Does Bank of America Verify Checks? What You Need to Know

We’ve all been there – standing at the bank teller window, a check in hand, a little unsure if it’s going to clear. Or maybe you’re the one anxiously awaiting a payment, wondering if that check you deposited is the real deal. It’s a common concern in our world of transactions, and understanding how banks verify checks can save us all from potential headaches.

Bank of America, like most major financial institutions, has a system in place to ensure the validity of checks. It's a critical process for them – a line of defense against fraud and a way to maintain the integrity of their financial operations. But what does this verification process actually look like for customers like you and me?

In today's world, where digital payments and mobile banking are becoming increasingly popular, you might be surprised to learn that checks are still very much a part of our financial landscape. While the way we use checks might be evolving, they remain a common method for payments, especially for larger sums or in certain industries.

That's why it’s more important than ever to understand how check verification works, particularly at institutions like Bank of America. Whether you’re a seasoned check-writer or someone who rarely uses them, having a grasp of this process can make your banking experience smoother and provide peace of mind.

Let’s delve into the world of check verification at Bank of America, exploring what happens behind the scenes when you deposit or cash a check, and what you can do to ensure a seamless transaction.

Advantages and Disadvantages of Bank of America Check Verification

While Bank of America's check verification process offers several advantages, it's also important to be aware of potential drawbacks. Let's take a look:

| Advantages | Disadvantages |

|---|---|

| Enhanced security against fraudulent checks | Possibility of holds on deposited checks, especially for large amounts or new accounts |

| Reduced risk of bounced checks and associated fees | Potential delays in funds availability compared to some digital payment methods |

| Provides peace of mind for both the payee and the payer | Reliance on technology means occasional system errors or glitches could occur |

Best Practices for Smooth Check Deposits

Here are a few best practices to help your checks clear quickly and without any hiccups:

- Endorse your checks properly: Always sign the back of your check in the designated area.

- Provide accurate information: Double-check that the payee name and amount are correct.

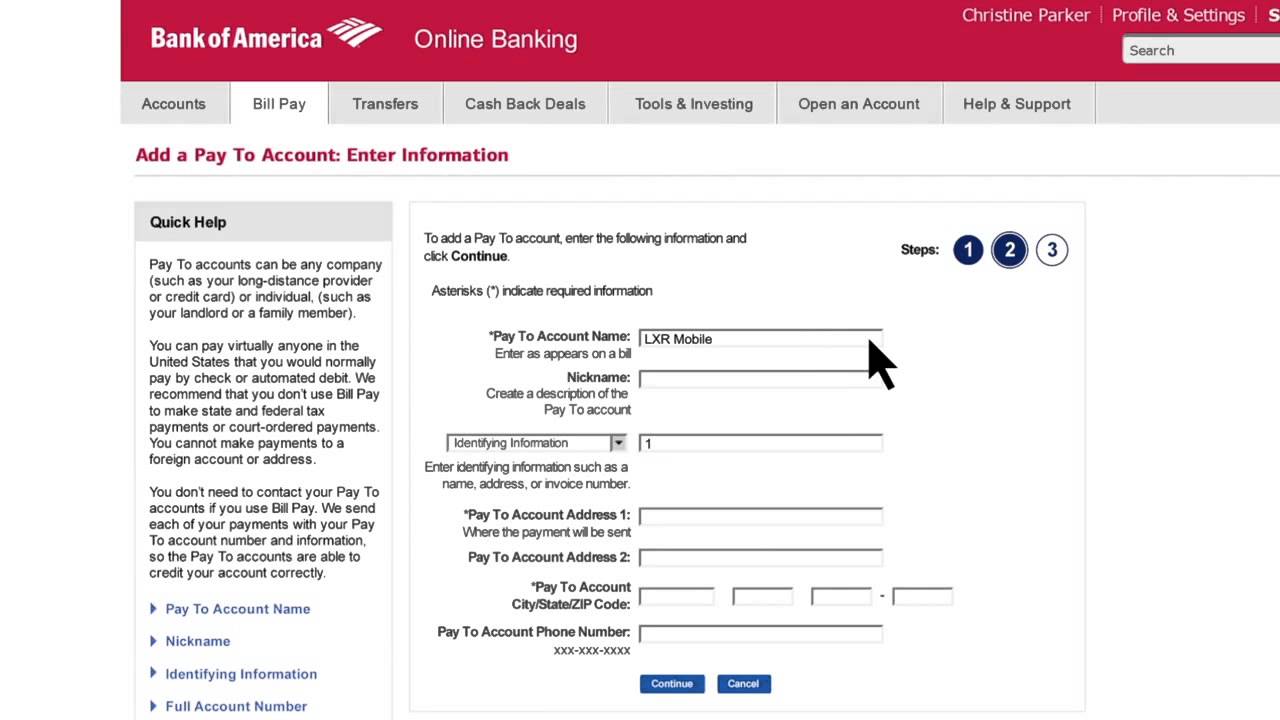

- Consider mobile deposit for smaller amounts: Bank of America's mobile app allows for convenient check deposits from your smartphone.

