Decoding Cashier's Checks: Your Guide to Bank of America

Navigating the world of financial instruments can feel overwhelming, especially when dealing with less common options like cashier's checks. This comprehensive guide will delve into the specifics of cashier's checks from Bank of America, answering your burning questions and equipping you with the knowledge you need to use them effectively.

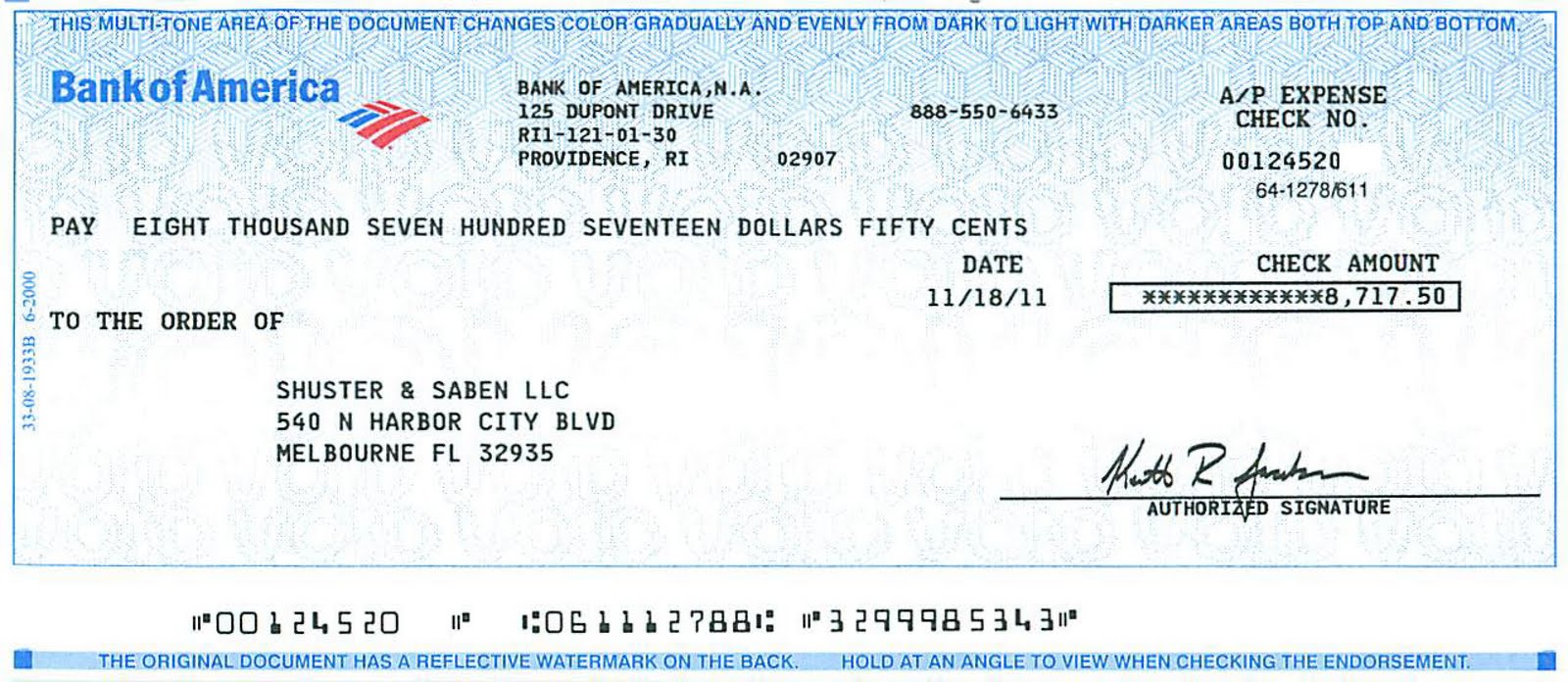

So, does Bank of America issue cashier's checks? Absolutely. Bank of America is a major financial institution that provides a full range of banking services, including cashier's checks. These checks, unlike personal checks, are guaranteed by the bank, making them a secure form of payment for larger transactions.

Why might you need a cashier's check? They're often required for significant purchases, such as buying a car, making a down payment on a house, or settling legal matters. The guarantee provided by the bank assures the recipient that the funds are available, offering a level of security not found with personal checks.

Obtaining a cashier's check from Bank of America generally involves visiting a branch. You'll need to provide identification and the exact amount for the check, along with any applicable fees. It's essential to have the correct information readily available to streamline the process. You can contact your local branch for specific requirements and fees.

While the history of cashier's checks isn't as glamorous as some other financial products, they have evolved to become an important tool in facilitating secure transactions. Originally, these checks served as a way to provide guaranteed payment in an era where personal checks weren't as widely accepted or trusted. Their importance lies in their ability to mitigate the risk of insufficient funds and provide a greater level of confidence for both the payer and the payee.

A cashier's check is essentially a check drawn on the bank's own funds. This means that the bank guarantees the availability of the funds, unlike a personal check, which relies on the individual's account balance. For example, if you're purchasing a car for $20,000, a cashier's check from Bank of America assures the seller that the bank has already set aside those funds.

Three key benefits of using a cashier's check from Bank of America include security, acceptance, and convenience. The guaranteed funds offer security for both buyer and seller. Wide acceptance makes them suitable for large transactions where personal checks might not be accepted. And while obtaining a cashier's check requires a trip to the bank, it simplifies the payment process for large sums.

To obtain a cashier's check from Bank of America, first gather necessary information like recipient details and the exact amount. Then, visit a local branch with valid identification and sufficient funds. Complete the required paperwork, pay the fee, and receive your cashier's check.

Advantages and Disadvantages of Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Funds | Requires a Trip to the Bank |

| Widely Accepted | Fees Involved |

| Increased Security | Risk of Loss or Theft (like cash) |

Best practices include verifying the recipient's information, keeping a copy of the check, and storing the check securely until it's needed. Always confirm the bank's current fees and procedures before visiting a branch.

Frequently Asked Questions:

1. Where can I get a cashier's check from Bank of America? Visit a local branch.

2. What do I need to bring to get a cashier's check? Valid identification and sufficient funds.

3. Are there fees for cashier's checks? Yes, contact your local branch for current fees.

4. Can I get a cashier's check online? This may vary, contact Bank of America for details.

5. How long is a cashier's check valid? Contact the bank for specifics.

6. What if my cashier's check is lost or stolen? Report it to the bank immediately.

7. Can I track my cashier's check? Inquire with the bank about tracking options.

8. Who can cash a cashier's check? Typically the designated recipient.

Tips: Keep your cashier's check safe and secure, just like cash. Make a copy of the check for your records.

In conclusion, Bank of America does issue cashier's checks, providing a secure and widely accepted method of payment for significant transactions. While obtaining a cashier's check requires a visit to a branch and involves fees, the benefits of guaranteed funds, enhanced security, and acceptance outweigh the minor inconveniences. By understanding the process, fees, and best practices outlined in this guide, you can confidently utilize cashier's checks from Bank of America for your financial needs. Remember to contact your local branch for the most up-to-date information on fees, requirements, and procedures. Proper use of cashier's checks can significantly simplify large transactions and provide peace of mind for both buyers and sellers. Take advantage of this valuable financial tool to facilitate secure and efficient transactions.

Hudson valley sidestepping the tourist traps

Unlocking the power of beige finding your perfect paint color

Decoding medicare plan b coverage