PNC Routing Number St. Louis, MO: Your Gateway to Seamless Transactions

Navigating the financial matrix of St. Louis requires precision, and the PNC routing number is your key. Think of it as the GPS coordinates for your PNC bank account in the Gateway to the West. This seemingly simple nine-digit code is the backbone of electronic transactions, ensuring your funds arrive at the right destination.

But what exactly is a PNC routing number for St. Louis, MO, and why is it so crucial? Imagine trying to send a letter without a zip code – chaos would ensue. Similarly, without the correct routing number, your direct deposits, bill payments, and wire transfers could get lost in the digital ether. This number identifies the specific PNC branch in St. Louis where your account was opened, allowing for smooth and accurate processing of your financial transactions.

The routing number system, established by the American Bankers Association, has been the backbone of the US financial system for decades. For PNC customers in St. Louis, this translates to efficient processing of payments and deposits within the city and across the country. Knowing your PNC routing number in St. Louis is essential for setting up direct deposit, paying bills online, and even transferring funds between accounts.

One potential issue is using the incorrect routing number. A simple typo can lead to delays, returned payments, and even fees. This is why double-checking your PNC routing number is paramount. Another challenge is the potential for fraud. While rare, it's crucial to protect your routing number like any other sensitive financial information.

Understanding the nuances of the PNC routing number in St. Louis, Missouri, empowers you to take control of your finances. Whether you're a seasoned resident or new to the city, having the correct routing number is vital for smooth financial operations. From direct deposits to online bill pay, this nine-digit code is the silent conductor of your financial orchestra.

The PNC routing number for St. Louis, MO, may vary depending on the specific branch where your account was opened. It's essential to verify the correct number directly with your bank or through official PNC online resources. Using an outdated or incorrect number can lead to transaction delays or failures.

One benefit of using the correct PNC routing number is the seamless processing of direct deposits. This allows your paycheck or government benefits to be deposited directly into your account, eliminating the need for paper checks and trips to the bank. Another advantage is the convenience of online bill pay. With the correct routing number, you can easily schedule and pay bills electronically, saving time and postage.

