Life's Curveballs? Qualifying Life Events for Insurance in Ohio

Life throws curveballs – a new job, a growing family, or maybe an unexpected move. These big moments often come with a wave of changes, and your health insurance shouldn't be one of them. Thankfully, in Ohio, you have options. Understanding "Qualifying Life Events" can be your key to getting the right coverage at the right time.

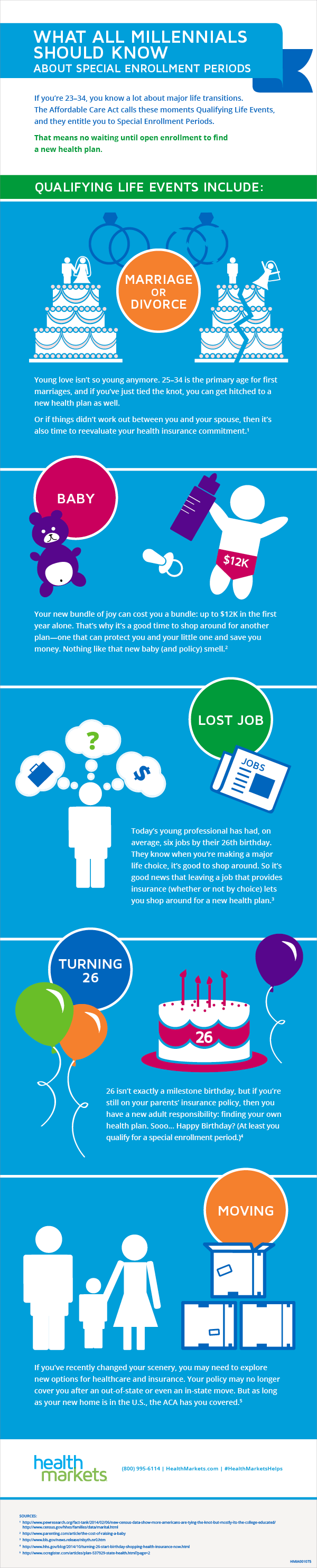

Imagine this: You've just landed your dream job, but there's a catch – the health insurance offered doesn't quite fit your needs. Or perhaps you're welcoming a new baby into the family, and your current plan doesn't cover the additional dependent. These are prime examples of Qualifying Life Events – significant shifts in your life that can trigger a Special Enrollment Period, allowing you to adjust your health insurance plan outside of the typical Open Enrollment timeframe.

Knowing what qualifies as a Qualifying Life Event in Ohio is crucial for navigating these pivotal moments. It's not just about understanding the rules; it's about empowering yourself to make informed decisions about your health coverage when life throws its inevitable curveballs your way.

But what exactly constitutes a Qualifying Life Event in Ohio? And how can you use this knowledge to your advantage? Let's break it down. In Ohio, Qualifying Life Events encompass a range of situations, including but not limited to:

• Losing your existing health insurance coverage: This could be due to job loss, the end of a student plan, or losing eligibility for a parent's plan.

• Changes in your household: Marriage, divorce, having a baby, adopting a child, or even the death of a dependent can all trigger a Special Enrollment Period.

• Moving to a new coverage area: If you relocate to a new zip code or county in Ohio where your current plan isn't offered, you're eligible to explore new options.

• Changes in your income that affect your eligibility for subsidies: If you experience a significant change in income, you might qualify for different financial assistance programs that can lower your health insurance costs.

Navigating these situations requires understanding your rights and options. Once you've identified a Qualifying Life Event that applies to you, you typically have a 60-day window from the date of the event to enroll in a new health insurance plan through the Marketplace or directly with an insurance provider.

This is where proactive planning makes all the difference. Waiting until the last minute can leave you with limited choices and potentially higher costs. By understanding Qualifying Life Events and acting promptly, you ensure that you and your loved ones have the right health coverage, no matter what life throws your way.

Remember, health insurance is not a one-size-fits-all situation. Your needs evolve, and your coverage should too. By familiarizing yourself with Qualifying Life Events, you gain the power to make informed decisions and secure the best possible health coverage for yourself and your family throughout life's exciting, and sometimes unpredictable, journey.

Finding your perfect certified toyota rav4 hybrid near you

The last man on earth exploring the end of humanity

Decking out your deck the ultimate guide to powerpoint heading fonts