Effortless Banking: Accessing Your Bank of America Account Online

In today's fast-paced world, who has time to stand in long bank lines? Thankfully, managing your finances is easier than ever with online banking. For Bank of America customers, accessing your Bank of America account online provides a convenient and secure way to stay on top of your money.

Imagine this: it's Sunday morning, and you're sipping your coffee, wondering if you have enough funds to treat yourself to brunch. With online access to your Bank of America accounts, you can quickly review your balance and make an informed decision, all from the comfort of your home. No need to rush to the bank before it closes! This ease of access is just one of the many perks of banking online with Bank of America.

Accessing your Bank of America account information online offers a level of control over your finances that wasn't possible before. From checking your balance and recent transactions to paying bills and transferring funds, the ability to manage your money digitally has revolutionized personal finance. But how did we get here? The history of online banking is a fascinating journey from clunky dial-up connections to the streamlined, secure systems we use today.

The evolution of online banking at Bank of America, and indeed across the entire financial industry, reflects the rapid advancements in technology. Early forms of online banking involved telephone-based systems, eventually evolving into the internet-based platforms we're familiar with today. This shift allowed customers to view account balances and transaction histories, paving the way for more complex features like online bill pay and fund transfers.

The ability to view your Bank of America account details online is no longer a luxury, but a necessity for many. It provides an unparalleled level of convenience and control, empowering you to manage your finances effectively. However, it's essential to use these online tools responsibly and securely. Understanding the potential risks, such as phishing scams and unauthorized access, is crucial for protecting your financial information. Let's delve deeper into the benefits, safeguards, and best practices for managing your Bank of America account online.

One of the key benefits of online access is the ability to view your Bank of America account balance anytime, anywhere. You can also easily track your spending by reviewing your recent transactions, which helps you stay on top of your budget. Furthermore, online banking allows you to transfer funds between accounts, pay bills electronically, and even set up automatic payments, simplifying your financial management.

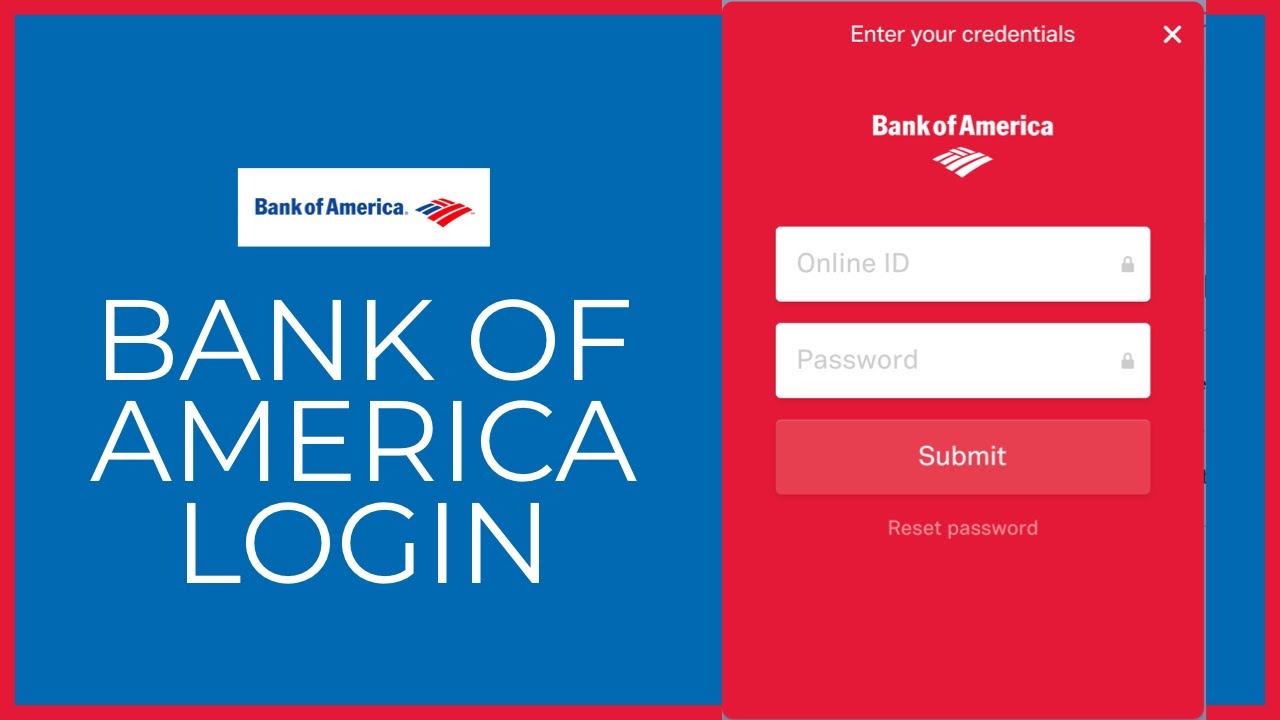

To log in to your Bank of America account online, you'll need your Online ID and Passcode. If you haven't enrolled in online banking yet, you can do so on the Bank of America website. Once logged in, you'll be able to access all your account information.

Advantages and Disadvantages of Online Banking

| Advantages | Disadvantages |

|---|---|

| 24/7 Account Access | Security Risks (Phishing, etc.) |

| Convenient Bill Pay | Requires Internet Access |

| Easy Fund Transfers | Potential Technical Issues |

Best Practices for Online Banking:

1. Use Strong Passwords

2. Be Wary of Phishing Emails

3. Regularly Monitor Your Account

4. Keep Your Software Updated

5. Log Out Securely

Frequently Asked Questions:

1. How do I enroll in online banking?

Visit the Bank of America website and follow the enrollment instructions.

2. What if I forget my password?

You can reset your password on the Bank of America website.

3. Is online banking secure?

Bank of America uses advanced security measures to protect your information.

4. Can I access my account on my mobile device?

Yes, Bank of America offers a mobile banking app.

5. How do I set up bill pay?

Log in to your account and navigate to the bill pay section.

6. What if I see unauthorized transactions?

Contact Bank of America immediately.

7. Can I deposit checks online?

Yes, you can use the mobile app to deposit checks.

8. How can I view my transaction history?

Log in to your account and select "transaction history."

Tips and tricks for efficient online banking include setting up account alerts for low balances or unusual activity, using budgeting tools within the online platform, and taking advantage of mobile check deposit to save time.

In conclusion, managing your Bank of America account online offers incredible convenience and control over your finances. From checking your balance on a Sunday morning to paying bills electronically, online banking simplifies many aspects of personal finance. While security concerns are valid, by following best practices and staying informed about potential risks, you can enjoy the many benefits of online banking. Taking advantage of the resources available, such as the Bank of America website, FAQs, and customer service, can further empower you to make the most of this valuable tool. Don't wait any longer; explore the world of online banking with Bank of America and experience the ease and efficiency it brings to managing your financial life. Start by visiting the Bank of America website today to learn more and enroll in online banking.

Exploring the mille lacs reservation in minnesota

Unlocking the potential your guide to secret bear alpha skins

Embracing freedom finding your groove in online hippie store canada

:max_bytes(150000):strip_icc()/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9.jpg)