How Long After a Qualifying Life Event: Making Crucial Decisions

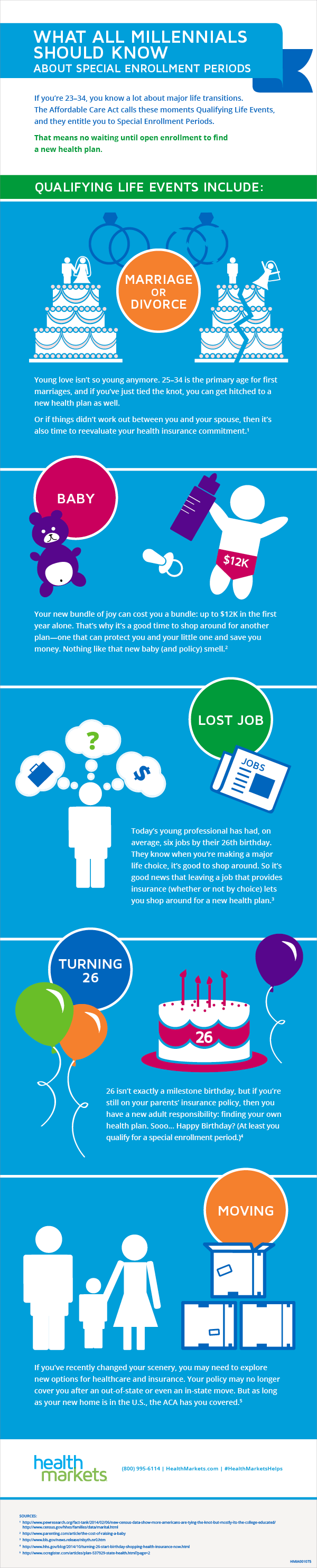

Life throws curveballs. It's a fact of life that we experience events that shake things up, from joyous occasions like marriage and the birth of a child to challenging transitions like job loss or the death of a loved one. In the midst of these major life changes, it's easy to overlook the logistical and, often, time-sensitive tasks that need our attention. These "qualifying life events" often come with important windows of opportunity to make decisions that impact our insurance coverage, financial plans, and more.

But just how long do you have to make these crucial decisions after a qualifying life event? The answer, as is often the case, is: it depends. The specific timeframe, known as a Special Enrollment Period, varies depending on the event itself, your location, and the specific policy or program in question. Whether you're navigating the complexities of health insurance, adjusting your retirement plan, or exploring other benefits, understanding these deadlines is essential.

Failing to act within the designated period could mean missing out on vital coverage, facing financial penalties, or dealing with a mountain of paperwork further down the line. That's why we're here to demystify this often-confusing aspect of life transitions. In this article, we'll delve into the concept of qualifying life events and their associated timelines, exploring common scenarios and providing you with the knowledge to confidently navigate these important life changes.

Imagine this: you've just landed a fantastic new job, a role you've been working towards for years. You're over the moon, but there's one small hiccup – your new employer's health insurance plan won't kick in for another three months. What happens if you need medical attention during this gap? This is where understanding qualifying life events and their associated timelines comes into play.

A qualifying life event isn't just a significant happening in your personal life; it's a trigger that opens a Special Enrollment Period, allowing you to make changes to your insurance policies or benefit elections outside the typical open enrollment timeframe. These periods are designed to provide flexibility and support during times of transition, ensuring you have access to the coverage you need when you need it most.

The importance of understanding these timelines cannot be overstated. Missing a deadline could mean forgoing crucial health insurance coverage, potentially leading to significant out-of-pocket expenses. It might mean delaying changes to your retirement contributions, impacting your long-term financial goals. In some cases, it could even mean facing penalties for non-compliance with regulations.

Let's say you recently got married, a joyous qualifying life event! This change in your marital status typically grants you a Special Enrollment Period to add your spouse to your health insurance plan, adjust your retirement plan beneficiaries, or explore other relevant benefits. But this period is limited. Depending on your insurance provider and location, you might have only 30 or 60 days from the date of your marriage to make these adjustments.

Navigating these timelines effectively requires being informed and proactive. This involves understanding the specific qualifying life events that apply to your situation, researching the deadlines associated with your insurance policies and benefits programs, and gathering all necessary documentation to support your application for changes.

Advantages and Disadvantages of Acting Within the Qualifying Life Event Period

| Advantages | Disadvantages |

|---|---|

| Access to necessary coverage or benefits during crucial times | Potential for rushed decision-making due to time constraints |

| Avoidance of penalties or gaps in coverage | Requirement for thorough research and understanding of policy specifics |

Best Practices for Navigating Qualifying Life Events and Their Timelines

1. Stay Informed: Familiarize yourself with common qualifying life events and their implications. Knowledge is power when it comes to making informed decisions.

2. Document Everything: Keep records of important dates, such as marriage, birth, or job loss, as these will be crucial for verifying your eligibility for a Special Enrollment Period.

3. Contact Your Providers: Reach out to your insurance company, employer's HR department, or benefits administrator as soon as possible after a qualifying life event. They can provide specific guidance and deadline information.

4. Don't Delay: Time is of the essence. Gather necessary documentation and submit your application for changes promptly to avoid missing the deadline.

5. Review and Confirm: Once you've made changes to your coverage or benefits, carefully review the updated policy documents to ensure accuracy and understanding.

Common Questions About Qualifying Life Events

1. What are some common qualifying life events? Common examples include marriage, divorce, birth or adoption of a child, job loss, death of a spouse, and relocation.

2. How long do I have to make changes after a qualifying life event? The timeframe, typically 30 to 60 days, varies depending on the event, your location, and the specific policy.

3. Where can I find the specific deadlines for my situation? Contact your insurance provider, employer's HR department, or refer to the official documentation of your benefits program.

4. What happens if I miss the deadline for a Special Enrollment Period? You may have to wait until the next open enrollment period to make changes, potentially facing gaps in coverage or penalties.

5. Can I make changes to my coverage online or do I need to speak with someone directly? This depends on the provider. Many offer online portals for making changes, while others may require phone or in-person communication.

6. What documents do I need to provide to verify a qualifying life event? This varies but commonly includes marriage certificates, birth certificates, termination letters, or other legal documents supporting the event.

7. Can I add a domestic partner to my health insurance plan during a Special Enrollment Period? Eligibility varies depending on your location and insurance provider's policies.

8. What if my qualifying life event isn't listed as a trigger for a Special Enrollment Period? Contact your provider or benefits administrator to discuss your specific circumstances. They may offer alternative solutions.

Navigating the world of insurance, benefits, and financial planning can feel overwhelming, especially during times of significant personal change. However, by understanding the concept of qualifying life events and their associated timelines, you empower yourself to make timely and informed decisions that protect your well-being and financial future. Remember to stay informed, be proactive, and don't hesitate to reach out for professional guidance when needed. Your future self will thank you.

Sculpt a strong upper body your ultimate shoulder and back workout routine

Whats the weather in palermo today che tempo fa oggi a palermo

Level up your stream the ultimate guide to twitch profile pictures pfps