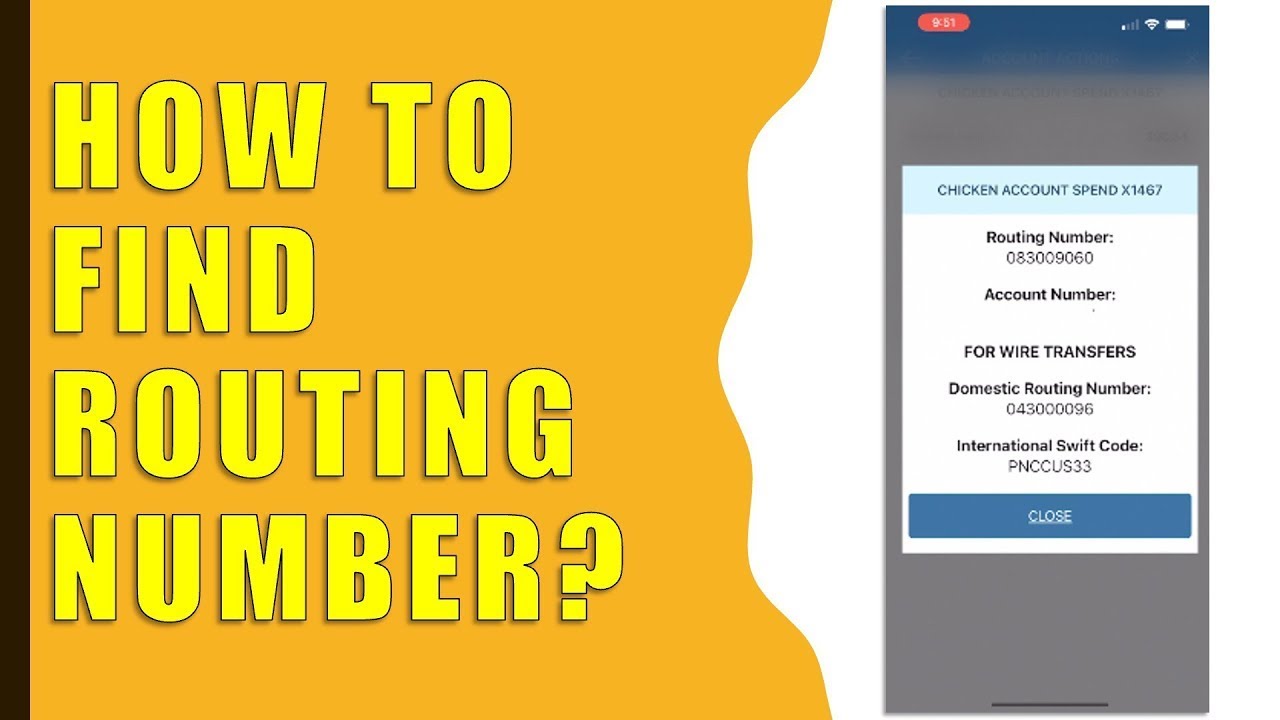

To find your PNC routing number, you can log in to your online banking account, check your printed checks, or contact PNC customer service. Always ensure the source of the information is reliable to avoid using incorrect numbers.

Advantages and Disadvantages of Online Banking

| Advantages | Disadvantages |

|---|---|

| Convenience of 24/7 access | Security risks associated with online platforms |

| Fast transaction processing | Potential for technical issues or website downtime |

| Easy access to account information | Requires internet access and digital literacy |

Best Practice: Always verify your PNC routing number with PNC directly before initiating any electronic transactions.

Best Practice: Keep your routing number confidential and protect it from unauthorized access.

Best Practice: Regularly review your bank statements for any unauthorized transactions.

Best Practice: Use strong passwords and two-factor authentication for your online banking accounts.

Best Practice: Be cautious of phishing scams that attempt to steal your financial information.

FAQ: What is a routing number? A routing number is a nine-digit code used to identify a specific financial institution in the United States.

FAQ: Where can I find my PNC routing number? You can find your PNC routing number on your checks, online banking platform, or by contacting PNC customer service.

FAQ: What happens if I use the wrong routing number? Using the wrong routing number can result in transaction delays, returns, or even fees.

FAQ: Is my routing number the same as my account number? No, your routing number and account number are different. The routing number identifies the bank, while the account number identifies your specific account.

FAQ: Can I use the same routing number for all PNC branches? No, the PNC routing number may vary depending on the specific branch where your account was opened.

FAQ: How do I protect my routing number? Protect your routing number like any other sensitive financial information. Don't share it with untrusted sources.

FAQ: What should I do if I suspect fraudulent activity on my account? Contact PNC immediately if you suspect any unauthorized activity on your account.

FAQ: Does my routing number change if I move? Your routing number might change if you move and your account is transferred to a different branch. Contact PNC to confirm.

Tips and tricks: When setting up direct deposit, double-check the routing and account numbers with your employer. When making online payments, always verify the recipient's information and the routing number before confirming the transaction. Keep a record of your PNC routing number in a secure location.

In conclusion, the PNC routing number for St. Louis, MO, is a critical piece of information for anyone holding a PNC account in the city. This nine-digit code is the linchpin of seamless electronic transactions, enabling efficient direct deposits, online bill payments, and smooth fund transfers. Understanding its importance and taking steps to ensure its accuracy and security empowers you to navigate the financial landscape of St. Louis with confidence. From setting up direct deposits to managing online payments, the correct PNC routing number is your gateway to smooth and efficient financial transactions. Be sure to keep your routing number secure, verify its accuracy before initiating any transactions, and contact PNC directly if you have any questions or concerns. By actively managing and protecting your financial information, you can ensure the smooth operation of your financial life in St. Louis.

Crafting compelling commercials a deep dive into advertisement rubrics rubrik sa paggawa ng patalastas

Deconstructing color navigating the sherwin williams paint website

Unlocking rich hues behr paint deep base 2300