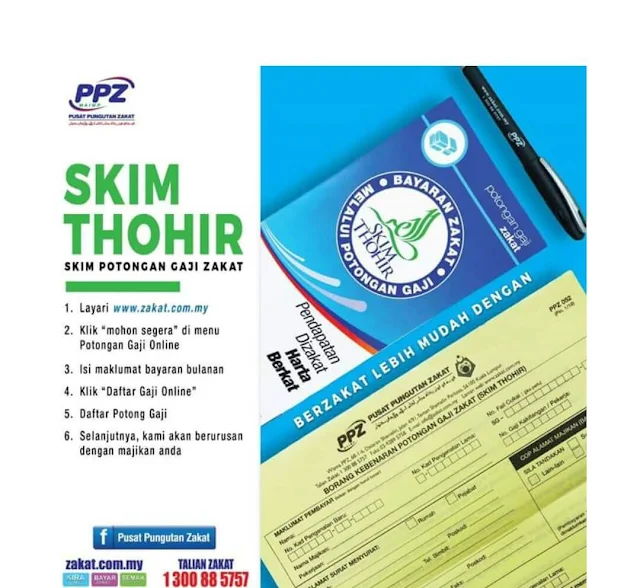

Imagine a system where your Zakat contributions are seamlessly deducted from your salary, eliminating the need for manual calculations and payments. This is the essence of the Borang Potongan Gaji Zakat Perak, a voluntary salary deduction scheme implemented in collaboration with the Perak State Islamic Religious Council (MAIPk). This initiative streamlines the Zakat payment process, making it hassle-free for employees while ensuring a consistent flow of funds for those in need.

But why is this system so important? Zakat, one of the five pillars of Islam, plays a crucial role in uplifting the less fortunate and fostering a more equitable society. By simplifying the payment process, the Borang Potongan Gaji Zakat Perak encourages greater participation in Zakat, leading to a larger pool of resources available for charitable causes within the state.

The history of this system is intertwined with the evolution of Zakat collection methods in Malaysia. Recognizing the need for a more efficient and accessible system, particularly for salaried individuals, the Perak state government, in partnership with MAIPk, introduced this salary deduction scheme. This initiative reflects the commitment to leveraging technology and modern practices to fulfill religious obligations.

However, like any system, the Borang Potongan Gaji Zakat Perak isn't without its challenges. One of the primary concerns revolves around awareness and understanding. Ensuring that all eligible employees, particularly those new to the workforce, are aware of this scheme and its benefits is crucial for widespread adoption. Additionally, clear communication regarding the deduction process, calculation methods, and the impact of these contributions is essential for building trust and transparency.

Advantages and Disadvantages of Borang Potongan Gaji Zakat Perak

| Advantages | Disadvantages |

|---|---|

| Convenience and Automation | Potential for Misunderstanding or Lack of Awareness |

| Consistency in Zakat Payments | Limited Flexibility in Payment Amounts (if not manually adjusted) |

| Contribution to Social Welfare Programs | Dependence on Employer Payroll Systems for Deductions |

While the concept of automated Zakat deductions is a positive step towards simplifying religious obligations, it's important to acknowledge potential drawbacks. Addressing these challenges through increased awareness campaigns, transparent communication, and user-friendly resources can further enhance the effectiveness and reach of the Borang Potongan Gaji Zakat Perak.

Despite these challenges, the Borang Potongan Gaji Zakat Perak stands as a testament to the commitment of the Perak state government in promoting social welfare and facilitating religious practices through modern and accessible solutions. As awareness grows and the system continues to evolve, it holds the potential to make a significant impact on the lives of countless individuals within the state.

Unlocking cook countys secrets your guide to public records

Steve and celina

Womens tattoos with meaning a permanent reminder of your power