Navigating the Financial Cosmos: Understanding JPMorgan Chase Bank Routing Numbers in New York

In the labyrinthine world of finance, where numbers dance and transactions flow like rivers, one element stands as a crucial guidepost: the bank routing number. Imagine it as a unique address, ensuring that your financial communications reach their intended destination. For those engaging with JPMorgan Chase in the bustling metropolis of New York, understanding the nuances of these nine-digit codes is paramount.

The JPMorgan Chase bank routing number for New York acts as a linchpin in the intricate machinery of electronic funds transfer. It's the silent navigator, directing payments and deposits accurately within the Chase network and across other financial institutions. Without this seemingly insignificant sequence of digits, the smooth flow of transactions we often take for granted would grind to a halt.

Think of the routing number as a key, unlocking the specific vault within the vast financial network where your account resides. When you initiate a direct deposit, set up automatic bill payments, or transfer funds electronically, the routing number for your specific New York Chase branch ensures that the transaction lands in the correct account. Its importance resonates through every facet of modern banking, from the smallest recurring payment to the largest corporate transfer.

The history of routing numbers is intertwined with the evolution of the American banking system. Established by the American Bankers Association (ABA) in 1910, these numbers initially aimed to streamline check processing. Over time, their role expanded to encompass the broader landscape of electronic transactions, becoming an essential component of the Automated Clearing House (ACH) network. For JPMorgan Chase, a bank with a rich and complex history marked by mergers and acquisitions, understanding the correct routing number for a specific New York location can be crucial.

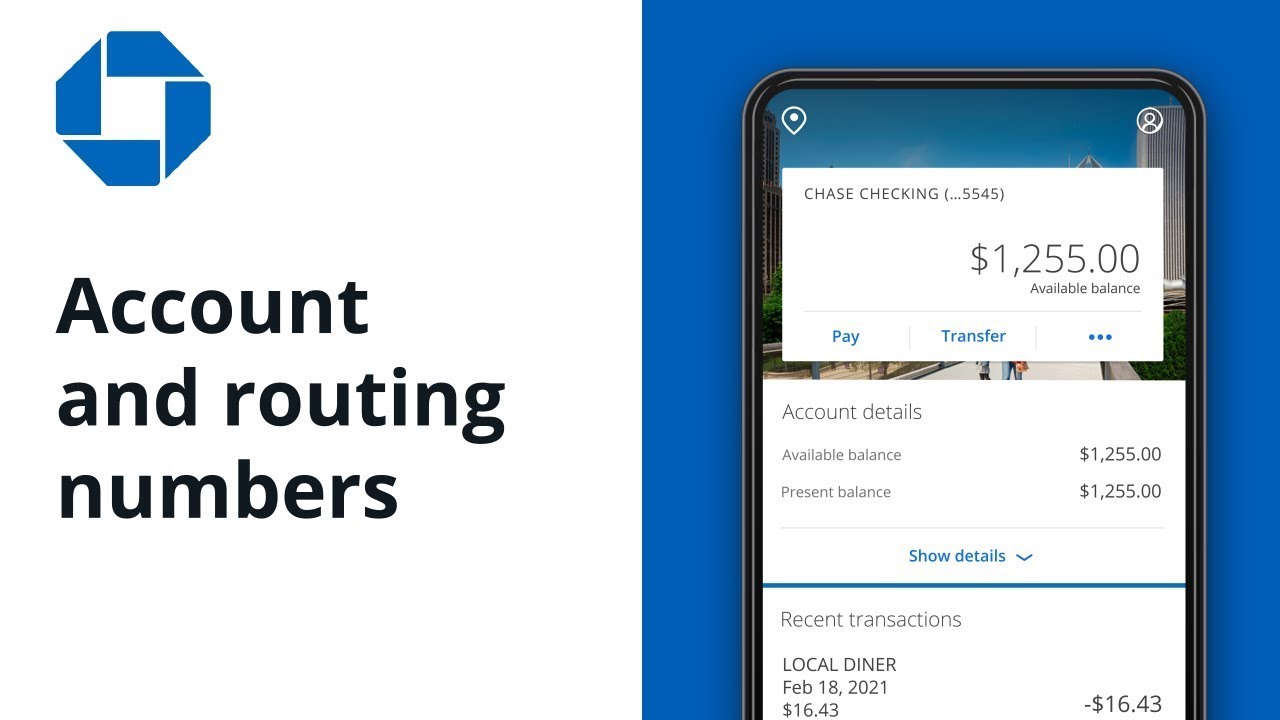

Locating the correct JPMorgan Chase bank routing number for your New York account is often straightforward. It can usually be found on your checks, at the bottom left-hand corner. Alternatively, you can access this information through online banking platforms, on your monthly statement, or by contacting Chase customer service. It's essential to confirm you have the correct routing number for your specific account and transaction type, as using an incorrect number can lead to delays or misdirected funds. Some online transactions, especially wire transfers, might require a different routing number than the one printed on your checks. Always double-check with Chase to avoid any complications.

One key challenge involves keeping your routing number secure. While it isn't as sensitive as your account number or social security number, sharing it indiscriminately increases the risk of fraud. Exercise caution when providing this information, especially online, and be wary of phishing scams that attempt to trick you into revealing your financial details.

A step-by-step guide to finding your JPMorgan Chase bank routing number in New York: 1. Check your checkbook: Look for the nine-digit number at the bottom left corner. 2. Log in to online banking: Navigate to your account details section. 3. Review your monthly statement: The routing number is usually printed alongside your account information. 4. Contact Chase customer service: They can provide the correct routing number for your account.

Advantages and Disadvantages of Electronic Transfers

| Advantages | Disadvantages |

|---|---|

| Convenience | Potential Security Risks |

| Speed | Reliance on Technology |

| Automation | Possible Delays |

Frequently Asked Questions:

1. What is a bank routing number? - A nine-digit code identifying a specific financial institution.

2. Why is the routing number important? - It ensures funds are transferred to the correct account.

3. Where can I find my Chase routing number? - On your checks, online banking, monthly statement, or by contacting Chase.

4. Is the routing number the same for all Chase branches in New York? - No, it can vary.

5. What happens if I use the wrong routing number? - The transaction may be delayed or rejected.

6. How can I protect my routing number? - Be cautious about sharing it online and be wary of phishing scams.

7. Do I need different routing numbers for different types of transactions? - Possibly, especially for wire transfers. Confirm with Chase.

8. Can I use my Chase New York routing number for international transactions? - Generally, no. International transfers require different codes (e.g. SWIFT codes).

Tips and Tricks: Always verify the routing number before initiating any transaction. Keep your routing number secure and never share it with untrusted sources. Utilize Chase's online resources for quick access to your account information.

In conclusion, the JPMorgan Chase bank routing number for New York serves as a critical component of our increasingly digital financial ecosystem. Understanding its function, importance, and best practices empowers us to navigate the complex world of electronic transactions with confidence. By staying informed and proactive, we can harness the power of modern banking while safeguarding our financial well-being. From streamlining everyday payments to facilitating crucial business transfers, the routing number's role is undeniable. By understanding its significance and taking appropriate precautions, we ensure the seamless flow of our financial lives. It's essential to treat this seemingly small detail with the respect it deserves, ensuring accuracy in all our financial endeavors. Embrace the knowledge, navigate wisely, and ensure your financial transactions reach their intended destination. This understanding is not just beneficial; it is essential for anyone engaging with the modern financial landscape.

Cheryl tiegs imagery a timeless allure

Virginia holidays a comprehensive guide

Locked out of gmail how to regain access to your google account