Decoding Your US Bank Checking Account Number

Ever wondered about the string of numbers at the bottom of your US Bank checks? That's your US Bank checking account number, a crucial piece of information for managing your finances. It's more than just a random sequence – it's the key to accessing your funds, making transactions, and ensuring smooth financial operations.

Your US Bank checking account number is a unique identifier tied specifically to your account. It allows US Bank to accurately process deposits, withdrawals, and other transactions. Without it, the bank wouldn't know where to allocate your funds or whose account to debit or credit. Think of it as your financial address within the US Bank system.

Knowing your US Bank account number is essential for various banking activities. From setting up direct deposits to making online payments, this number plays a vital role. Understanding its significance empowers you to manage your finances efficiently and securely.

This article will delve into the intricacies of US Bank checking account numbers. We’ll cover everything from how to locate your account number to best practices for keeping it secure. We'll also address common questions and provide helpful tips for managing your US Bank checking account.

While seemingly simple, your US Bank checking account number is a critical component of your financial life. By understanding its importance and employing safe practices, you can ensure the security of your funds and maintain control over your finances.

The history of checking accounts dates back centuries, but modern numbering systems are a more recent development. These numbers enable banks to manage millions of accounts efficiently. Your US Bank checking account number is part of this system, ensuring your transactions are processed accurately and securely.

