Decoding the Matrix: JP Morgan Chase Incoming Wire Transfers

Ever wondered how money magically traverses the globe in the blink of an eye? In today's interconnected world, transferring funds across borders or even within the country is a common necessity. One prominent player in this financial landscape is JP Morgan Chase, and their incoming wire transfer service is a key component of this intricate system. But what exactly are these "incoming wire transfers" at Chase, and why should you care?

JP Morgan Chase incoming wire transfers are electronic methods of receiving funds directly into your Chase account. They provide a secure and efficient way to receive payments from businesses, individuals, and institutions, both domestically and internationally. Think of it as a digital highway for money, bypassing the traditional paper-check route and offering a faster, more streamlined experience.

The history of wire transfers predates the internet, originating in the 19th century with the invention of the telegraph. Banks quickly realized the potential of this technology for transmitting financial information, and the concept of wire transfers was born. Today, with the advent of electronic banking and sophisticated security measures, JP Morgan Chase incoming wire transfers represent a crucial component of modern finance, facilitating countless transactions every day.

The significance of JP Morgan Chase incoming wire transfers lies in their speed, security, and global reach. They are essential for large-value transactions, international commerce, and time-sensitive payments. However, they also come with their own set of challenges, such as potential delays, fees, and the risk of fraud if proper precautions aren't taken.

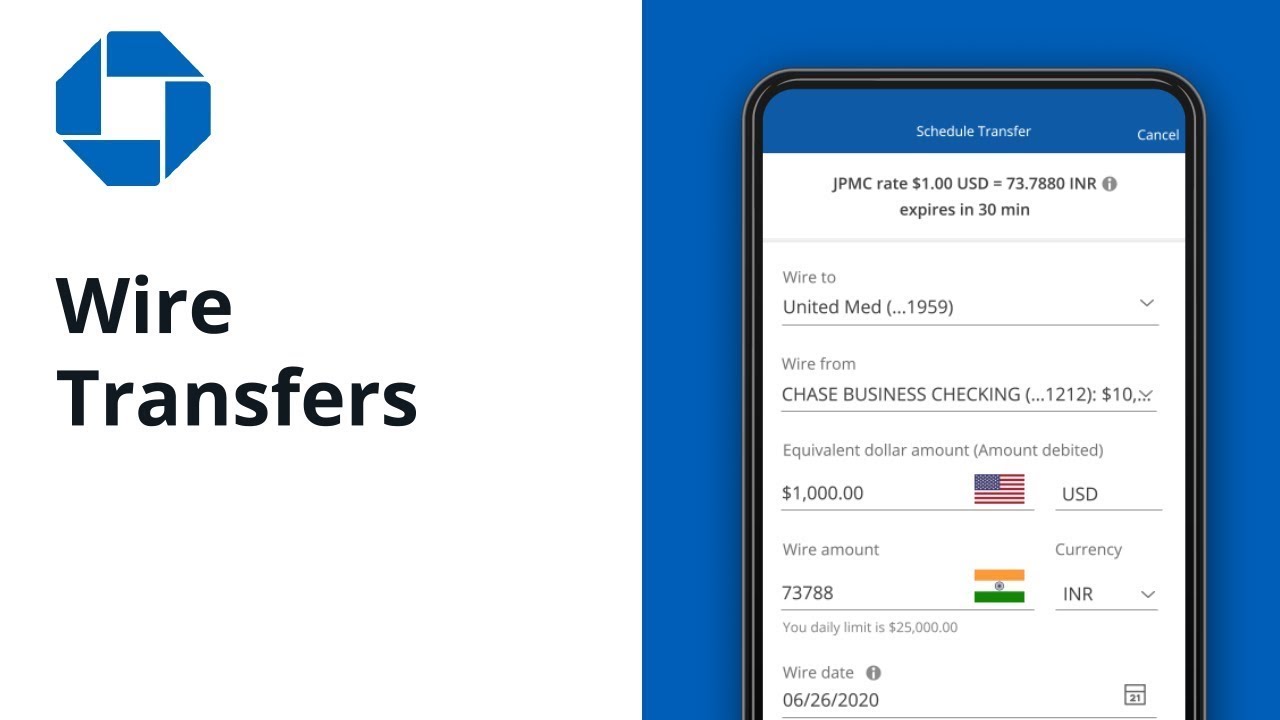

Understanding how JP Morgan Chase incoming wire transfers work is crucial for both individuals and businesses. The process typically involves the sender providing their bank with your Chase account details, including the account number, routing number, and your name as it appears on the account. They then initiate the transfer, and the funds are electronically transmitted to your Chase account. This can take anywhere from a few hours to a few business days, depending on various factors like the origin of the funds and currency conversions.

Benefits of using JP Morgan Chase incoming wires include faster processing than traditional checks, enhanced security measures protecting your funds, and the ability to receive payments from virtually anywhere in the world. For example, if a client in London needs to pay you immediately for a service rendered, a wire transfer is a swift and reliable option.

To initiate a JP Morgan Chase incoming wire, the sender needs your Chase account details, including the account number and routing number, along with your full name. The sender then instructs their bank to transfer the funds, providing these details. Ensure all information is accurate to avoid delays or rejection of the transfer.

While wire transfers are generally secure, it's important to be vigilant against fraud. Double-check the sender's information and be wary of unsolicited requests for your bank details. Report any suspicious activity to Chase immediately.

Advantages and Disadvantages of JP Morgan Chase Incoming Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Fast Processing | Potential Fees |

| Secure Transactions | Irreversible Transactions |

| Global Reach | Requires Accurate Information |

Best practices for receiving wire transfers include verifying the sender's identity, confirming all account details are accurate, and monitoring your account for incoming funds. Regularly review your bank statements for any discrepancies and report any suspicious activity to the bank immediately.

Frequently Asked Questions about JP Morgan Chase Incoming Wire Transfers:

1. How long does it take to receive an incoming wire transfer?

2. What are the fees associated with incoming wire transfers?

3. What information is needed to receive a wire transfer?

4. How can I track the status of an incoming wire transfer?

5. What should I do if I suspect fraudulent activity related to a wire transfer?

6. What are the limits on incoming wire transfer amounts?

7. Can I receive a wire transfer in a foreign currency?

8. What are the cut-off times for receiving wire transfers?

(General answers should be provided for these FAQs).In conclusion, JP Morgan Chase incoming wire transfers are a vital tool in today's financial landscape, offering a rapid, secure, and efficient way to receive funds electronically. While there are potential challenges, understanding the process, following best practices, and remaining vigilant can ensure a smooth and successful experience. The ability to move money swiftly and securely across borders and within the country is crucial for businesses and individuals alike. By leveraging the power of JP Morgan Chase incoming wire transfers, you can navigate the complexities of modern finance with confidence and efficiency. Whether you're a business owner receiving payments from international clients or an individual receiving funds from family abroad, Chase wire transfers provide a reliable and convenient solution for your financial needs. Contact your local Chase branch or visit their website for more details.

Unlocking success your guide to borang permohonan pengesahan projek perkeso

Unlocking freedom your guide to the yamaha vx cruiser waverunner

Unlocking the mystique a journey into the hidden chambers of ps99