Streamline Payroll: Mastering Salary Calculations with Excel

Managing payroll is a fundamental aspect of any business, and ensuring accurate salary calculations is crucial for both employee satisfaction and legal compliance. In today's digital age, leveraging technology can significantly simplify this process. Microsoft Excel, with its powerful formulas and functions, has become an indispensable tool for businesses of all sizes to streamline their payroll operations.

Before the advent of spreadsheets and specialized software, payroll calculations were often performed manually, a tedious and error-prone process. The introduction of Excel revolutionized payroll management, offering a more efficient and reliable method. By inputting employee data and utilizing formulas, businesses could automate calculations for base salary, overtime, bonuses, taxes, and other deductions. This not only saved time but also minimized the risk of human errors.

The importance of accurate base salary calculation in Excel cannot be overstated. It forms the foundation of an employee's compensation package and has a direct impact on their take-home pay. Errors in base salary calculation can lead to underpayment or overpayment, resulting in employee dissatisfaction, legal issues, and financial discrepancies.

One of the main issues associated with manual payroll processing is the potential for errors. Manually inputting data, applying formulas, and transferring information between different documents can lead to inaccuracies. Excel addresses this issue by providing a centralized platform for data storage and calculations, reducing the risk of human errors.

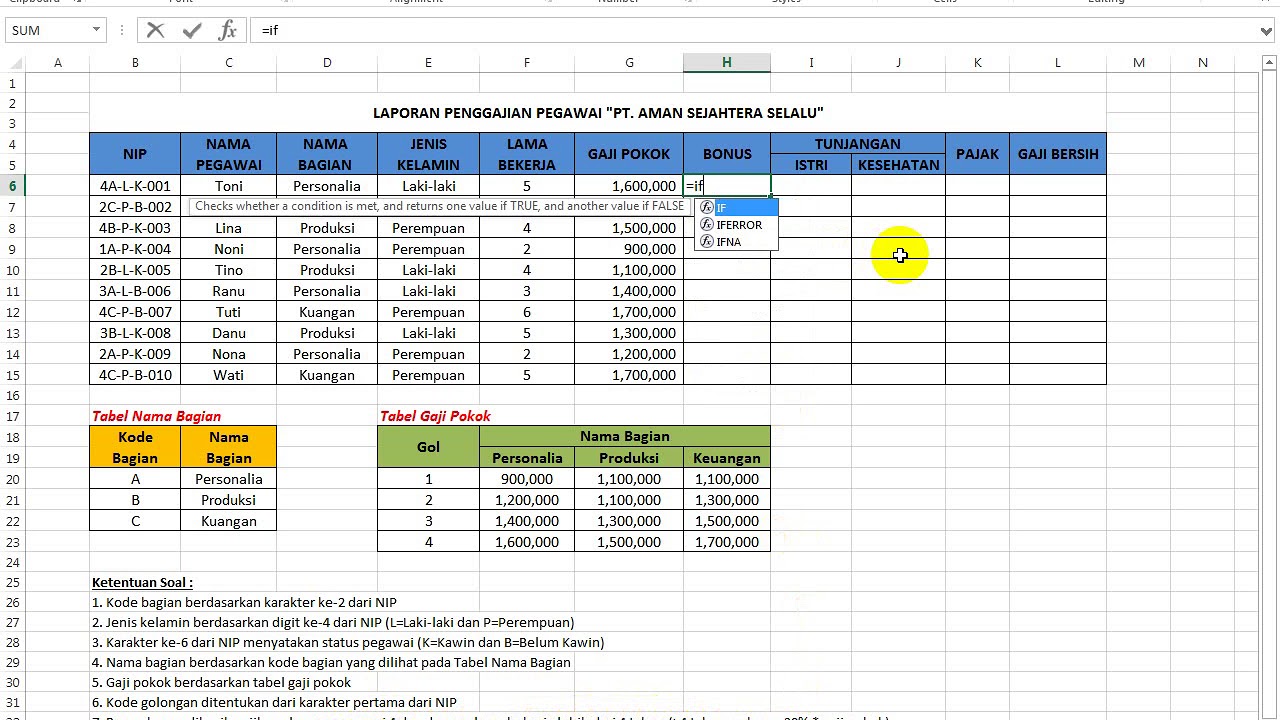

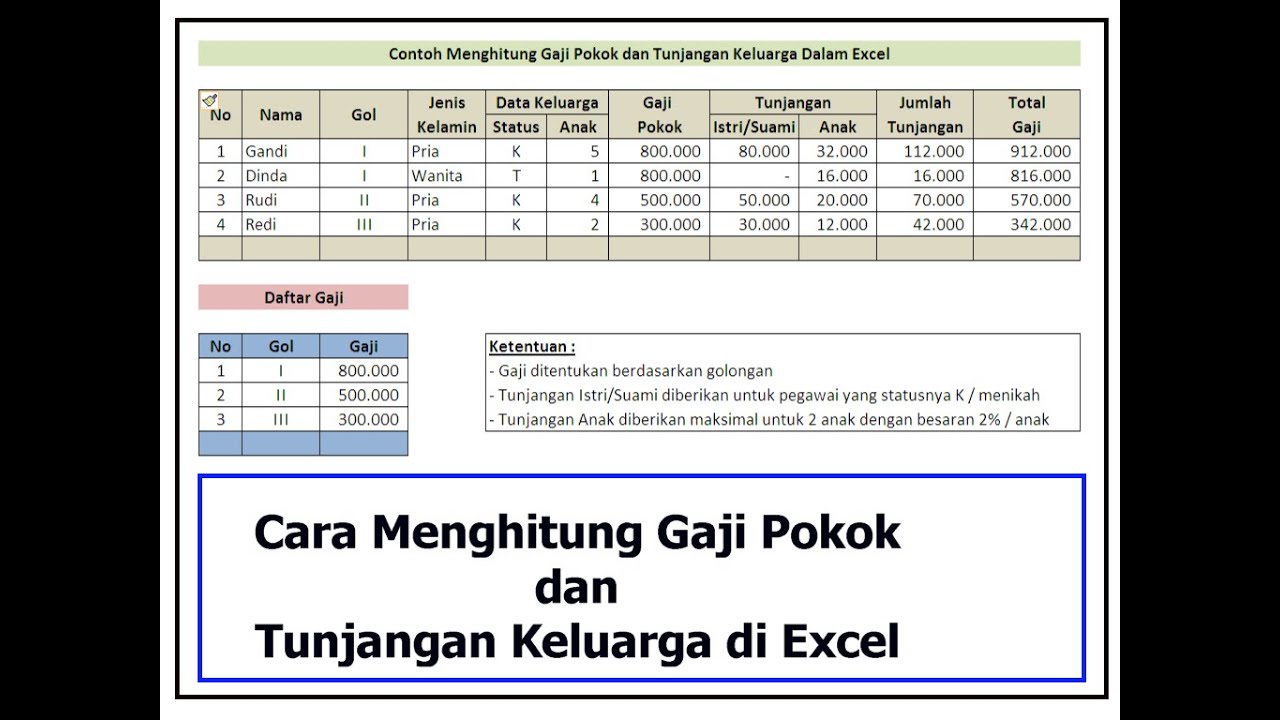

