PTPTN Loan Repayment Exemption Application: Your Guide to Financial Freedom

Graduating from university should feel like stepping onto a launchpad, ready to blast off into the exciting world of career and possibilities. But for many Malaysian graduates, that feeling is weighed down by the burden of student loan debt, specifically PTPTN loans. The pressure to start repaying can feel immense, especially when you're just starting your career. What if there was a way to ease that pressure, even eliminate it entirely?

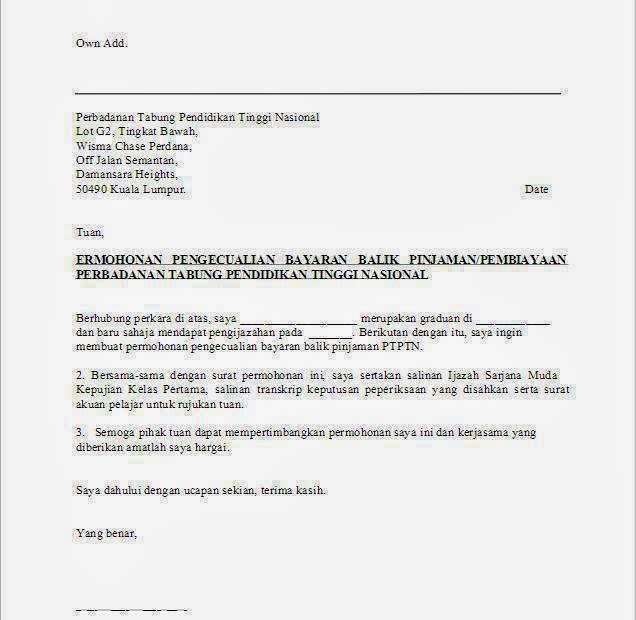

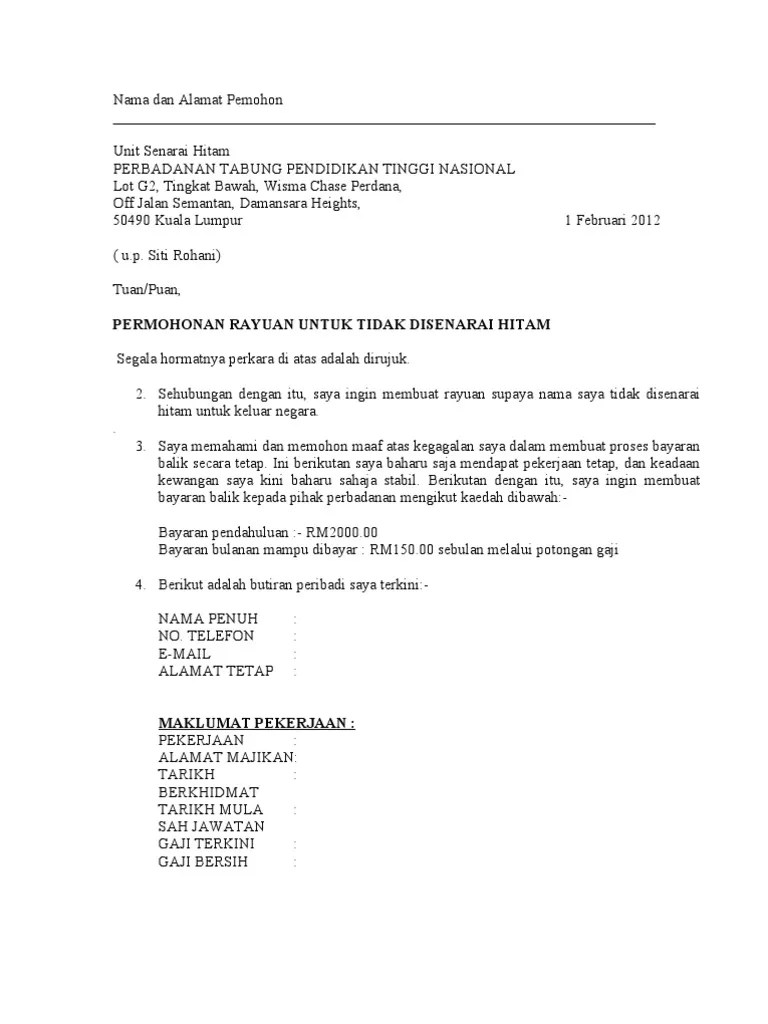

That's where the "PTPTN Permohonan Pengecualian Bayaran Balik" comes in. In English, that's the "PTPTN Loan Repayment Exemption Application." It's a lifeline for those who meet specific criteria, offering a chance to have their PTPTN loan entirely forgiven. This isn't some well-kept secret, but navigating the application process and understanding the requirements can feel like navigating a labyrinth.

