Mastering the Bill of Exchange Format (Formato de la Letra de Cambio)

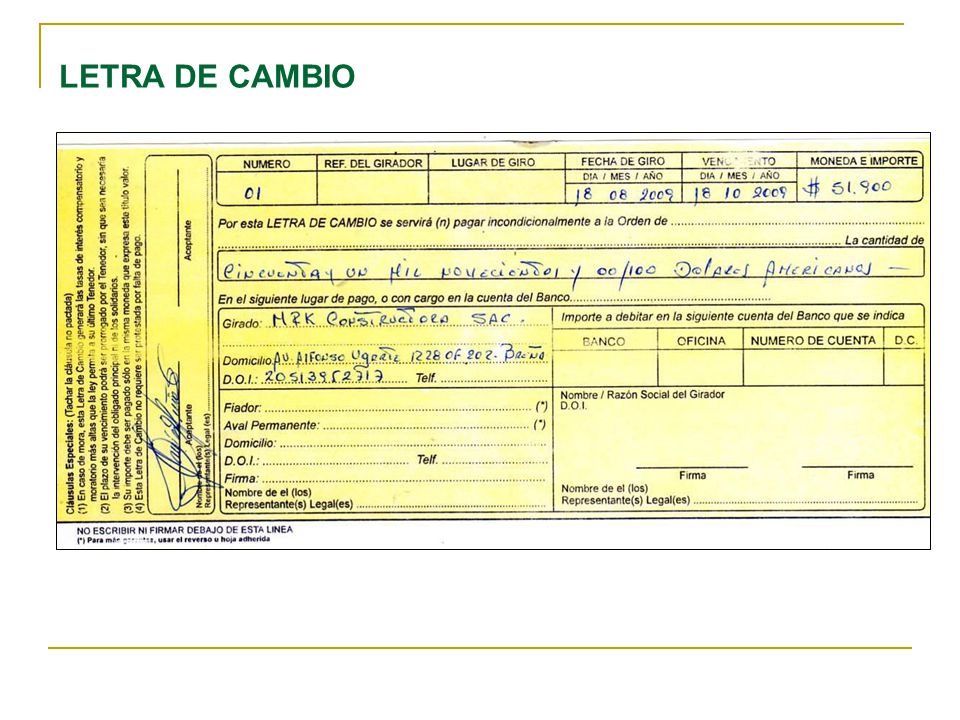

In the intricate world of international commerce, ensuring secure and efficient transactions is paramount. Businesses and individuals alike seek reliable instruments to facilitate the smooth flow of goods and funds across borders. This is where the "Bill of Exchange," or as it's known in Spanish, "Letra de Cambio" comes into play. A key element in its successful use is understanding the specific format, the "formato de la letra de cambio."

Imagine this: a seller in one country needs to send goods to a buyer in another. How do they ensure payment? A simple invoice carries risks, and direct bank transfers can be cumbersome. The bill of exchange offers a time-tested solution. This written, unconditional order acts as a type of "promissory note," binding one party to pay a fixed sum of money to another on a predetermined date. But it's the precise "formato de la letra de cambio" that gives this document its legal weight and international recognition.

The history of the bill of exchange, and its specific format, dates back centuries, finding its roots in medieval Italy. As trade flourished, merchants sought reliable ways to manage payments across long distances and different currencies. The bill of exchange emerged as a revolutionary tool, standardizing transactions and fostering trust between trading partners. Over time, its use spread throughout Europe and eventually across the globe. This evolution also led to a refined and standardized "formato de la letra de cambio," ensuring clarity and legal enforceability across borders.

But why is the "formato de la letra de cambio" so important? Simply put, it provides a universal language for international trade. This standardized structure ensures that regardless of language barriers or varying legal systems, the bill of exchange is a legally binding document. Every element within the "formato de la letra de cambio" serves a specific purpose, outlining the rights and obligations of each party involved. This clarity minimizes the risk of misunderstandings or disputes.

Today, while electronic forms of payment are increasingly common, the bill of exchange, in its correct "formato de la letra de cambio," remains a vital tool, particularly in international trade. Its tangible nature, coupled with its established legal framework, provides a level of security and recourse that digital transactions sometimes lack. Therefore, understanding the intricacies of the "formato de la letra de cambio" is essential for businesses and individuals engaged in cross-border commerce.

While this article provides a general overview, delving deeper into the specific requirements and variations within the "formato de la letra de cambio," based on specific countries and trade agreements, is recommended. Consulting with trade experts or legal professionals can ensure your transactions are conducted securely and effectively within the global marketplace.

Advantages and Disadvantages of Bills of Exchange

| Advantages | Disadvantages |

|---|---|

| Provides a written, legally binding agreement. | Can be time-consuming compared to electronic transfers. |

| Offers security and recourse in case of non-payment. | Requires careful handling and storage of physical documents. |

| Facilitates international trade by bridging different currencies and legal systems. | Subject to potential fraud or forgery if not handled securely. |

For businesses engaged in international trade, or individuals dealing with cross-border transactions, a thorough understanding of the bill of exchange and its specific format ("formato de la letra de cambio") is highly recommended. It's a testament to the enduring power of this centuries-old financial instrument in our modern, interconnected world.

Mastering your rav4 wheel torque specs a comprehensive guide

Unlock your creativity drawing butterflies

Unleash the legend the power of a chinese style dragon tattoo