Can You Cash a Check Signed Over to You? US Bank Policies Explained

You're holding a check, but it's not made out to you. Someone has written "Pay to the order of [Your Name]" on the back, effectively signing it over. Can you cash this at US Bank? The answer isn't a simple yes or no. While US Bank does have policies in place for handling endorsed checks, several factors come into play.

Navigating the world of endorsed checks can feel like entering a financial maze. It's essential to understand the terminology, potential risks, and US Bank's specific requirements before attempting to cash such a check. This article will shed light on these crucial aspects, empowering you with the knowledge to make informed decisions.

First and foremost, it's crucial to understand that US Bank, like many financial institutions, generally exercises caution when dealing with endorsed checks. This cautious approach stems from the heightened risk associated with these transactions. When a check is endorsed, it adds another layer of complexity and potential for fraud or disputes. US Bank has a responsibility to protect itself and its customers from such risks.

Several factors influence US Bank's decision to accept or reject an endorsed check. One key factor is the relationship between the bank and the individuals involved. If both the payee (the original recipient of the check) and the endorser (the person signing it over) are existing US Bank customers with good standing, the likelihood of acceptance increases. The bank can quickly verify identities and account histories, mitigating potential risks.

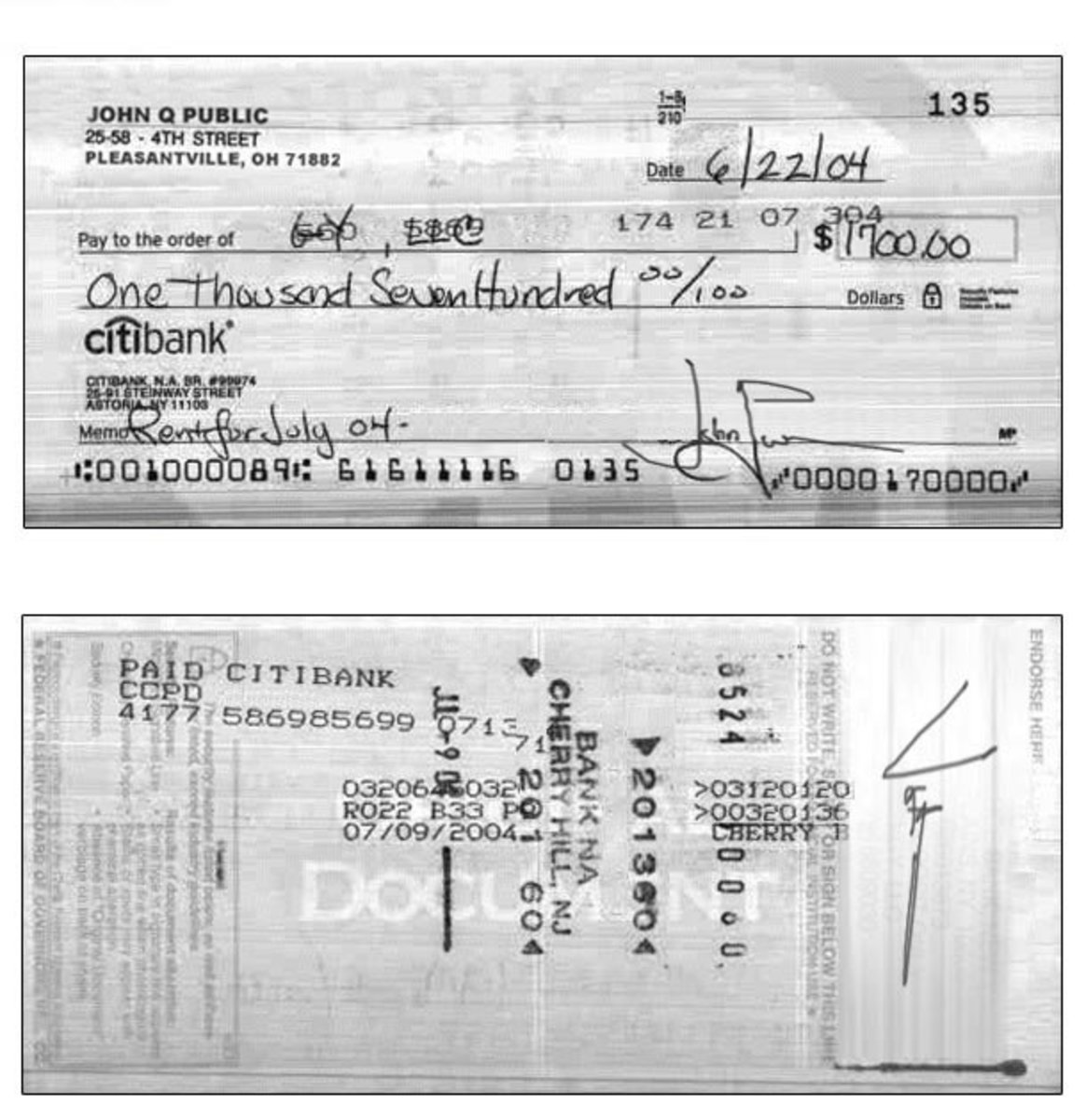

Another crucial aspect is the check itself. US Bank will carefully scrutinize the check's legitimacy, examining factors such as the issuer, the amount, and any visible alterations or damage. Checks drawn from reputable institutions or businesses are more likely to be accepted than those from unfamiliar or questionable sources. Furthermore, smaller check amounts may face fewer hurdles compared to substantial sums.

Let's say you have a check for $100 from a reputable company, endorsed to you by a close friend who also banks with US Bank. In this scenario, the bank may be more inclined to accept the check due to the established relationships, the smaller amount, and the check's origin from a trustworthy source.

However, suppose you're dealing with a check for $5,000 from an unknown individual, endorsed multiple times before reaching you. The bank's risk assessment would likely trigger red flags, potentially leading to rejection. The lack of a direct relationship, the significant amount, and the multiple endorsements create a higher risk profile, making US Bank more hesitant to process the transaction.

While these examples provide a general understanding, the best course of action is to contact your local US Bank branch or their customer service directly. They can provide the most up-to-date information and specific guidance based on your unique situation. Remember, policies can change, and it's always best to confirm the current procedures and requirements.

Advantages and Disadvantages of Accepting Signed-Over Checks

| Advantages | Disadvantages |

|---|---|

| Convenience for the recipient | Increased risk of fraud or disputes |

| Potential for quicker access to funds | Possibility of delays or holds on funds |

Ultimately, while US Bank does have policies in place for endorsed checks, the decision to accept or reject them depends on a thorough risk assessment. By understanding the factors influencing this decision and engaging in open communication with your bank, you can navigate the intricacies of endorsed checks with greater confidence.

Wells fargo mobile check deposit not working heres what to do

Gifted letter for mortgages the ultimate guide to navigating family finances

Banish furnace blues clearing your condensate drain