Decoding the JPMorgan Chase Wire Routing Number

Navigating the world of finance can feel like deciphering a complex code. One crucial piece of this code, particularly for electronic transactions, is the wire routing number. For JPMorgan Chase customers, understanding the specifics of the JPMorgan Chase wire routing number is paramount for seamless and secure transactions.

Imagine needing to send a large sum of money quickly and securely. Whether it's for a down payment on a house, a crucial business transaction, or an international transfer, a wire transfer is often the preferred method. At the heart of this process lies the JPMorgan Chase wire routing number, a nine-digit code that identifies the specific JPMorgan Chase branch involved in the transaction.

The significance of this number cannot be overstated. It's the key that unlocks the door to a successful wire transfer. Without the correct JPMorgan Chase wire routing number, your funds could be delayed, sent to the wrong account, or even lost. This underscores the importance of understanding how to locate and use your specific routing number accurately.

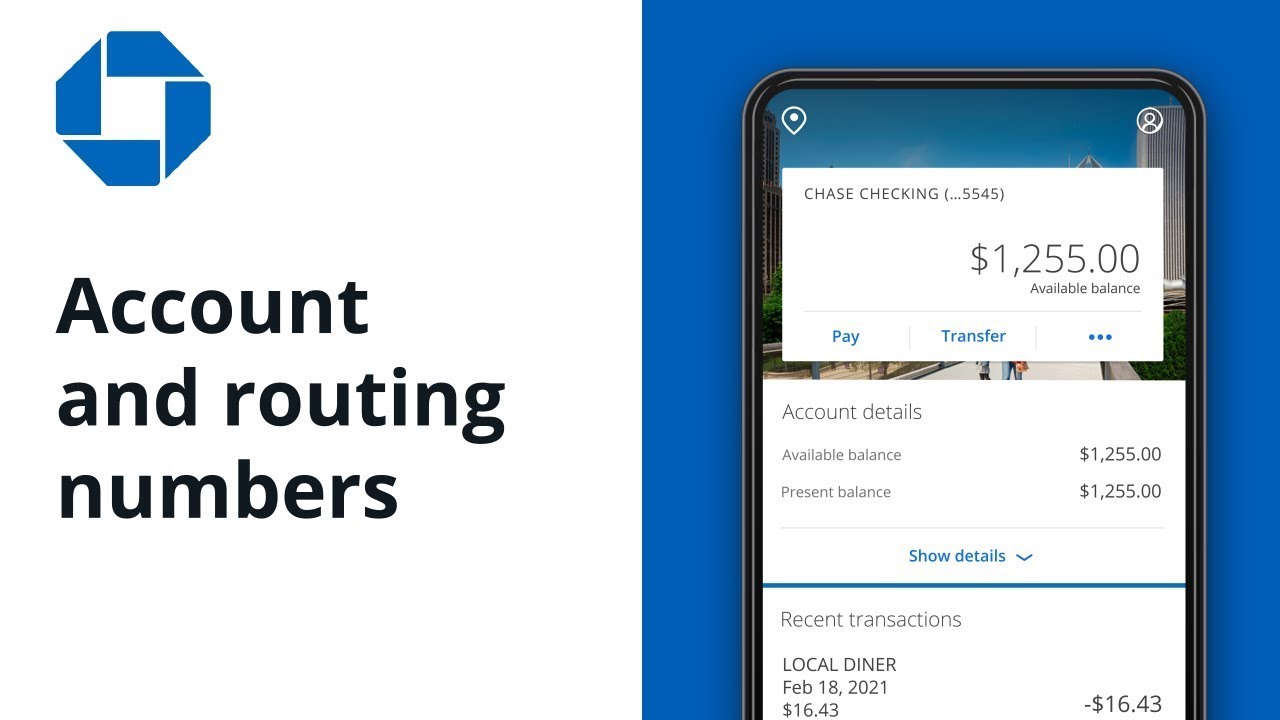

Finding your JPMorgan Chase wire routing number isn't a scavenger hunt. Several readily available resources can provide you with this vital information. Your checkbook, online banking platform, and official JPMorgan Chase website are all reliable sources. Understanding where to find this information empowers you to initiate wire transfers with confidence.