- Keep track of your deposits: Monitor your account online or via the mobile app to track your check's status.

- Communicate with the payee: If you're waiting for a check to clear, stay in touch with the payer to confirm they've sent it and to address any potential issues.

Common Questions About Bank of America Check Verification

Let's address some frequently asked questions about check verification at Bank of America:

1. How long does it take for Bank of America to verify a check?

The verification process usually takes 1-2 business days. However, several factors can influence this timeframe, including the check amount, your account history, and potential fraud concerns.

2. Can I access funds from a deposited check immediately?

While Bank of America may provide access to a portion of the funds right away, the full amount might not be available until the verification process is complete.

3. Does Bank of America verify all checks?

Yes, all checks deposited or cashed at Bank of America undergo a verification process, regardless of the amount or the account holder.

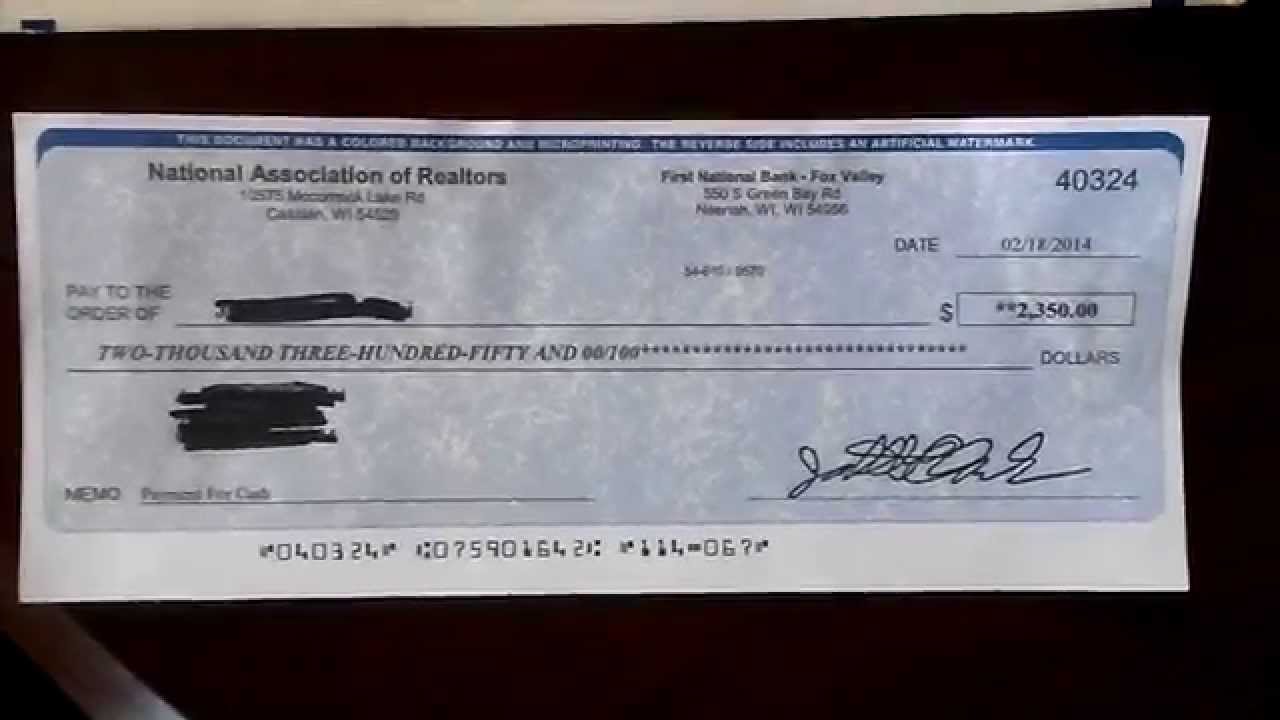

4. What happens if a check I deposit bounces?

If a check bounces, you'll likely incur a fee, and the funds will be withdrawn from your account. It's essential to communicate with the check writer to resolve the issue promptly.

