Decoding Your PNC Bank Check: A Treasure Hunt for Your Account Number

Ever found yourself staring at a PNC Bank check, feeling like you're on a scavenger hunt for your account number? You're not alone. This seemingly simple string of numbers can be surprisingly elusive, hidden amidst a flurry of routing numbers, check numbers, and other financial hieroglyphics. Fear not, intrepid financial explorer! This guide is your map to navigating the terrain of your PNC Bank check and uncovering the whereabouts of that all-important account number.

Locating your PNC Bank check account number is more than just a quirky banking puzzle. It's a fundamental piece of information you'll need for various financial transactions, from setting up direct deposit to making online payments. Imagine trying to wire money without knowing your account details – it's like trying to send a letter without an address. Your PNC check account number is your financial address, the key to accessing and managing your funds.

The placement of the PNC Bank check account number follows a standardized format, a common language shared across the banking world. This isn't some arcane secret passed down through generations of bankers; it's designed for efficiency and clarity. But even with standardization, deciphering a check can sometimes feel like cracking a code. We'll break down the anatomy of a PNC Bank check, revealing the exact location of your account number and demystifying the surrounding numerical landscape.

While the location of your PNC account number is consistent on your checks, understanding its importance extends beyond simply finding it. Protecting this number is paramount to safeguarding your finances. Think of it as your financial fingerprint – unique to you and crucial for your financial security. Mishandling your account number can expose you to potential fraud and unauthorized access to your funds. This guide will equip you with the knowledge and best practices to keep your account number safe and secure.

Beyond the physical check, your PNC Bank account number can be found in various other locations, each serving a different purpose. From your online banking portal to your monthly statements, your account number is readily accessible, provided you know where to look. This guide will explore these various access points, empowering you to manage your finances with confidence and ease.

Historically, check account numbers have evolved alongside the banking system. Their location on checks became standardized to facilitate efficient processing. The importance of this number lies in its unique identification of your account, enabling secure transactions. One of the main issues associated with account numbers is the risk of fraud if they fall into the wrong hands.

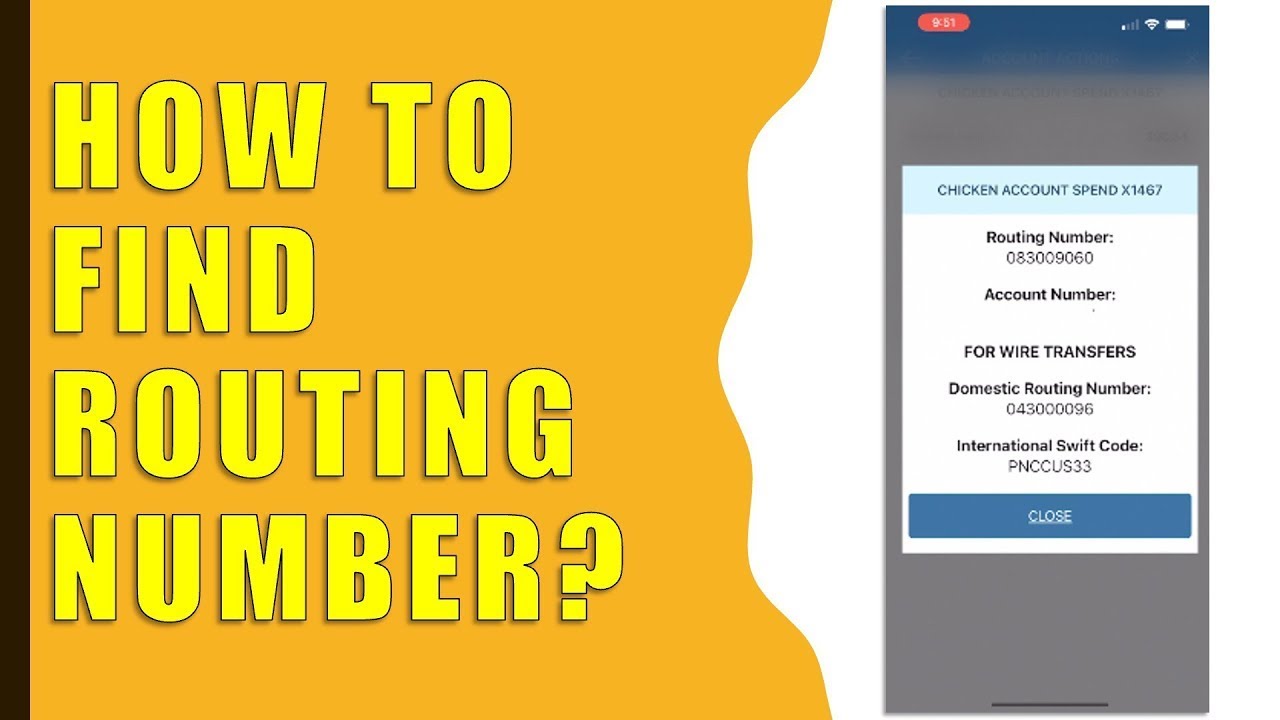

Your PNC Bank check account number is located at the bottom of your check, between the routing number on the left and the check number on the right. It is typically a 9-12 digit number.

Benefits of knowing your PNC Bank check account number location: 1. Easy access for online transactions. 2. Setting up direct deposit. 3. Quickly providing information for wire transfers.

To locate your account number: 1. Obtain a PNC Bank check. 2. Look at the bottom of the check. 3. Identify the number located between the routing number and the check number.

Advantages and Disadvantages of Knowing Your Account Number Location

| Advantages | Disadvantages |

|---|---|

| Facilitates transactions | Risk of fraud if mishandled |

FAQs:

1. What if I can't find my checkbook? A: Check your online banking or contact PNC customer service.

2. Is my account number the same as my routing number? A: No, they are different.

3. How many digits is my PNC account number? A: Typically 9-12 digits.

4. Can I find my account number online? A: Yes, through your online banking portal.

5. What should I do if I suspect fraudulent activity? A: Contact PNC immediately.

6. How can I protect my account number? A: Store your checks securely and shred old checks.

7. Where can I find more information about my account? A: PNC Bank's website or customer service.

8. What if my check is damaged and I can't read the number? A: Request a new check from PNC.

Tips and tricks: Keep your checks in a safe place. Shred old or voided checks. Be cautious about sharing your account number.

In conclusion, knowing the location of your PNC Bank check account number is essential for navigating the world of personal finance. It's not just a random string of numbers; it's your financial address, the key to accessing and managing your funds. Understanding where to find this number, how to use it, and most importantly, how to protect it, empowers you to take control of your finances. By following the tips and best practices outlined in this guide, you can confidently navigate the financial landscape and ensure the security of your hard-earned money. Take the time to familiarize yourself with your PNC Bank check and its components – it’s a small investment of time that can pay big dividends in terms of financial literacy and security. Don’t hesitate to contact PNC Bank if you have any further questions or require assistance. Your financial well-being is their priority.

Belated happy birthday memes

Unveiling the secret the alchemy of peach color

Choosing the perfect nombres para chicos guapos a guide