JPMorgan Chase Bank Address for Insurance: Everything You Need to Know

So, you're dealing with insurance and JPMorgan Chase. Maybe you're updating your beneficiary information, filing a claim, or simply need to provide a banking address. Whatever the reason, navigating the labyrinthine world of financial institutions can be...let's just say, less than thrilling. But don't worry, we're here to decode the mysteries of the JPMorgan Chase bank address for insurance.

First things first, there's not one single "JPMorgan Chase bank address for insurance." The address you need depends on the specific insurance company, the type of insurance, and sometimes even the specific policy. It could be the address of your local branch, a processing center, or a corporate headquarters. Confused yet? We get it.

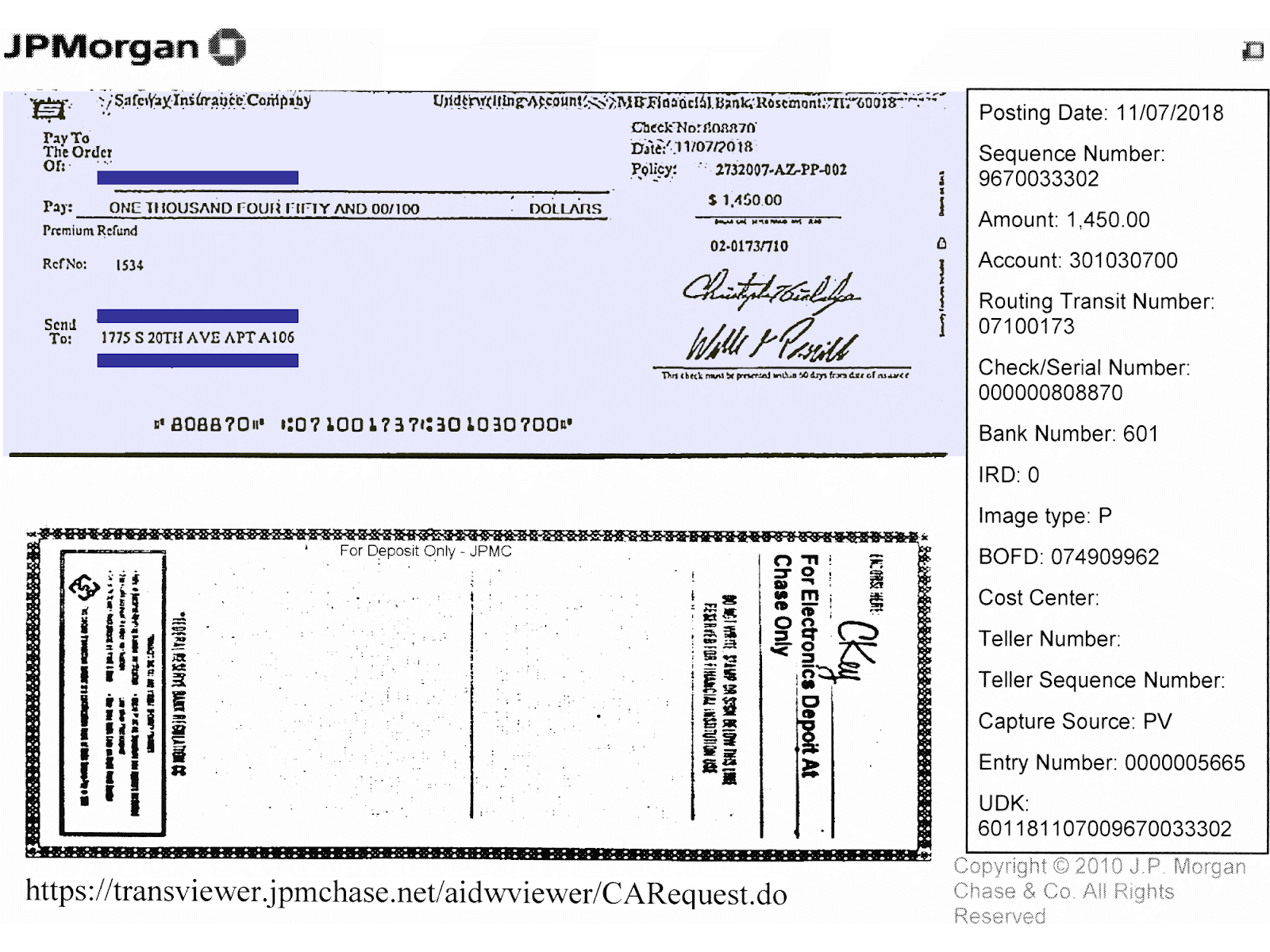

Getting the right JPMorgan Chase bank address for your insurance is crucial. Providing incorrect information can lead to delays in processing claims, misdirected payments, and a whole lot of bureaucratic headaches. Imagine waiting for that crucial insurance check, only to find out it's lost in the mail because you used the wrong address. Not fun.

Now, let's talk about why you might need a JPMorgan Chase bank address for insurance in the first place. Common scenarios include setting up direct deposit for insurance payouts, updating beneficiary details, verifying account information for loan applications, or providing banking details for insurance-backed investments.

One common misconception is that your personal JPMorgan Chase branch address is always the right one to use. While this might be true in some cases, it's often not. For specific insurance-related transactions, you'll likely need a designated address provided by the insurance company itself. This is where things get tricky. You'll need to contact your insurance provider and ask them specifically which JPMorgan Chase address they require.

The history of banking and insurance is intertwined, and JPMorgan Chase's role within this complex relationship is significant. As one of the largest financial institutions, it plays a crucial part in facilitating transactions, managing accounts, and providing financial services connected to insurance. From processing premium payments to handling claims disbursements, JPMorgan Chase's infrastructure is deeply embedded in the insurance ecosystem.

Benefits of using the correct JPMorgan Chase bank address for insurance include streamlined transactions, faster processing times, and reduced risk of errors. For example, providing the correct address ensures your insurance payments are credited to the right account, preventing delays and potential penalties. Similarly, when filing a claim, using the correct address ensures the payout is directed to you without unnecessary hurdles.