5. Can I deposit a check made out to someone else into my account?

Generally, no. Checks need to be endorsed to you to be deposited into your account.

6. How can I check the status of a deposited check?

You can easily track your check's status through Bank of America's online banking platform or their mobile app.

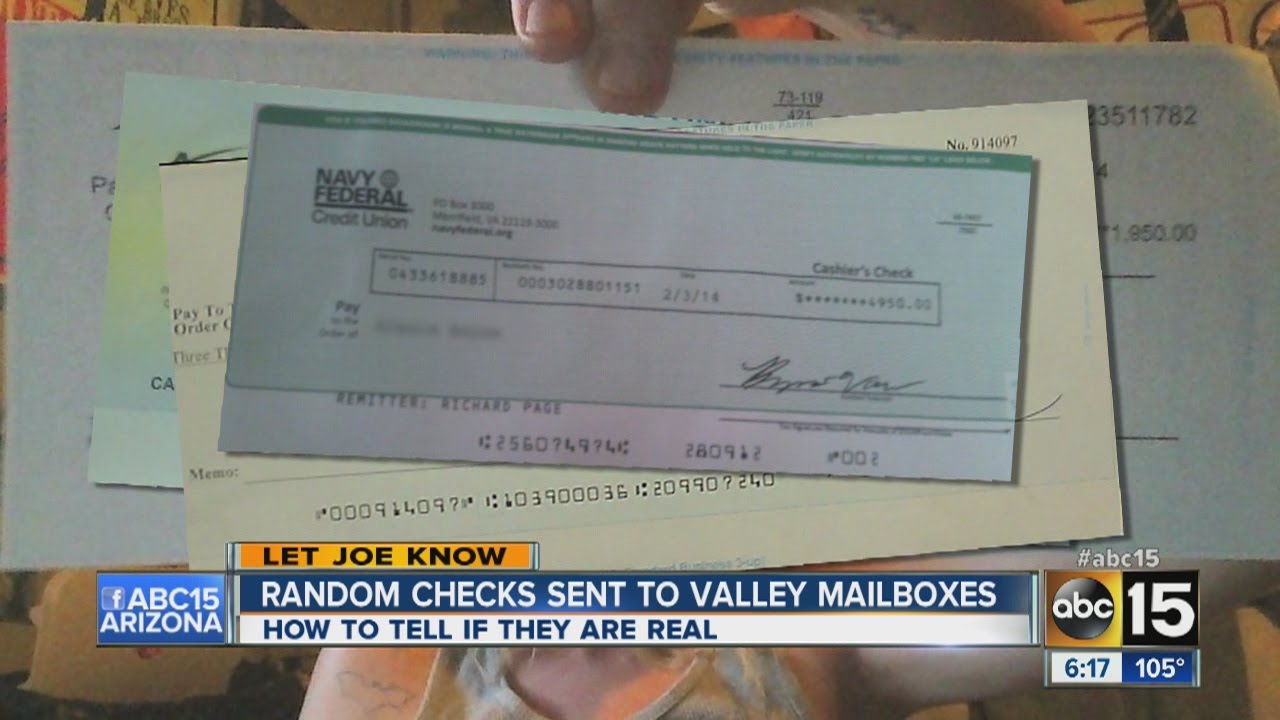

7. What should I do if I think a check I've received is fraudulent?

It's crucial to report any suspected fraudulent activity to Bank of America immediately. You can reach out to their customer service hotline or visit your local branch for assistance.

8. Can I request expedited check verification for urgent situations?

While expedited verification isn't always guaranteed, it's worth contacting Bank of America to discuss your options, especially if you have a time-sensitive need for the funds.

Tips and Tricks

To make your check depositing experience even smoother, consider these additional tips:

- Maintain a good banking history with Bank of America.

- Deposit checks promptly to avoid potential delays.

- Take advantage of Bank of America's mobile app for convenient check deposits and balance monitoring.

Navigating the world of checks in today's digital age doesn’t have to be daunting. Understanding how Bank of America verifies checks empowers you as a customer, giving you the tools and knowledge to manage your finances with confidence. By staying informed about the process, best practices, and potential challenges, you can make your banking experience smoother and avoid unnecessary hurdles. Remember, knowledge is power, especially when it comes to your hard-earned money!

Sunflower and lotus tattoo a symbol of duality and growth

Cek no plat kereta what your license plate reveals

Unlock creativity with figuras geometricas en foami