Stay Ahead of Your Finances: A Guide to Semakan Baki Pinjaman MARA

Imagine this: you're planning your dream vacation, finally ready to tick that destination off your bucket list. But a nagging question pops up – how much do you still owe on your MARA loan? Suddenly, the excitement feels a little less vibrant. Understanding your financial obligations, especially student loans, is crucial for peace of mind and effective financial planning. In Malaysia, many students benefit from the Majlis Amanah Rakyat (MARA) education loan, a program designed to ease financial burdens and pave the way for a brighter future. However, keeping track of your loan balance is essential, and that's where "semakan baki pinjaman MARA" comes into play.

"Semakan baki pinjaman MARA," which translates to "MARA loan balance check" in Malay, is a simple yet powerful tool that empowers borrowers to stay informed about their loan status. This process provides transparency, allowing you to see how much you've paid off, how much you still owe, and your repayment progress. By utilizing this tool, you can proactively manage your finances, avoid potential penalties, and plan for a secure financial future.

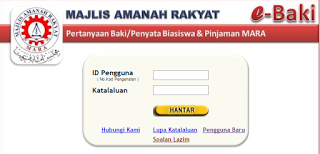

In today's fast-paced world, convenience is key. Recognizing this, MARA offers various methods for borrowers to conduct a "semakan baki pinjaman MARA." Whether you prefer the ease of online platforms, the personalized touch of phone calls, or the structure of a physical visit, MARA ensures accessibility and flexibility. These methods cater to diverse preferences and schedules, empowering borrowers to choose the most convenient way to stay updated on their loan balances.

While the concept of "semakan baki pinjaman MARA" might seem straightforward, its impact extends far beyond simply knowing your loan amount. Regularly checking your loan balance allows you to identify any discrepancies, ensuring you're not overcharged or facing any inaccuracies. It's about taking control of your financial well-being and making informed decisions based on accurate information.

This guide will delve deeper into the world of "semakan baki pinjaman MARA," exploring its importance, benefits, methods, and answering common questions. We aim to equip you with the knowledge and resources to manage your MARA loan efficiently and take charge of your financial journey.

Advantages and Disadvantages of Regularly Conducting "Semakan Baki Pinjaman MARA"

| Advantages | Disadvantages |

|---|---|

| Stay Informed: Always know your outstanding balance. | Time Commitment: Checking your balance requires a small time investment. |

| Financial Control: Track your repayment progress and plan accordingly. | Potential for Worry: Seeing a large outstanding balance can be stressful. |

Best Practices for Managing Your MARA Loan

- Regular Checks: Make it a habit to check your balance at least once a month.

- Set Reminders: Use calendar alerts or mobile apps to remind yourself of payment deadlines.

- Explore Repayment Options: Understand the different repayment schemes offered by MARA and choose one that suits your financial situation.

- Early Repayment: If possible, consider making early or additional payments to reduce your overall interest and shorten your loan tenure.

- Communication is Key: If you face financial difficulties, reach out to MARA and discuss possible solutions. Don't avoid communication.

Common Questions and Answers About "Semakan Baki Pinjaman MARA"

Q1: How often can I check my MARA loan balance?

A: You can check your balance as often as you need. There are no restrictions on how frequently you can conduct a "semakan baki pinjaman MARA."

Q2: Are there any fees for checking my balance?

A: No, MARA does not charge any fees for checking your loan balance.

Q3: What should I do if I find an error in my loan balance?

A: If you notice any discrepancies, contact MARA immediately through their official channels to report the issue and seek clarification.

Q4: Can I check my balance if I'm overseas?

A: Yes, you can access your loan information online through the MARA portal regardless of your location.

Q5: What is the official MARA website for checking my loan balance?

A: Please refer to the official MARA website for the most up-to-date information and access their online portal.

Q6: Can I update my contact information through the online portal?

A: Yes, the MARA online portal typically allows you to update your personal information, including your contact details.

Q7: Is my loan information secure online?

A: MARA takes data security seriously. Their online platforms are designed with security measures to protect your personal and financial information.

Q8: Can I request a statement of my loan repayment history?

A: Yes, you can usually request a statement of your loan account through the MARA online portal or by contacting their customer service.

Tips and Tricks for Managing Your MARA Loan

- Budgeting: Create a monthly budget that allocates funds for your loan repayment.

- Automate Payments: Set up automatic payments through your bank to avoid late fees.

- Financial Literacy: Seek out resources and information to improve your financial literacy, helping you make better financial decisions.

In conclusion, understanding and utilizing "semakan baki pinjaman MARA" is more than just a routine task—it's a crucial aspect of responsible financial management. By actively engaging with your MARA loan, you gain control over your financial well-being, ensure accuracy in your repayments, and pave the way for a brighter, debt-free future. Embrace the tools and knowledge available to navigate your loan journey confidently and make informed decisions that empower your financial success. Remember, taking charge of your finances today opens doors to a more secure and fulfilling tomorrow.

Maximizing space with double sliding doors understanding lebar pintu geser 2 daun

Borang permohonan pelekat kenderaan what you need to know

Unleash the fun your guide to epic bounce house rentals in elizabethtown ky