Managing Your Bank of America Finances: A Comprehensive Guide

In today's fast-paced world, managing your finances effectively is more critical than ever. Having quick and easy access to your banking information is essential for making informed financial decisions. This guide will focus on how you can effectively review and manage your Bank of America account information. We'll explore various methods, from online banking to mobile apps, and provide valuable tips for maintaining accurate records and ensuring your financial security.

Understanding your Bank of America account details is crucial for budgeting, tracking expenses, and identifying potential issues. Whether you're a seasoned online banking user or prefer traditional methods, staying informed about your account balance, transaction history, and other key details empowers you to take control of your financial well-being.

Reviewing your Bank of America account details regularly can help you catch unauthorized transactions, identify billing errors, and ensure that your funds are being used as intended. This proactive approach can save you time, money, and potential headaches down the road. Moreover, understanding your account information allows you to make better financial decisions, such as planning for future expenses, investing wisely, and achieving your financial goals.

There are various ways to access your Bank of America account information. Online banking offers the convenience of checking your balance, reviewing transactions, and paying bills from anywhere with an internet connection. The Bank of America mobile app provides similar functionality on your smartphone or tablet, allowing you to manage your finances on the go.

Beyond digital access, you can also review your Bank of America account details through traditional methods such as visiting a local branch or requesting paper statements. While these methods may not be as instantaneous, they can be helpful for those who prefer a more hands-on approach or require physical documentation for record-keeping.

The history of accessing banking information has evolved significantly. From handwritten ledgers and passbooks to online banking and mobile apps, the way we manage our finances has become increasingly streamlined and accessible. The importance of convenient account access cannot be overstated, as it empowers individuals to make informed decisions about their money.

A key issue related to reviewing account details is security. Protecting your personal and financial information is paramount. Always use strong passwords, be cautious of phishing scams, and avoid accessing your account on public Wi-Fi networks. Bank of America employs robust security measures to safeguard your information, but it's essential to take proactive steps to protect yourself as well.

One benefit of regularly checking your Bank of America account details is early fraud detection. For instance, if you notice an unauthorized transaction, you can immediately report it to the bank and minimize potential losses.

Another advantage is improved budgeting. By tracking your spending patterns, you can gain a better understanding of where your money is going and identify areas where you can save. For example, if you realize you're spending a significant amount on dining out, you can adjust your budget accordingly.

A third benefit is simplified record-keeping. Online banking and mobile apps provide detailed transaction histories, making it easier to track your finances for tax purposes or personal budgeting. This can save you time and effort compared to manually tracking expenses.

Advantages and Disadvantages of Online Account Access

| Advantages | Disadvantages |

|---|---|

| 24/7 access to account details | Requires internet access |

| Convenient and quick | Security risks if precautions aren't taken |

Best Practice 1: Regularly review your account statements. At least once a month, go through your transactions to identify any discrepancies or unauthorized activity.

Best Practice 2: Use strong passwords. Choose a complex password that includes a combination of uppercase and lowercase letters, numbers, and symbols.

Frequently Asked Questions:

1. How do I access my Bank of America account online? Answer: Visit the Bank of America website and log in with your username and password.

2. What if I forget my online banking password? Answer: You can reset your password through the Bank of America website.

3. How can I set up account alerts? Answer: You can customize account alerts through the online banking platform or mobile app.

4. How do I report a lost or stolen debit card? Answer: Contact Bank of America immediately to report a lost or stolen card.

5. How can I view my transaction history? Answer: Your transaction history is available through online banking and the mobile app.