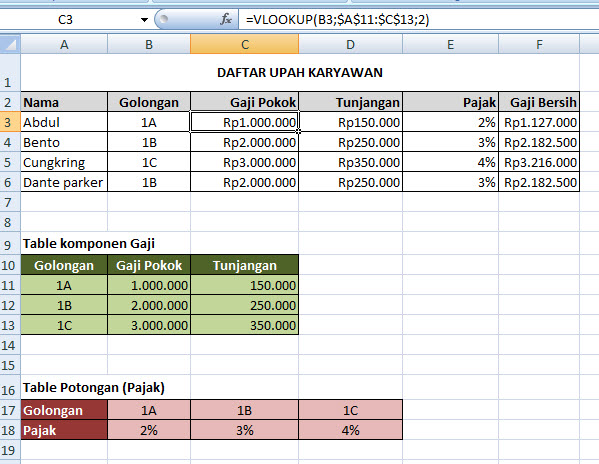

Let's delve into the basics of using Excel for base salary calculation. The "basic salary" typically refers to the fixed amount an employee earns before any deductions or additions, such as taxes, insurance, or bonuses. In Excel, you can use a simple formula to calculate the base salary. For instance, if an employee's hourly rate is in cell A1 and the number of hours worked is in cell B1, the formula in cell C1 would be "=A1*B1" to calculate their earnings.

While Excel greatly simplifies payroll calculations, there are still potential challenges. One common issue is data entry errors. Accidentally inputting incorrect data, such as an incorrect hourly rate or number of hours worked, can lead to inaccurate results. Another challenge is understanding and correctly applying Excel formulas. Using the wrong formula or making syntax errors can result in significant calculation discrepancies.

Advantages and Disadvantages of Using Excel for Base Salary Calculations

Let's explore the advantages and disadvantages of utilizing Excel for managing base salary calculations:

| Advantages | Disadvantages |

|---|---|

|

|

Despite its potential drawbacks, Excel remains a valuable tool for businesses, especially smaller ones, seeking an accessible and customizable solution for managing base salary calculations. By understanding its capabilities, limitations, and best practices, businesses can leverage Excel effectively to streamline their payroll processes and ensure accurate compensation for their employees.

The untimely end of jimmy ellis unraveling the mystery

Pipe insulation your secret weapon against frozen pipes and high energy bills

Rediscovering the thrill a guide to ski it again competition boats