To get the right address, contact your insurance provider. They will guide you on the specific JPMorgan Chase address needed for your policy. Another approach is to check your insurance policy documents. The required address might be listed there. Finally, you can visit the JPMorgan Chase website or contact their customer service for assistance.

Advantages and Disadvantages of Using JPMorgan Chase for Insurance-Related Transactions

While JPMorgan Chase offers many advantages for insurance transactions, some potential drawbacks exist.

| Advantages | Disadvantages |

|---|---|

| Wide network of branches and ATMs | Potential for long customer service wait times |

| Robust online banking platform | Fees may apply for certain services |

| Established reputation and financial stability | Complexity of navigating a large institution |

Frequently Asked Questions:

1. What if I use the wrong address? Contact your insurance company immediately to rectify the error.

2. Where can I find the correct address? Contact your insurance provider or check your policy documents.

3. Can I use my local branch address? Not always; confirm with your insurance company.

4. What if my insurance company doesn't specify an address? Contact both JPMorgan Chase and your insurer for clarification.

5. How do I update my bank address with my insurance company? Contact your insurance provider and follow their update procedure.

6. Is there a fee for providing my bank address? Typically, no.

7. What if my insurance check is lost due to an incorrect address? Contact your insurance company immediately.

8. Can I use a PO Box for insurance transactions? Check with your insurance provider regarding their policies on PO Boxes.

In conclusion, using the correct JPMorgan Chase bank address for insurance is essential for smooth and efficient transactions. While it can seem confusing, taking the time to confirm the correct address with your insurance provider can save you a lot of trouble down the line. By following the steps outlined above and understanding the potential challenges, you can ensure a hassle-free experience when managing your insurance and finances. Remember, accurate information is key to a seamless and efficient process. Contact your insurance provider today to confirm the correct JPMorgan Chase address for your policy, and ensure your financial transactions are handled accurately and efficiently. This proactive approach will save you time and potential headaches in the future, giving you peace of mind knowing your financial information is correctly recorded and your insurance matters are handled with precision.

Unearthing faces of the great war a guide to finding wwi soldier photos

Unlocking value choosing the right single door size for your home

Araw ng kagitingan understanding its meaning and significance