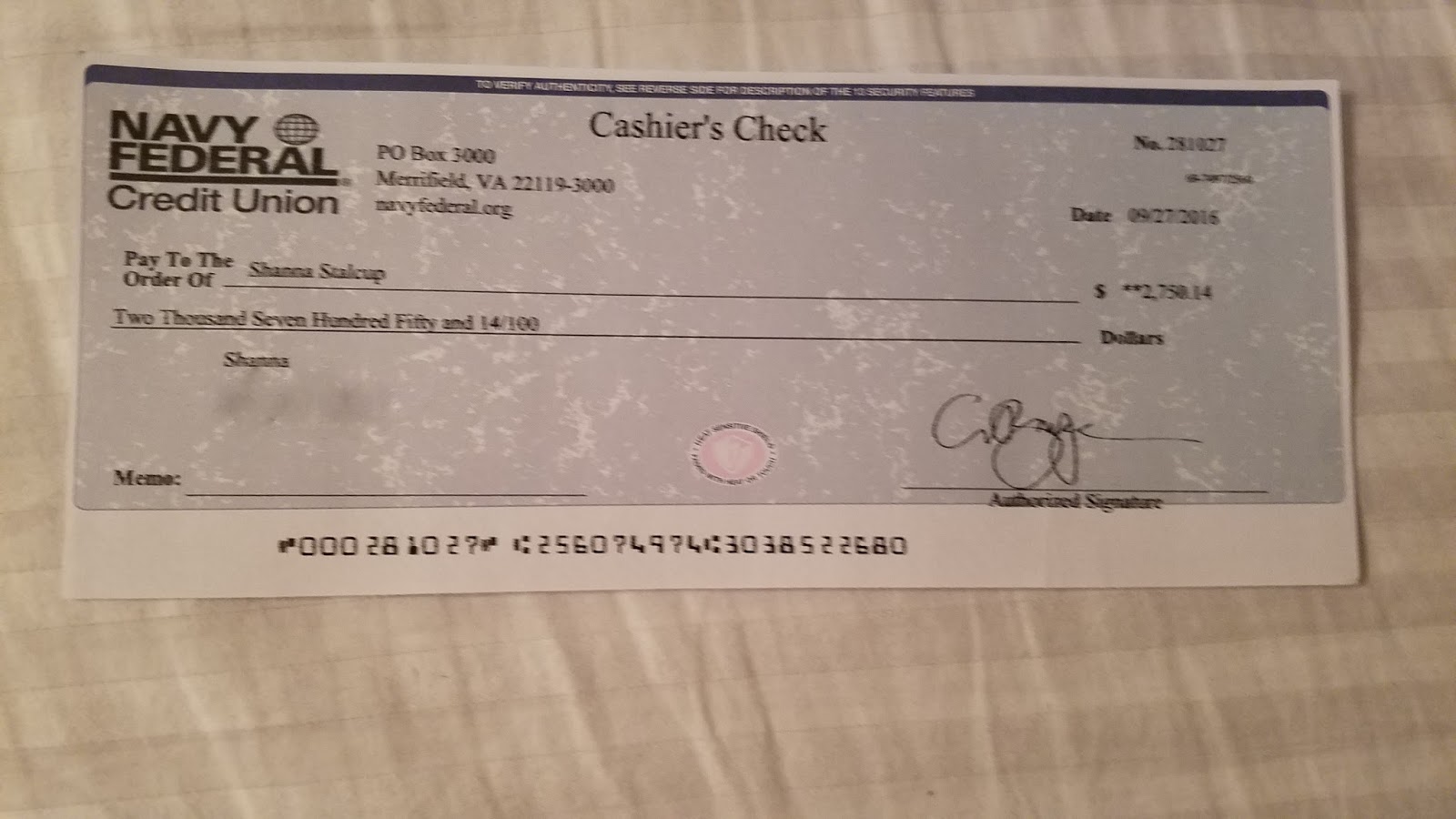

Your US Bank checking account number typically appears on your checks, deposit slips, and online banking platform. It’s usually located at the bottom of your checks, alongside the routing number.

One benefit of having a US Bank checking account is the convenience of direct deposit. By providing your account number and routing number to your employer, you can have your paycheck deposited directly into your account, eliminating the need for physical checks.

Another benefit is the ability to make online payments. Using your US Bank account number and routing number, you can easily pay bills and shop online without needing physical checks or cash.

A third benefit is the ability to set up automatic bill payments. By providing your account information, you can automate recurring payments, ensuring you never miss a due date.

Advantages and Disadvantages of Online Banking

| Advantages | Disadvantages |

|---|---|

| Convenience of accessing your account anytime, anywhere. | Security risks associated with online transactions. |

| Easy access to account information and transaction history. | Potential for technical difficulties or website outages. |

Best Practice 1: Never share your US Bank checking account number over the phone or via unencrypted email.

Best Practice 2: Regularly monitor your account statements for unauthorized transactions.

Best Practice 3: Use strong passwords for your online banking account.

Best Practice 4: Be cautious of phishing scams that attempt to steal your account information.

Best Practice 5: Shred old checks and bank statements to protect your account number.

FAQ 1: How do I find my US Bank checking account number? Answer: You can find it on your checks, deposit slips, and online banking platform.

FAQ 2: What is the difference between a checking account number and a routing number? Answer: The checking account number identifies your specific account, while the routing number identifies the bank.

FAQ 3: What should I do if I lose my checks? Answer: Contact US Bank immediately to report the loss and request new checks.

FAQ 4: Can I change my checking account number? Answer: Contact US Bank to inquire about changing your account number.

FAQ 5: What is the format of a US Bank checking account number? Answer: The format can vary, but it is usually a string of numbers.

FAQ 6: How is my US Bank checking account number used for online transactions? Answer: It's used with your routing number to identify your account for deposits, withdrawals, and transfers.

FAQ 7: Is it safe to provide my checking account number for direct deposit? Answer: Yes, it is generally safe when provided to trusted sources like your employer.

FAQ 8: How can I protect my US Bank checking account number from fraud? Answer: Follow security best practices, like monitoring your account and being cautious of phishing scams.

Tip: Store your US Bank checking account number in a secure location. Trick: Create a strong password for your online banking account using a combination of letters, numbers, and symbols.

In conclusion, your US Bank checking account number is an essential element of your financial life. It's crucial for accessing your funds, making transactions, and ensuring the smooth operation of your finances. Understanding its importance, knowing how to locate it, and practicing security measures are critical for protecting your financial well-being. By following the best practices outlined in this article, you can safeguard your account and maintain control over your financial resources. Remember to monitor your account regularly, protect your account number, and utilize the resources available to you through US Bank for a secure and efficient banking experience. Take advantage of the convenience and security features offered by US Bank to manage your finances effectively. By taking proactive steps to understand and protect your US Bank checking account number, you empower yourself to navigate the financial landscape with confidence.

Finding the best builder of contemporary homes near me reviews

Unleash the smackdown universe your guide to wwes blue brand

Power up your safety the ultimate guide to hand and power tool inspections

/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

:max_bytes(150000):strip_icc()/where-is-the-account-number-on-a-check-315278_final-30e94da21d1644329716939bef5107ac.png)