Mastering Your Monthly Tax Deductions: A Guide to Pengiraan Potongan Cukai Bulanan

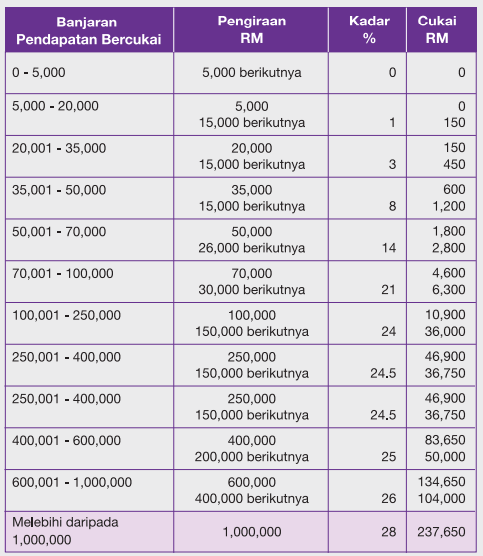

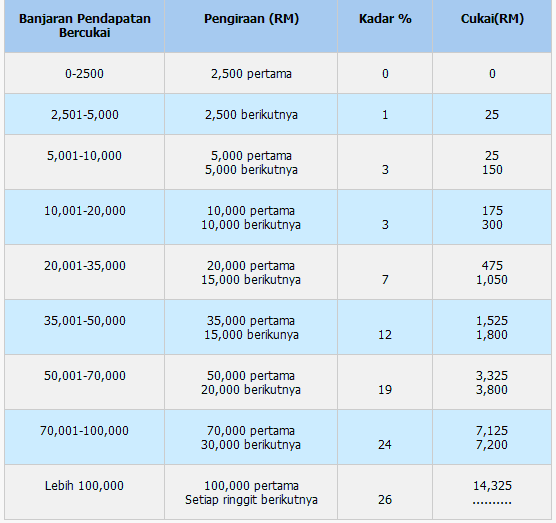

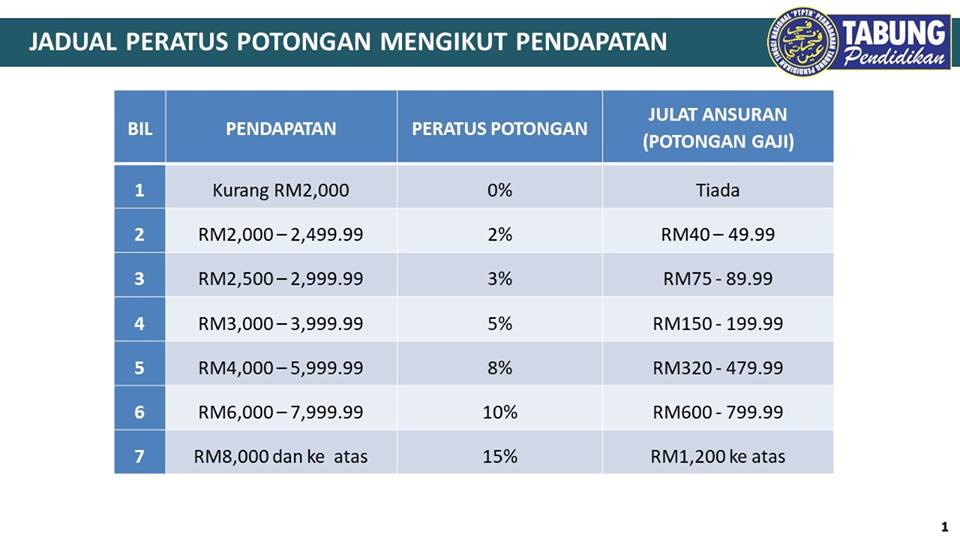

Navigating the world of taxes can feel like venturing into a dense jungle, full of twists, turns, and unexpected pitfalls. One crucial aspect of this journey, especially for salaried individuals, is understanding the concept of "pengiraan potongan cukai bulanan" – essentially, the calculation of your monthly tax deductions. While this might sound intimidating, it's a path worth exploring for greater financial clarity and potentially significant savings.

Imagine this: your salary hits your account every month, and a portion disappears even before you can say "budget." That's the taxman doing his job. But what if there were ways to influence this deduction, ensuring it's not a penny more than what you absolutely have to pay? That's where "pengiraan potongan cukai bulanan" comes in, empowering you to understand how these deductions work and how to potentially optimize them.

Now, you might be wondering, "Why should I bother with all these calculations? Can't I just let the government take what they deem fit?" Well, here's the thing: being proactive with your tax deductions is essentially taking control of your own money. It's about understanding where your hard-earned Ringgit is going and exploring legal avenues to minimize your tax liability, leaving you with more resources to save, invest, or even enjoy life's little pleasures guilt-free.

Think of it like this: every Ringgit saved on unnecessary tax deductions is a Ringgit earned. Over time, these savings can accumulate into a substantial amount, helping you achieve your financial goals faster. It's not about evading taxes; it's about being smart and informed, ensuring you're only paying your fair share.

In this comprehensive guide, we'll demystify the intricacies of "pengiraan potongan cukai bulanan," providing you with the knowledge and tools to navigate this crucial aspect of personal finance confidently. We'll delve into the various components that influence your tax deductions, explore potential avenues for optimization, and equip you with practical tips to make informed financial decisions. So, whether you're a seasoned professional or just starting your financial journey, join us as we embark on this enlightening expedition to unlock the secrets of "pengiraan potongan cukai bulanan."

Advantages and Disadvantages of Understanding "Pengiraan Potongan Cukai Bulanan"

| Advantages | Disadvantages |

|---|---|

| Potentially lower your monthly tax deductions. | Requires time and effort to understand and manage. |

| Avoid unexpected tax bills at the end of the year. | Tax laws and regulations can change, requiring adjustments. |

| Better manage your cash flow and budget effectively. | Mistakes in calculations can lead to penalties. |

While this guide provides a comprehensive overview, it's crucial to remember that tax laws and regulations are subject to change. For personalized advice tailored to your specific financial situation, consulting with a qualified tax professional is always recommended.

Elevate your bathroom design the allure of matte black bathroom exhaust fans with light

K garden korean bbq a culinary deep dive

A moment in liberty unpacking time in missouris heartland