While the process of using a wire routing number is generally straightforward, certain issues can arise. Incorrectly entered numbers, using the wrong routing number for the type of transaction (domestic vs. international), or outdated information can all lead to complications. Being aware of these potential pitfalls can help you avoid delays and ensure your funds reach their intended destination.

The JPMorgan Chase wire routing number has evolved alongside the banking industry. Initially, routing numbers were assigned to facilitate check clearing processes between banks. With the rise of electronic transactions, the role of the routing number expanded to encompass wire transfers, ACH payments, and other electronic fund transfers.

The JPMorgan Chase wire routing number acts as a digital address for your bank branch. It ensures that funds are routed correctly within the complex network of financial institutions. Its importance lies in its ability to facilitate accurate and efficient transfer of funds, which is crucial for both personal and business financial operations.

One benefit of using the correct JPMorgan Chase wire routing number is speed. Wire transfers are known for their quick processing times, often allowing funds to be available within the same business day. Another advantage is security. Wire transfers are generally considered a secure method of transferring funds, particularly when compared to other methods like mailing checks.

To initiate a wire transfer with JPMorgan Chase, you'll need the recipient's name, account number, bank name, and the correct wire routing number for their bank. You'll also need to specify the amount and any associated fees. This information is typically entered through your online banking platform or provided to a bank teller in person.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| Large Sum Transfers | Potential for Errors |

Best Practices for Wire Transfers:

1. Double-check all information: Verify the recipient's details and the routing number.

2. Use secure channels: Initiate wire transfers through secure online banking platforms or in person at a bank branch.

3. Keep records: Maintain documentation of all wire transfer details.

4. Be aware of fees: Understand the associated fees before initiating a transfer.

5. Contact customer support: If you have any questions or concerns, reach out to JPMorgan Chase customer support.

Frequently Asked Questions:

1. Where can I find my JPMorgan Chase wire routing number? Check your checkbook, online banking, or the JPMorgan Chase website.

2. What is the difference between a domestic and international wire routing number? Domestic routing numbers are used for transfers within the United States, while international routing numbers (SWIFT codes) are used for international transfers.

3. What happens if I use the wrong routing number? The transfer could be delayed, sent to the wrong account, or returned.

4. Are there fees associated with wire transfers? Yes, JPMorgan Chase typically charges fees for both incoming and outgoing wire transfers.

5. How long does a wire transfer take? Domestic wire transfers often complete within the same business day, while international transfers may take longer.

6. Is it safe to send wire transfers online? Yes, using a secure online banking platform is generally safe for initiating wire transfers.

7. Can I cancel a wire transfer? It may be possible to cancel a wire transfer if it hasn't been processed yet. Contact JPMorgan Chase immediately.

8. What should I do if I suspect fraudulent activity related to a wire transfer? Contact JPMorgan Chase immediately to report the suspected fraud.

Tips and Tricks: Save your routing number in a secure location for easy access. Always double-check the recipient's information before initiating a transfer. Set up transaction alerts to monitor your account activity.

In conclusion, the JPMorgan Chase wire routing number plays a critical role in facilitating secure and efficient electronic fund transfers. Understanding how to locate, use, and protect this crucial piece of information empowers you to navigate the complexities of the financial world with confidence. By following best practices, staying informed about potential issues, and utilizing available resources, you can ensure your wire transfers are processed smoothly and accurately. From small business transactions to significant personal payments, the correct use of the JPMorgan Chase wire routing number ensures that your funds reach their intended destination swiftly and securely. Take the time to familiarize yourself with this essential component of electronic banking and experience the peace of mind that comes with knowing your finances are handled with precision and care. Don't hesitate to contact JPMorgan Chase customer support if you have any questions or require assistance with your wire transfers.

Savor st john uncovering the islands top dining gems

Upgrade your ride exploring the world of toyota sequoia wheels

The intriguing impulse to crack your back como tronarse la espalda