Don't Fall for the Wells Fargo Remediation Check Scam!

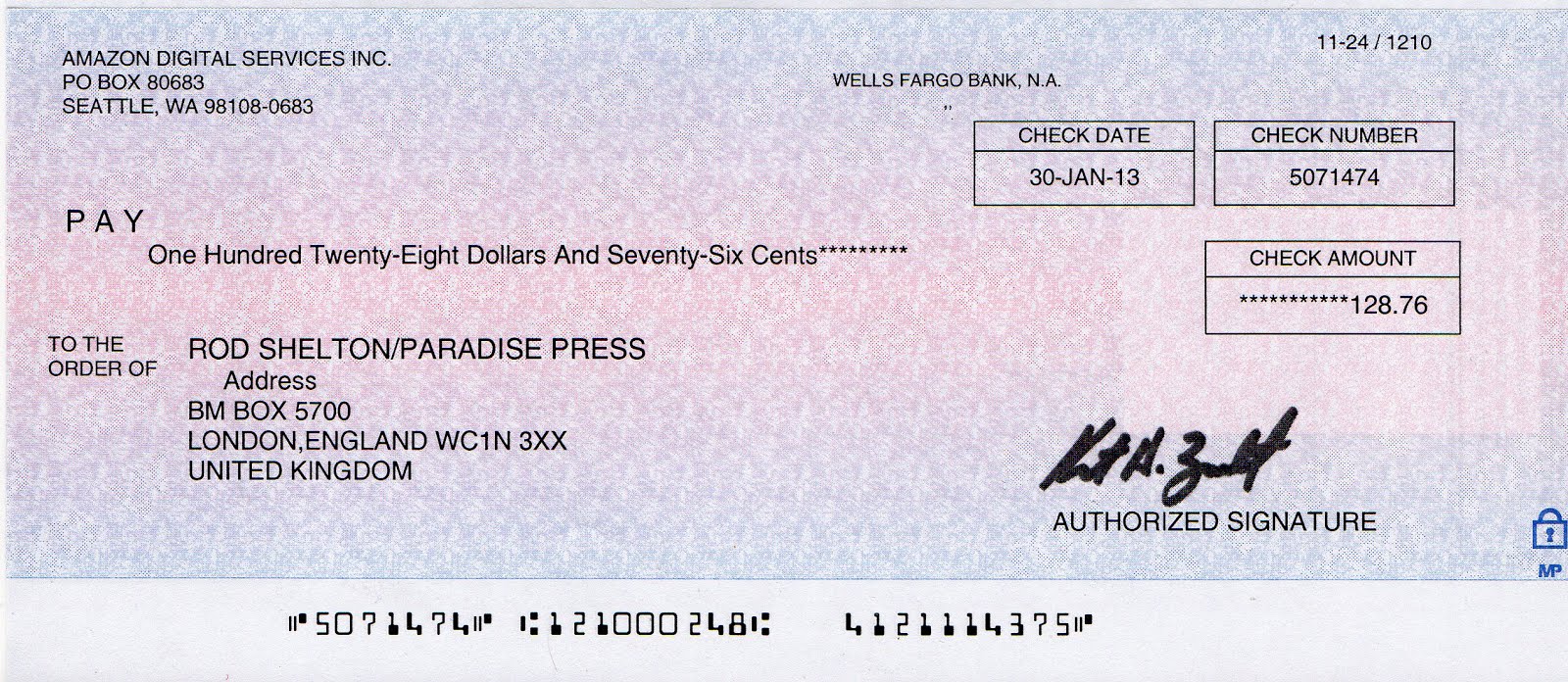

You get a check in the mail unexpectedly. It looks official, bearing the Wells Fargo logo, and it's for a significant amount. It even references "remediation" – a term that suggests you're receiving compensation for a past wrong. This, my friend, is not your lucky day. This could be a classic example of a Wells Fargo remediation check scam, and falling for it could cost you dearly.

Scammers are becoming increasingly sophisticated, and this scheme preys on people's trust in known institutions and their hope for unexpected windfalls. The promise of easy money, especially when it appears to be from a reputable source like Wells Fargo, can be tempting. However, understanding the mechanics of this scam and learning how to identify red flags can save you from a world of financial headache.

