Decoding the JPMorgan Chase Wire Routing Number for California: Your Ultimate Guide

So, you're dealing with money, the California dreamin' kind, and suddenly, this enigmatic string of numbers appears: the JPMorgan Chase wire routing number for California. Don't worry, it's not some secret code. It's just a crucial piece of information that ensures your money ends up in the right place. Think of it as the GPS coordinates for your funds.

Let's be real, navigating the world of finance can be a headache. Between account numbers, SWIFT codes, and now this routing number business, it's enough to make anyone's head spin. But fear not, intrepid Californian, because we're about to break down everything you need to know about the JPMorgan Chase wire routing number for your golden state.

First off, why even bother with this routing number? Simply put, it's the address your bank uses to identify itself in the vast network of financial institutions. When you initiate a wire transfer, this number tells the system exactly which JPMorgan Chase bank in California should receive or send the funds. Without it, your money could get lost in the digital ether, and nobody wants that.

Now, you might be thinking, "Isn't there just one routing number for JPMorgan Chase?" Nope, not quite. Different states, sometimes even different branches within a state, can have different routing numbers. That's why it's essential to use the correct JPMorgan Chase California routing number for your specific transaction. Using the wrong one can lead to delays, returned funds, or even worse, sending your money to the wrong account. Yikes!

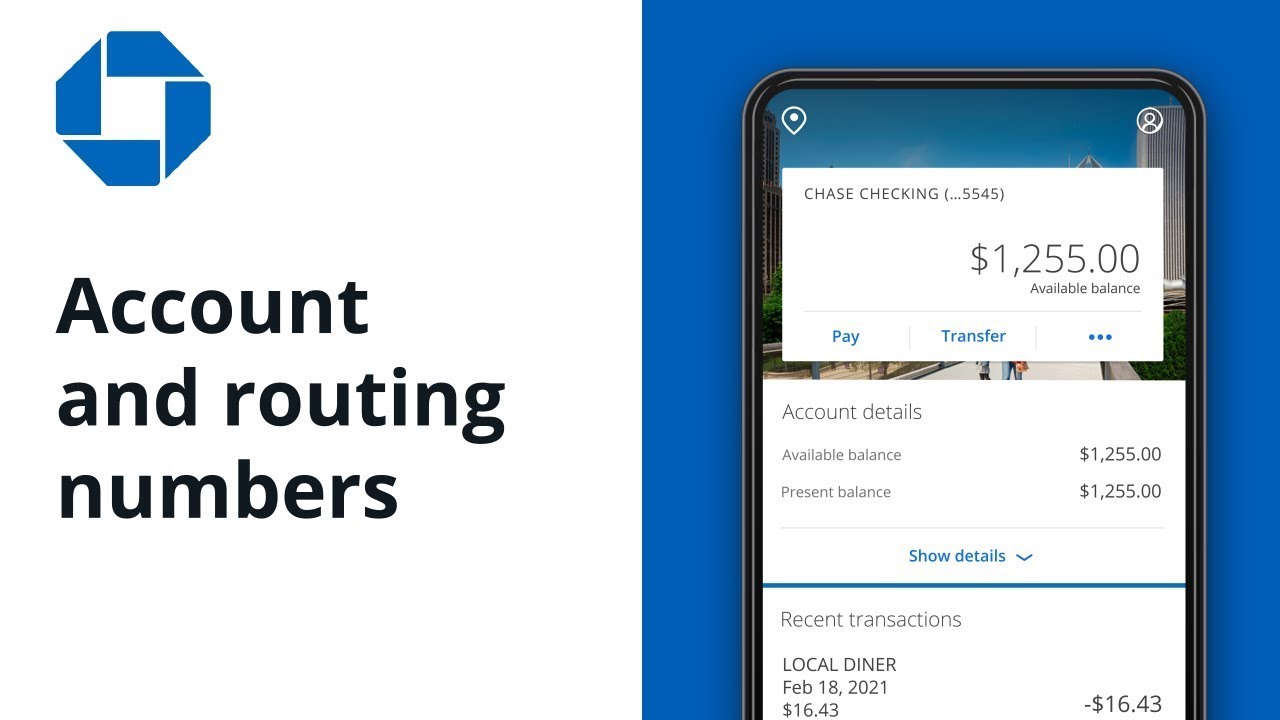

So, how do you find this magical number? The easiest way is to check your JPMorgan Chase bank statement. It's usually printed somewhere near your account number. You can also find it on the bank's website, or by contacting customer service. But be warned, the internet is a wild place, so always double-check the information on a reputable source like the official JPMorgan Chase website to avoid any scams or misinformation.

The history of routing numbers is tied to the development of the Federal Reserve System in the early 20th century. These numbers were created to facilitate interbank transactions and standardize the process of transferring money between different banks. The American Bankers Association (ABA) assigns these numbers, ensuring each financial institution has a unique identifier.

Let's say you're sending money to a friend in California who banks with JPMorgan Chase. You'll need their account number and the correct California routing number for JPMorgan Chase to ensure the transfer goes through smoothly. Similarly, if you're receiving a wire transfer, you'll need to provide the sender with your account number and the appropriate routing number.

While the correct routing number is crucial for successful transactions, using the wrong one can lead to delays and returned funds. It's always best to double-check the information you have with your bank or on their official website.

Advantages and Disadvantages of Using Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Fast transfer speeds | Can be expensive compared to other methods |

| Secure way to send large amounts of money | Irreversible once processed |

Best Practices:

1. Always verify the routing number with your bank.

2. Double-check the recipient's account information.

3. Keep records of your wire transfers.

4. Be wary of phishing scams requesting your banking details.

5. Contact your bank immediately if you suspect any fraudulent activity.

FAQ:

1. What is a routing number? - A routing number identifies a specific bank in the US.

2. Where can I find my JPMorgan Chase routing number? - On your bank statement, the bank's website, or by contacting customer service.

3. What happens if I use the wrong routing number? - The transfer might be delayed, returned, or sent to the wrong account.

4. Is the routing number the same for all JPMorgan Chase branches in California? - No, it can vary.

5. What is the difference between a routing number and an account number? - The routing number identifies the bank, while the account number identifies your specific account.

6. Are wire transfers safe? - Generally yes, but be cautious of scams.

7. How long does a wire transfer take? - Typically within the same business day.

8. Can I cancel a wire transfer? - Contact your bank immediately, but it may not be possible.

In conclusion, the JPMorgan Chase wire routing number for California, while seemingly a small detail, plays a vital role in ensuring your funds reach their intended destination. Understanding its importance and using the correct number can save you time, money, and unnecessary headaches. By following the best practices and verifying information, you can navigate the world of wire transfers with confidence. So, the next time you're sending or receiving money, remember the power of this nine-digit code and double-check everything. Your wallet will thank you.

Afton family as vines when gaming memes collide with bite sized comedy

The artful ascendancy of oba jackson an ink master journey

Time card salad calculator a recipe for disaster or delicious efficiency