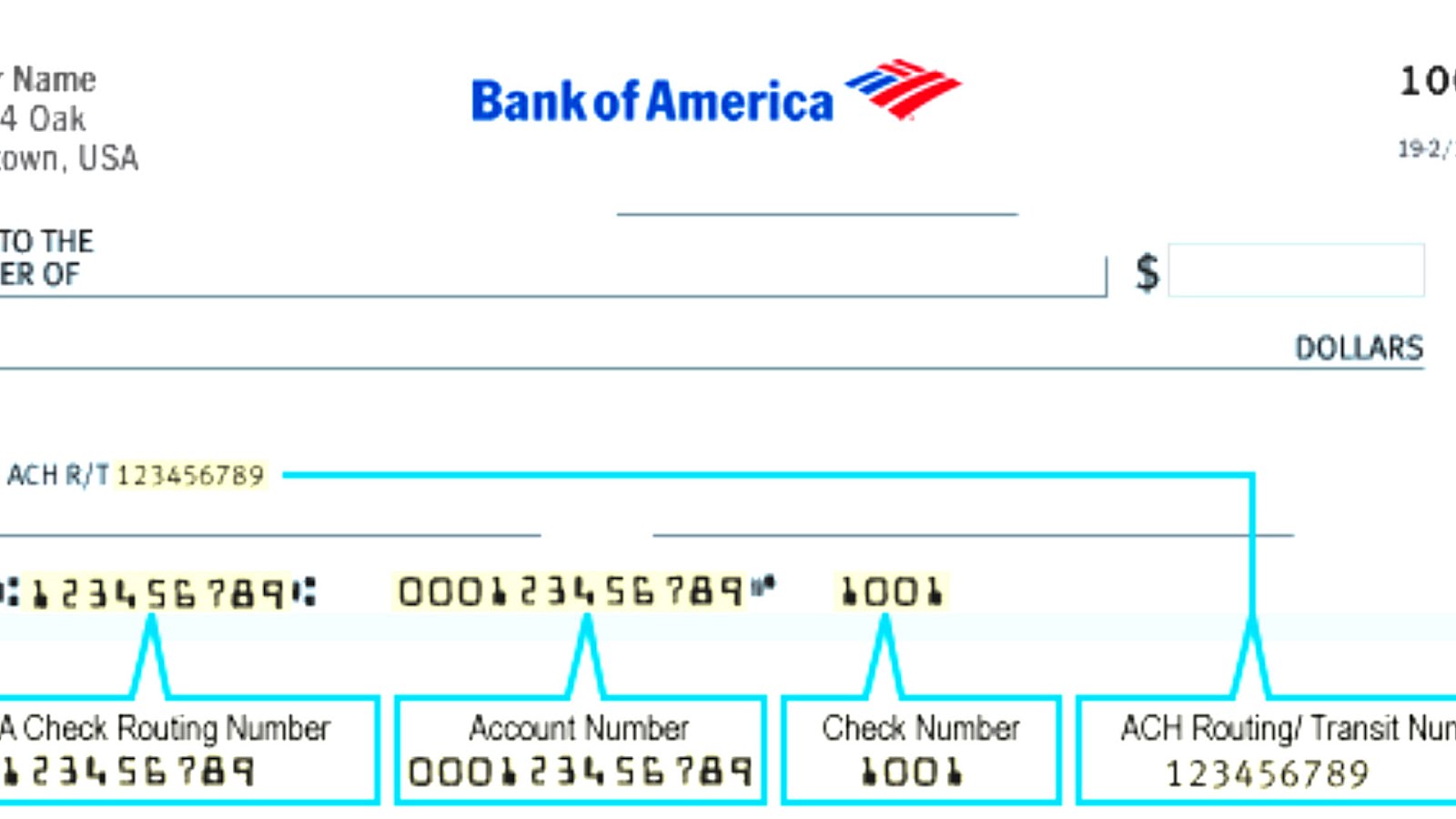

6. How do I set up direct deposit? Answer: You can typically set up direct deposit through your employer or by contacting Bank of America.

7. How do I order checks? Answer: You can order checks through online banking or by visiting a branch.

8. How can I contact customer support? Answer: Bank of America's customer support number is readily available on their website and your statements.

Tip: Set up account alerts to receive notifications about important activity, such as low balance warnings or large transactions.

In conclusion, managing your Bank of America account details effectively is essential for financial well-being. By utilizing online banking, mobile apps, and other available resources, you can easily stay on top of your finances, track your spending, and protect yourself from fraud. Regularly reviewing your account information empowers you to make informed financial decisions and achieve your financial goals. Taking advantage of the available tools and resources provided by Bank of America can significantly simplify your financial management and contribute to your overall financial success. Remember to always prioritize security and take proactive steps to protect your personal and financial information. By following the tips and best practices outlined in this guide, you can gain a comprehensive understanding of your Bank of America account details and take control of your financial future. Start managing your finances effectively today and reap the long-term benefits of informed financial decision-making.

The refined transition exchanging your tub for a walk in shower

Transform your skin exploring body peel before and after results

Lost your whatsapp chats how to get them back