Decoding JPMorgan Chase Bank Wire Transfer Addresses

Navigating the world of international finance can feel daunting, especially when it comes to wire transfers. For those dealing with JPMorgan Chase, understanding the specifics of their wire transfer address system is crucial for smooth and successful transactions.

A JPMorgan Chase bank wire transfer address isn't a physical location, but rather a combination of codes and numbers that identify the specific bank branch involved in the transfer. This information ensures that your funds reach the correct destination swiftly and securely. This seemingly complex process can be demystified with a little understanding of the key components involved.

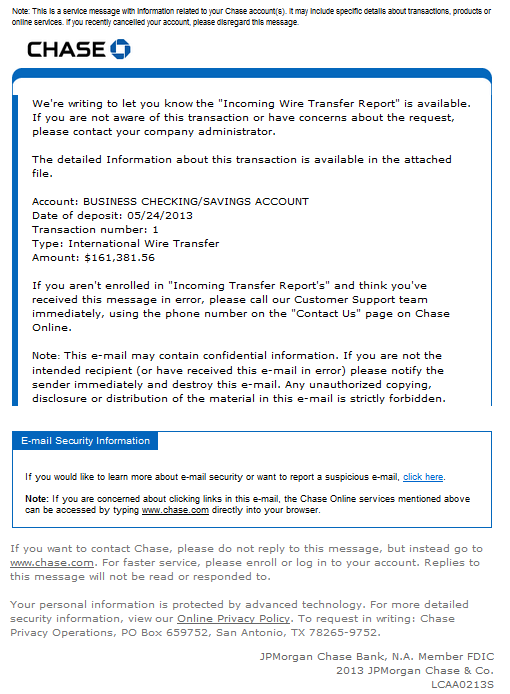

One of the most important elements is the SWIFT code, also known as the BIC (Bank Identifier Code). This unique identifier helps pinpoint the exact JPMorgan Chase branch internationally. Domestically, routing numbers serve a similar purpose, identifying the specific Chase bank within the United States. Accurate information for both domestic and international transfers is vital to avoid delays or misdirected funds.

Getting the right JPMorgan Chase bank wire transfer details is paramount. While online resources can provide some information, directly contacting the bank or referring to your account statements is the most reliable way to obtain the necessary codes and numbers. This proactive approach minimizes the risk of errors and ensures a seamless transfer process.

Beyond simply knowing the right address, understanding the process is equally important. Wire transfers with Chase typically involve fees, both incoming and outgoing. Being aware of these costs upfront helps avoid surprises and allows for better budgeting. Additionally, processing times can vary, so factoring this into your financial planning is essential.

The origins of wire transfers predate modern banking systems, evolving from telegraphic transfers. JPMorgan Chase, with its rich history in finance, has been instrumental in shaping the modern wire transfer system. Today, these transfers are a cornerstone of global commerce, enabling rapid and secure movement of funds across borders and within countries.

One common challenge with JPMorgan Chase wire transfers, like any other bank, is ensuring accuracy. Inputting incorrect information can lead to significant delays or even lost funds. Double-checking all details before initiating a transfer is a crucial best practice. Other common issues include unexpected fees and varying processing times. These issues are typically addressed by thorough research and planning.

A JPMorgan Chase domestic wire transfer typically requires the recipient's name, account number, and the bank's routing number. For international transfers, you'll need the SWIFT code, IBAN (International Bank Account Number) if applicable, recipient's name and address, and their account number.

Benefits of wire transfers include speed, security, and large transfer capabilities. For instance, a business needing to quickly settle a large invoice internationally can leverage wire transfers for a rapid and secure transaction. Similarly, individuals may use them for time-sensitive payments like real estate purchases.

Advantages and Disadvantages of Wire Transfers with JPMorgan Chase

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency | Cost (fees can be substantial) |

| Security and reliability | Irreversible nature (errors can be costly) |

| Large transfer capacity | Potential for delays due to incorrect information |

Best Practices:

1. Verify all recipient information with the recipient directly.

2. Use secure banking channels for initiating transfers.

3. Keep records of all transfer details.

4. Be aware of potential fees and factor them into your budget.

5. Contact Chase directly for any questions or concerns.

Frequently Asked Questions:

1. What is a SWIFT code? - A unique identifier for banks involved in international transfers.

2. How do I find the correct routing number? - Check your account statement or contact Chase.

3. How long do wire transfers take? - Typically 1-3 business days.

4. What are the fees associated with wire transfers? - Vary based on domestic/international and transfer amount.

5. How can I track my wire transfer? - Contact Chase customer service with your transfer details.

6. What happens if I enter incorrect information? - Contact Chase immediately to attempt to rectify the issue.

7. Is there a limit on the amount I can transfer? - Contact Chase for details regarding transfer limits.

8. Can I cancel a wire transfer? - Contact Chase immediately, as cancellation may be possible depending on the transfer's status.

Tips and Tricks: Initiate transfers during business hours for faster processing. Always double-check recipient details and save confirmation receipts.

In conclusion, understanding the intricacies of JPMorgan Chase bank wire transfer addresses is essential for successful transactions. From securing the correct SWIFT codes and routing numbers to being aware of fees and processing times, proactive planning and meticulous attention to detail are crucial. Leveraging the speed, security, and convenience of wire transfers through Chase can significantly streamline your financial activities, whether for business or personal use. By adhering to best practices, understanding the process, and utilizing the available resources, you can navigate the complexities of wire transfers with confidence, ensuring your funds reach their intended destination safely and efficiently. Take the time to research, verify, and double-check, and your wire transfer experience with JPMorgan Chase will be smooth and stress-free. By embracing these best practices, you can harness the power of wire transfers to effectively manage your finances in today's interconnected world.

Level up your online presence the ultimate guide to cool usernames for boys

Level up your game the ultimate guide to dd character sheets printable pdfs

Pimp your ride the ultimate guide to customized decals for cars