Navigating the Digital Age: A Guide to Wells Fargo Voided Check PDF Fillers

In an era where digital transactions reign supreme, the humble check might seem like a relic of the past. However, many financial processes still rely on these paper instruments, albeit with a modern twist. Enter the "Wells Fargo voided check PDF filler," a term that has become increasingly relevant in our digitally driven world. But what exactly does it mean, and why should you care?

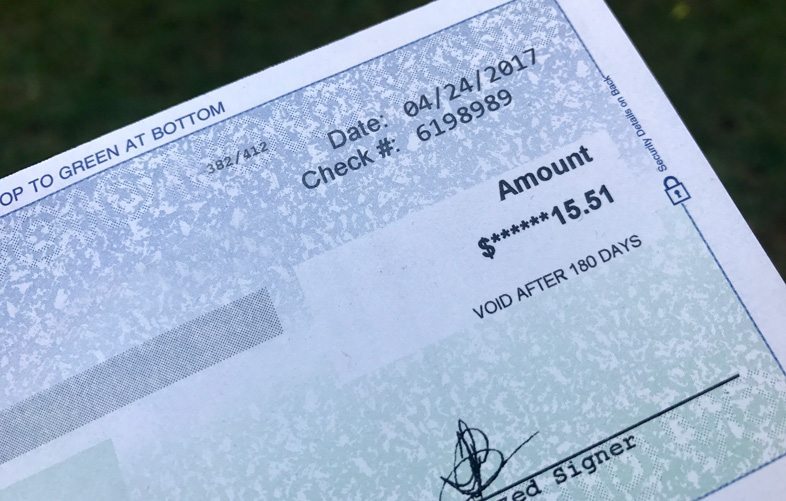

A voided check, as you might know, is a check that's been marked "VOID" to prevent its use for payment. Traditionally, you'd physically write "VOID" across a check. But today, with online banking and digital documents, the process has become more streamlined. A Wells Fargo voided check PDF filler essentially allows you to electronically fill out a voided check template, replicating the traditional method. This digital version serves the same purpose as its physical counterpart — providing your banking information to a third party for setting up direct deposits, automatic payments, or verifying your account details.

The rise of Wells Fargo voided check PDF fillers is directly tied to the increasing digitization of financial services. As more people manage their finances online, the need for convenient, paperless solutions has become paramount. These fillers eliminate the need to physically void a check, scan it, and send it, saving time and effort. They also address concerns about security and privacy by providing a controlled environment for sharing sensitive banking information.

However, like any digital tool, Wells Fargo voided check PDF fillers also come with their own set of challenges. One primary concern is the potential for misuse if these forms land in the wrong hands. Therefore, it's crucial to only use reputable websites or software and to ensure the security of the platform you're using. Always double-check the recipient's legitimacy before submitting any banking information electronically.

Despite the potential risks, the benefits of utilizing Wells Fargo voided check PDF fillers are undeniable. The convenience, speed, and efficiency they offer make them an attractive alternative to traditional methods. As we increasingly embrace digital solutions in our financial lives, understanding and utilizing tools like Wells Fargo voided check PDF fillers will become essential for navigating the financial landscape effectively.

Advantages and Disadvantages of Wells Fargo Voided Check PDF Fillers

| Advantages | Disadvantages |

|---|---|

| Convenience | Security risks if used on unverified platforms |

| Speed and efficiency | Potential for misuse if forms are accessed by unauthorized individuals |

| Environmentally friendly (paperless) |

While the digital world offers incredible convenience, it also demands caution and awareness. By staying informed and prioritizing security, you can confidently navigate the world of digital banking tools like Wells Fargo voided check PDF fillers and simplify your financial life.

Level up your game finding the best fortnite clip software

Shacarri richardson where is she now and whats next

Decoding the childhood friend complex your guide to the trope