Cashier's Checks & Online Banking: A Modern Approach

In today's fast-paced digital world, even traditional banking instruments are adapting to the online realm. One such instrument is the cashier's check, a payment method known for its guaranteed funds and enhanced security. But can you obtain a cashier's check through your online banking platform? This article delves into the evolving landscape of cashier's checks and the role of online banking, particularly focusing on institutions like Bank of America.

Traditionally, obtaining a cashier's check required a physical visit to a bank branch. You'd fill out a request form, provide identification, and pay the necessary fees. The bank would then issue the check, drawing funds directly from your account. This process, while secure, could be time-consuming and inconvenient. With the rise of online banking, many are seeking more efficient ways to manage their finances, including requesting cashier's checks.

While some banks are exploring ways to fully integrate cashier's check requests into their online platforms, the process isn't universally available in the same way as, say, transferring funds between accounts. This is primarily due to security concerns and the need for verification. However, the future points towards increased digitization of this process. We can expect to see more banks offering online request options, perhaps with enhanced security measures like two-factor authentication or digital signature verification.

Bank of America, among other large financial institutions, currently offers several ways to obtain a cashier's check. While a fully online request and delivery system might not be available yet, they do offer the convenience of scheduling an appointment online to pick up a cashier's check at your local branch. This blends the digital ease of scheduling with the security of in-person verification. You can often initiate the request process online, filling out necessary information beforehand to expedite the in-branch process.

Understanding the benefits and limitations of online banking in relation to cashier's checks is crucial in navigating the modern financial landscape. The traditional method of physically visiting a branch offers guaranteed security and immediate receipt of the check. On the other hand, utilizing online tools for scheduling appointments or initiating requests can save time and effort. As technology evolves, we can expect a more seamless integration of cashier's checks into online banking platforms.

Historically, cashier's checks were primarily used for large transactions, like purchasing a car or a house, where guaranteed funds were essential. They offered a higher level of security than personal checks. Now, with the rise of digital payment methods, the use of cashier's checks has somewhat diminished, but they still play a significant role in certain situations.

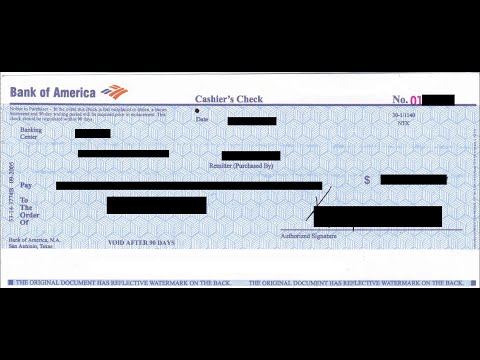

A cashier's check is a check guaranteed by a bank, drawn on the bank's own funds, and signed by a cashier. It is considered more secure than a personal check because the funds are guaranteed by the issuing bank. For example, if you're purchasing a used car from a private seller, a cashier's check provides assurance that the funds are available.

One of the main issues surrounding the transition to a fully online process for cashier's checks is security. Counterfeit checks are a concern, and banks need to implement robust security measures to prevent fraud. This is why many institutions still prefer the in-person verification process.

Advantages and Disadvantages of Utilizing Online Banking for Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Convenience of scheduling appointments | May not be fully online for all banks |

| Potential for faster processing in the future | Security concerns related to online transactions |

| Ability to initiate requests online (in some cases) | Requires in-person verification for pickup in most cases |

Best Practices when dealing with cashier's checks:

1. Verify the legitimacy of the issuing bank.

2. Ensure the check is properly filled out and signed.

3. Keep a copy of the check for your records.

4. Be wary of requests for cashier's checks in unusual situations (e.g., online scams).

5. Contact the issuing bank directly if you have any doubts about the authenticity of a cashier's check.

Frequently Asked Questions:

1. Can I get a cashier's check online from Bank of America? While you can't order one fully online and have it mailed, you can initiate the process and schedule an appointment for pickup.

2. Are cashier's checks safe? Yes, they are generally considered a safe form of payment.

3. What is the difference between a cashier's check and a money order? A cashier's check is issued by a bank, while a money order can be purchased from various locations.

4. How much does a cashier's check cost? Fees vary depending on the bank.

5. How long is a cashier's check valid? Cashier's checks do not typically expire, but it's best to deposit them promptly.

6. Can I track a cashier's check? You should retain your receipt and can inquire with the issuing bank.

7. What happens if a cashier's check is lost or stolen? Contact the issuing bank immediately.

8. Can I cancel a cashier's check? Yes, but it usually involves a process and fees.

Tips for using cashier's checks: Keep a record of the check number, date, and payee. Contact the issuing bank if you have any questions. Be aware of potential scams involving cashier's checks.

In conclusion, the intersection of cashier's checks and online banking is constantly evolving. While a fully online experience for requesting and receiving cashier's checks is not yet the norm, banks like Bank of America are offering increasing levels of digital integration. Understanding the current options, benefits, and limitations of using online banking for cashier's check-related tasks is essential for navigating today's financial world. By staying informed about the latest developments in online banking and utilizing the available tools, you can manage your finances more efficiently and securely. As technology progresses, we can anticipate more streamlined and fully digital options for handling cashier's checks in the near future, making transactions even smoother and more convenient. Taking advantage of these advancements will be key to staying ahead in the rapidly changing financial landscape.

East point health center your guide to wellness in east point ga

The intricate threads of business corvel corporation dallas tx

Kuromi baku wallpaper the unexpectedly chic duo you need