Requesting Checkbooks: A Comprehensive Guide

Managing your finances effectively often involves utilizing various banking instruments. Among these, checkbooks remain a relevant tool for many individuals and businesses. However, obtaining a new checkbook requires a formal request to your bank. This article serves as a comprehensive guide to understanding the process of applying for a checkbook, particularly focusing on the checkbook request letter (often referred to as "contoh surat permohonan penerbitan buku cek" in Indonesian).

The need for a new checkbook arises for various reasons, from running out of checks to requiring a new checkbook for a newly opened account. Regardless of the reason, understanding the correct procedure for requesting a checkbook is crucial. This involves knowing how to write a formal request letter or utilizing your bank's online systems, if available.

While digital transactions are increasingly prevalent, checkbooks still hold value in certain situations. They offer a tangible record of transactions and are often preferred for specific payments like rent or large purchases. Therefore, knowing how to obtain a new checkbook when needed is an essential aspect of financial management.

A formal request, whether through a letter or an online form, ensures a smooth and efficient process. This allows the bank to process your request accurately and deliver your new checkbook promptly. This guide will delve into the details of making this request effectively.

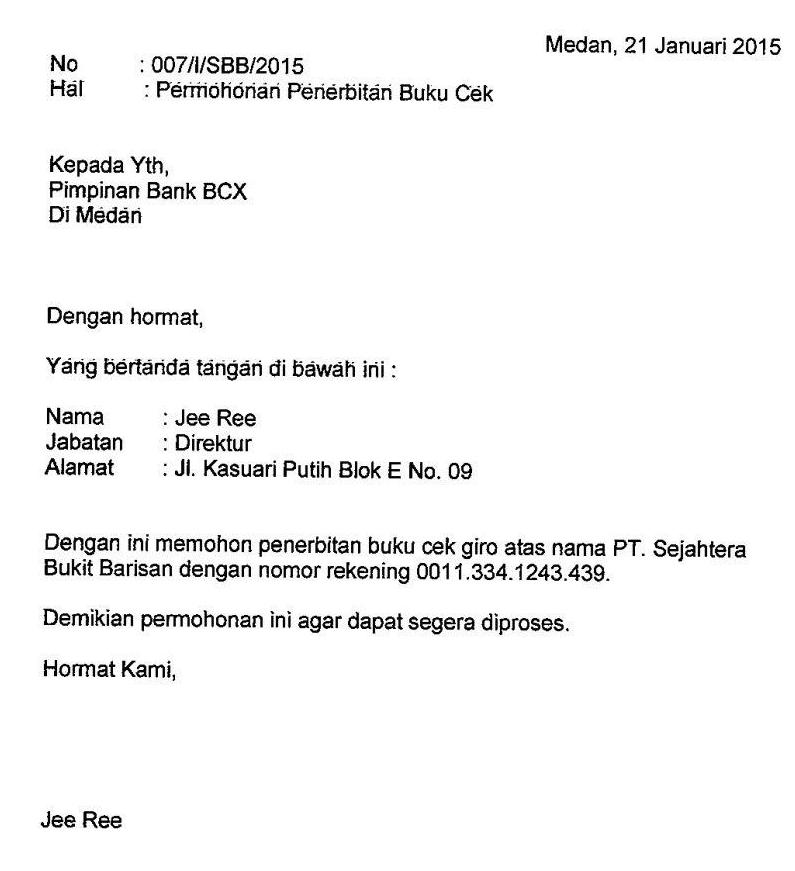

The term "contoh surat permohonan penerbitan buku cek" translates from Indonesian to "example letter of request for issuing a checkbook." This highlights the importance of a formal written request in the Indonesian banking context. While the specific format may vary between banks, the underlying principles remain the same: a clear and concise request containing all necessary information.

The history of check usage dates back centuries, evolving from various forms of promissory notes. Checkbook request procedures have evolved alongside this history, moving from purely paper-based systems to include online requests and even automated reordering in some cases.

A well-written checkbook request letter eliminates ambiguity and reduces processing time. It ensures that the bank has all the necessary information to fulfill your request accurately. Key information usually includes your account number, full name, contact details, and the number of checkbooks required.

Benefits of a formal request: 1. Clarity: A written request or a properly filled online form leaves no room for misinterpretations. 2. Efficiency: It expedites the process as the bank receives all necessary information upfront. 3. Record Keeping: A formal request serves as documentation of your request, which can be useful for future reference.

Steps to request a checkbook: 1. Check your bank's preferred method: Some banks may prioritize online requests, while others might still require a physical letter. 2. Gather necessary information: Have your account details, contact information, and the required number of checkbooks ready. 3. Submit your request: Send the letter or complete the online form accurately. 4. Follow up: If you haven't received your checkbook within a reasonable timeframe, contact your bank to inquire about the status of your request.

Advantages and Disadvantages of Using Checkbooks

| Advantages | Disadvantages |

|---|---|

| Tangible record of transactions | Can be lost or stolen |

| Accepted for larger payments | Requires manual reconciliation |

| Useful when online payments aren't available | Processing time can be longer than digital payments |

Frequently Asked Questions:

1. How long does it take to receive a new checkbook? - Typically, it takes a week or two, depending on your bank's policies.

2. What if I lose my checkbook? - Report it to your bank immediately to prevent fraudulent activity.

3. Can I request a checkbook online? - Many banks offer online checkbook request facilities through their websites or mobile apps.

4. Is there a fee for requesting a new checkbook? - While some banks may charge a nominal fee, many provide checkbooks free of charge.

5. How many checkbooks can I request at a time? - This depends on your bank's policy.

6. What should I do if my checkbook request is delayed? - Contact your bank's customer service to inquire about the status.

7. Can I customize my checkbook? - Some banks offer personalized checkbook options.

8. What if my address has changed? - Inform your bank about your new address before requesting a new checkbook.

Tips and Tricks: Keep a record of your checkbook requests. If your bank offers automated checkbook reordering, consider enrolling in the service.

In conclusion, while the world increasingly moves towards digital transactions, checkbooks remain a relevant tool for various financial needs. Understanding the process of requesting a new checkbook, whether through a formal letter (contoh surat permohonan penerbitan buku cek) or through online methods, ensures you have access to this essential banking instrument when needed. Properly managing your checkbook requests contributes to efficient financial management. The ability to request a new checkbook seamlessly provides peace of mind and ensures you can conduct your financial affairs smoothly. Take the time to familiarize yourself with your bank's specific procedures and utilize the information provided in this guide to streamline your checkbook requests. This ensures uninterrupted access to this valuable financial tool.

Cimb bank business current account your business moneys new home

Unlocking science success your guide to form 3 science textbooks answers

Navigating the midlife crossroads a womans journey