Life's Curveballs: When Change Unlocks Benefits

Life has a habit of throwing curveballs when you least expect it. A new job, a growing family, even saying goodbye to a loved one – these seismic shifts in our personal landscapes often come with a ripple effect that extends beyond the emotional. Suddenly, the systems we rely on – health insurance, retirement plans, even tax benefits – might need a serious re-evaluation.

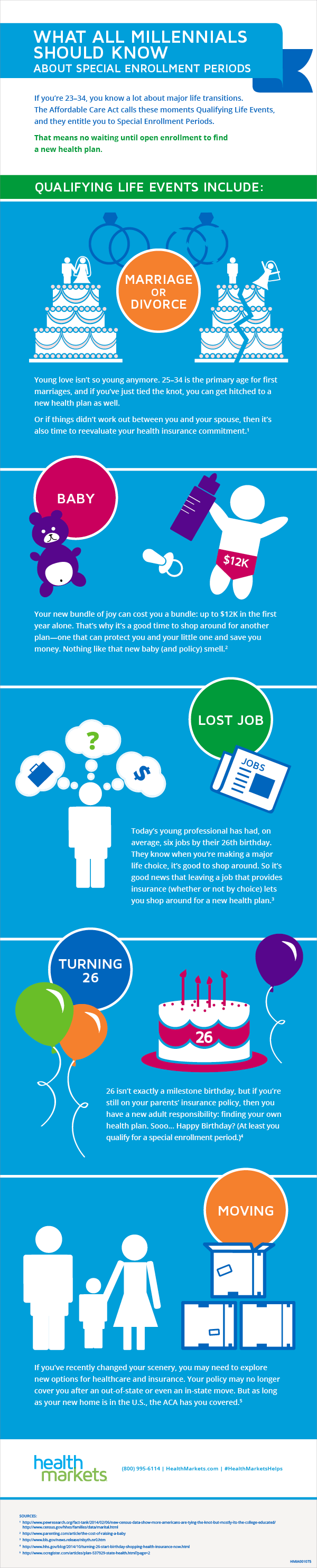

This is where understanding "qualifying life events" comes in. Think of them as the reset buttons in the matrix of benefits and protections that surround us. They act as triggers, allowing you to make adjustments to your existing coverage or access new options that better align with your current circumstances. Ignoring these critical moments could mean missing out on crucial support when you need it most.

But navigating the world of qualifying life events can feel like deciphering ancient scrolls. The terminology is dense, the regulations seem endless, and the fear of missing a crucial detail can be paralyzing. How do you know which life events qualify? What documentation do you need? And what happens if you miss a deadline?

This is where we come in. This guide will walk you through the labyrinth of qualifying life events, providing clarity on their impact and empowering you to make informed decisions during periods of significant change. From understanding the types of events that qualify to exploring your options and navigating the often-confusing world of paperwork, we'll equip you with the knowledge to confidently navigate these pivotal moments.

Ready to take control of your benefits and ensure you're getting the support you deserve? Let’s dive in and demystify the world of qualifying life events.

Imagine this: you've just landed your dream job – congratulations! But as you bask in the glow of this exciting new chapter, a wave of uncertainty washes over you. Your old job's health insurance plan, the one you've relied on for years, is no longer an option. Panic sets in as you realize you need to find new coverage, and fast. This is a prime example of a qualifying life event in action.

Advantages and Disadvantages of Qualifying Life Events for Benefits

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage when needed | Potential for confusion and missed deadlines |

| Access to benefits that better align with your current situation | Requirement for documentation and paperwork |

| Opportunity to save money on premiums or out-of-pocket costs | Limited timeframe to make changes |

Best Practices for Navigating Qualifying Life Events

Here are a few best practices to keep in mind when dealing with qualifying life events:

- Do Your Research: Before a major life change occurs, familiarize yourself with the qualifying life events relevant to your benefits.

- Keep Records: Maintain meticulous records of important documents, such as marriage certificates, birth certificates, and termination notices.

- Act Promptly: Most benefits programs have strict deadlines for reporting qualifying life events and making changes to coverage. Don't delay!

- Seek Assistance: If you're unsure about your options or the process, don't hesitate to reach out to your benefits administrator or a qualified professional for guidance.

- Review Regularly: Even if you don't experience a major life event, it's wise to review your benefits coverage annually to ensure it still meets your needs.

Common Questions and Answers About Qualifying Life Events

Q: What are some examples of qualifying life events?

A: Common qualifying life events include marriage, divorce, birth or adoption of a child, death of a spouse or dependent, job loss, and changes in residence.

Q: How long do I have to report a qualifying life event?

A: The timeframe for reporting qualifying life events varies depending on the specific benefit and provider. Typically, you have 30 to 60 days from the date of the event.

Q: What types of benefits can be affected by qualifying life events?

A: Qualifying life events can impact a range of benefits, including health insurance, life insurance, disability insurance, and retirement plans.

Q: What if I miss the deadline to report a qualifying life event?

A: Contact your benefits administrator immediately. They may be able to grant you an extension or provide guidance on alternative options.

Q: Where can I find more information about qualifying life events?

A: Start by reviewing your benefits plan documents or contacting your employer's human resources department.

Tips and Tricks

Here are a few extra tips to help you navigate qualifying life events with confidence:

- Set calendar reminders for reporting deadlines.

- Keep digital copies of important documents easily accessible.

- Don't be afraid to ask questions and seek clarification.

Navigating life's twists and turns can be challenging enough without the added complexity of benefits and coverage. Understanding the power of qualifying life events – those moments that allow you to recalibrate your safety net – can be the key to staying afloat during times of change. By proactively educating yourself about your options, acting swiftly, and seeking support when needed, you can ensure you have the right resources in place to weather any storm and embrace the future with confidence.

Unlocking the secrets of the 2023 nfl draft a comprehensive guide

Traditional tattoo heart attack stories

Unlocking your gardens potential the vegetable planting calendar