Navigating the Currents of Personal Finance: A Deep Dive into Wells Fargo Checking Accounts

In the vast and ever-shifting landscape of personal finance, the checking account stands as a fundamental cornerstone. It's the hub through which our financial lives flow, a conduit for earnings, expenses, and the aspirations they fuel. Among the myriad institutions offering these vital services, Wells Fargo looms large, its name synonymous with a long history in American banking. But what does a Wells Fargo personal checking account truly offer in today's complex financial world?

Choosing the right checking account is akin to selecting the right vessel for a journey. It must be sturdy, reliable, and equipped to handle the specific demands of the voyage. For some, this might mean prioritizing low fees and convenient ATM access. For others, it might involve robust online banking features and seamless integration with budgeting tools. Understanding your own financial needs and priorities is the crucial first step in navigating the sea of options.

Wells Fargo offers a range of personal checking accounts, each designed to cater to different financial profiles. From the basic Everyday Checking account to the premium Portfolio by Wells Fargo program, the choices can seem daunting. This exploration aims to demystify the world of Wells Fargo personal checking, providing a compass to guide you through the various offerings and help you determine which, if any, aligns with your individual financial goals.

The history of Wells Fargo itself is deeply interwoven with the history of American finance, dating back to the mid-19th century. Originally founded as an express company serving the burgeoning needs of the Gold Rush era, Wells Fargo evolved into a banking institution, weathering economic storms and adapting to the changing tides of the financial landscape. This historical context informs the present-day offerings, reflecting both a legacy of tradition and an ongoing effort to adapt to the demands of modern banking.

The importance of a well-managed checking account cannot be overstated. It serves as the central hub for managing daily transactions, paying bills, receiving deposits, and accessing funds. A checking account is more than just a repository for money; it's a tool for financial empowerment, enabling individuals to track their spending, budget effectively, and build a secure financial foundation. However, issues can arise with any checking account, including overdraft fees, monthly maintenance charges, and potential security concerns. Understanding these potential pitfalls is crucial for making informed decisions and navigating the complexities of personal finance.

Wells Fargo offers several types of personal checking accounts, including Everyday Checking, Preferred Checking, and Portfolio by Wells Fargo. Each account has different features and fees. For example, Everyday Checking is a basic account with a monthly service fee that can be avoided by meeting certain requirements. Preferred Checking offers interest-earning potential and other perks. Portfolio by Wells Fargo is a premium account with a higher monthly fee but provides access to enhanced services and benefits.

Three key benefits of Wells Fargo personal checking are: wide ATM access, a robust online banking platform, and convenient mobile banking options. The extensive ATM network allows for easy cash withdrawals and deposits across numerous locations. The online banking platform enables users to manage their accounts, pay bills, and track transactions from anywhere with internet access. The mobile app offers the same functionality on the go, further enhancing convenience.

Advantages and Disadvantages of Wells Fargo Personal Checking

| Advantages | Disadvantages |

|---|---|

| Large ATM Network | Potential Monthly Fees |

| Robust Online and Mobile Banking | Past Customer Service Issues |

| Variety of Account Options | Overdraft Fees |

Frequently Asked Questions about Wells Fargo Personal Checking:

1. How do I open a Wells Fargo checking account? You can open an account online, in a branch, or by phone.

2. What are the fees associated with Wells Fargo checking accounts? Fees vary depending on the account type. Check the Wells Fargo website for details.

3. How can I avoid monthly maintenance fees? Requirements vary by account, but often include maintaining a minimum balance or setting up direct deposit.

4. What are the overdraft protection options? Wells Fargo offers several overdraft protection options, including linking to a savings account or applying for an overdraft line of credit.