Let's be real: dealing with government bureaucracy and paperwork isn't exactly anyone's idea of a good time. But what if I told you that taking the time to understand the PTPTN loan repayment exemption could potentially save you thousands of Ringgit, money you could use to travel, invest, or simply breathe a little easier? It's worth exploring, right?

In this article, we'll break down everything you need to know about "PTPTN Permohonan Pengecualian Bayaran Balik" – from who's eligible to the step-by-step application process, and even common pitfalls to avoid. We'll equip you with the knowledge you need to navigate the process confidently and increase your chances of approval.

This isn't just about understanding a government program; it's about taking control of your financial future. It's about understanding your options and making informed choices that empower you to pursue your dreams without the looming shadow of student loan debt. So, buckle up, grab your favorite beverage, and let's dive into the world of PTPTN Loan Repayment Exemption!

Advantages and Disadvantages of Applying for PTPTN Loan Repayment Exemption

While the prospect of having your PTPTN loan forgiven is undoubtedly appealing, it's essential to weigh the pros and cons before diving headfirst into the application process.

| Advantages | Disadvantages |

|---|---|

| Significant financial relief, freeing up monthly income. | Time commitment required to gather documents and navigate the application process. |

| Opportunity to invest the money previously allocated for loan repayment. | Potential changes in eligibility criteria or government policy in the future. |

| Reduced financial stress and improved mental well-being. | Possibility of rejection, requiring continued loan repayment. |

Best Practices for a Successful PTPTN Loan Repayment Exemption Application

Here are some tried-and-true tips to maximize your chances of a successful application:

- Start Early, Stay Organized: Don't wait until the last minute. Gather all required documents well in advance and organize them meticulously.

- Double-Check Everything: Accuracy is crucial. Ensure all information provided on your application is correct and consistent with supporting documents.

- Meet Deadlines: Adhering to application deadlines is essential. Late submissions might not be considered.

- Follow Up: After submitting your application, don't hesitate to follow up with PTPTN to check its status and address any queries promptly.

- Seek Clarification When Needed: Don't hesitate to contact PTPTN directly if you have any questions or need clarification on any aspect of the application.

Common Questions about PTPTN Loan Repayment Exemption

Let's address some frequently asked questions about the exemption:

- What are the eligibility criteria for PTPTN Loan Repayment Exemption? Eligibility criteria vary depending on the specific exemption category. However, common factors include academic achievement (First Class Honors), disability, and certain medical conditions.

- How do I apply for PTPTN Loan Repayment Exemption? Applications are typically submitted online through the official PTPTN website. Detailed instructions and downloadable forms are usually available on the website.

- What documents do I need to provide with my application? Required documents commonly include academic transcripts, identification documents, and supporting documentation for specific exemption categories (e.g., medical reports for medical exemptions).

- How long does it take to process the application? Processing times can vary, but it generally takes a few months from the application submission date to receive a decision.

- What happens if my application is rejected? If your application is rejected, you typically have the option to appeal the decision. Details on the appeals process are usually provided in the rejection notification.

- Can I apply for exemption if I have already started repaying my loan? Yes, in some cases, you can still apply for exemption even if you have already begun repaying your PTPTN loan. However, eligibility criteria and procedures might vary.

- Are there any penalties for unsuccessful exemption applications? No, there are typically no penalties for applying for exemption, even if your application is unsuccessful. You will continue with your existing loan repayment schedule.

- Where can I get more information about PTPTN Loan Repayment Exemption? The official PTPTN website is the best resource for the most up-to-date information, application forms, and contact details.

Navigating the world of PTPTN loan repayment doesn't have to be daunting. While this article provides a general overview, always refer to the official PTPTN website for the most current information and specific requirements. Remember, investing time in understanding your options and meticulously preparing your application can potentially save you a significant amount of money and pave the way for a brighter financial future. So take that first step, explore your eligibility, and unlock the financial freedom you deserve!

Conquering corporate puzzles your guide to quiz logo game answers

Words that soar crafting the perfect graduation message to your son

The subtle art of small tattoos for women exploring stencils and meaning