The "Wells Fargo remediation check scam" doesn't necessarily involve Wells Fargo itself. Scammers often impersonate real companies to lend legitimacy to their schemes. They might be capitalizing on news of actual remediation efforts by Wells Fargo to make their ruse more convincing. You might receive a check with instructions to deposit it and then return a portion of the funds, often as a "processing fee" or "tax." The scammer might claim there was an error, and they overpaid you. They create a sense of urgency, pushing you to act quickly before the "mistake" is discovered.

Here's the catch: the check is fake. By the time your bank realizes this, you would have already sent money to the scammer, money that's very difficult, if not impossible, to recover. Remember, if something seems too good to be true, it probably is. Legitimate companies rarely operate this way. They won't pressure you to deposit checks and return funds quickly.

Protecting yourself starts with awareness and a healthy dose of skepticism. Always scrutinize unexpected checks, especially if they arrive with urgent requests for you to send money back. Verify the legitimacy of any check by contacting Wells Fargo directly, using verified contact information, not the details provided with the suspicious check. Remember, your bank is your ally. If you have any doubts, consult them before taking any action. Knowledge is your best defense against falling victim to the Wells Fargo remediation check scam and other financial fraud attempts.

While this article focuses on Wells Fargo, remember that scammers can impersonate any bank or company. Stay informed about common scams and always prioritize your financial safety.

Advantages and Disadvantages of Knowing About the Wells Fargo Remediation Check Scam

| Advantages | Disadvantages |

|---|---|

| Protects you from financial loss. | Scams constantly evolve, requiring ongoing awareness. |

| Empowers you to identify and report fraudulent activity. | May lead to mistrust of legitimate communications. |

| Raises awareness among family and friends, creating a safer community. | Can be emotionally unsettling to encounter attempted fraud. |

Best Practices to Avoid Falling Victim

- Be wary of unexpected checks: Always be skeptical of unsolicited checks, especially if they come with a request to return a portion of the funds.

- Verify directly with the company: If you receive a check claiming to be from Wells Fargo, contact the bank directly using their official phone number or website. Don't use contact information provided on the check itself.

- Don't rush into action: Scammers often create a sense of urgency to pressure you into making mistakes. Take your time, verify the information, and don't be afraid to ask questions.

- Report suspicious activity: If you believe you've encountered a scam, report it to Wells Fargo and your local authorities. You can also file a complaint with the Federal Trade Commission (FTC).

- Educate yourself and others: Stay informed about common scams and share this information with your friends and family to help protect them as well.

Common Questions and Answers About Wells Fargo Remediation Check Scams

1. What should I do if I already deposited a fraudulent check?

Contact your bank immediately and explain the situation. They can guide you through the necessary steps to report the fraud and potentially recover any lost funds.

2. Can I be held responsible for money lost in a scam?

While banks may offer some protection, ultimately, you might be held liable for funds lost to a scam, especially if you took actions like sending money back to the scammer.

3. Are there other variations of this scam?

Yes, scammers constantly adapt their tactics. They might impersonate government agencies, lottery officials, or even romantic interests to trick you into sending money.

4. How can I verify if a check is real?

Contact the issuing institution directly using verified contact information. Don't rely on phone numbers or websites provided on the check itself.

5. What are some red flags to watch out for?

Red flags include unsolicited checks, requests for you to send money back, pressure to act quickly, and grammatical errors or typos in communications.

6. How can I protect myself from future scams?

Stay informed about common scams, be cautious with your personal information, and always verify requests for money or personal details.

7. Where can I report a scam?

You can report scams to the Federal Trade Commission (FTC), your local police department, and the issuing institution (if applicable).

8. What are some resources for learning more about scams?

The FTC website (ftc.gov) provides valuable information on various scams and consumer protection tips.

Tips and Tricks to Remember

Remember, vigilance is key. Always be wary of unsolicited offers that seem too good to be true. Verify everything, and don't be afraid to ask questions. Your bank is your ally; consult them if you have any doubts. By staying informed and following these tips, you can protect yourself from becoming a victim of the Wells Fargo remediation check scam and other financial fraud attempts.

The Wells Fargo remediation check scam highlights the importance of being vigilant in today's digital age. By understanding how these scams work and recognizing the red flags, you can protect yourself and your finances from falling into the traps set by scammers. Remember, if an offer seems too good to be true, it probably is. Always verify information directly with the supposed source and prioritize your financial well-being. Stay informed, stay cautious, and stay safe!

Unlocking your dream hues the magic of paint color matching

Mercedes c class electrical troubleshooting mastering the fuse box

Where is mrs mccarthy on father brown the curious case of a missing housekeeper