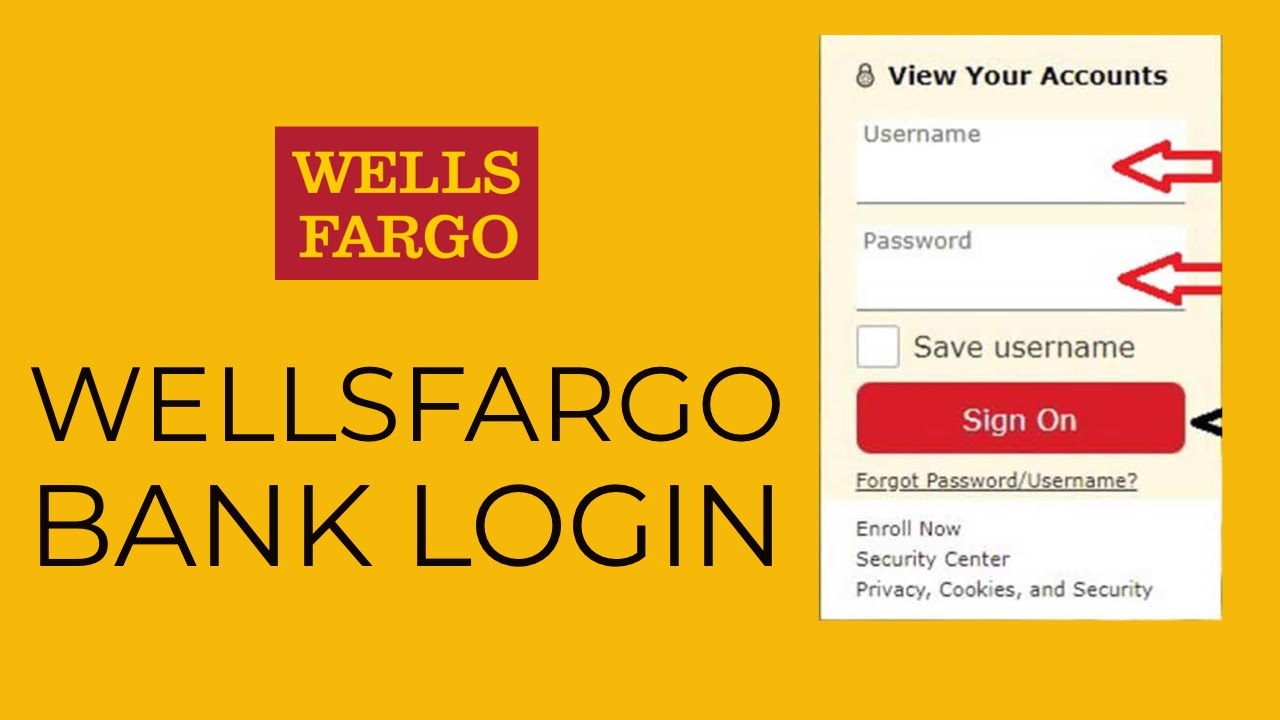

5. How do I access my account online? Visit the Wells Fargo website and log in with your username and password.

6. What is the Wells Fargo mobile app? It's an app that allows you to manage your account on your smartphone or tablet.

7. How can I contact customer service? You can call, email, or visit a branch.

8. What are the requirements for opening a Wells Fargo checking account? You will need identification and a Social Security number.

A tip for managing your Wells Fargo personal checking account is to set up account alerts to stay informed about your balance and transactions.

In conclusion, navigating the intricacies of personal finance requires careful consideration of the tools and resources at our disposal. Wells Fargo personal checking accounts, with their long history and diverse offerings, represent one such tool. While the ideal financial vessel for each individual will vary depending on their unique needs and circumstances, understanding the nuances of Wells Fargo’s options—from the Everyday Checking account to the premium Portfolio by Wells Fargo—empowers individuals to make informed choices. By weighing the advantages and disadvantages, considering the fees, and exploring the available features, you can determine whether a Wells Fargo checking account aligns with your financial goals. Taking the time to thoroughly research and understand the options available, including exploring resources like the Wells Fargo website and consulting with financial advisors, is a crucial step in charting a course toward financial well-being. The journey towards financial security is a continuous one, and choosing the right checking account is just the beginning. However, with careful planning, diligent management, and a clear understanding of your financial goals, you can navigate the currents of personal finance with confidence and chart a course towards a more secure financial future.

Unlocking young minds your guide to reading comprehension grade 1 printable

Maximize your vertical space with wall trellises

Transform your home exterior with behr paint colors