Access Your Wells Fargo Pension: A Comprehensive Guide

Planning for retirement is crucial, and understanding your pension benefits is a key part of that process. If you're a Wells Fargo employee or retiree, accessing your pension information is essential for making informed financial decisions.

This guide provides a comprehensive overview of accessing your Wells Fargo pension plan. We'll discuss the importance of regularly reviewing your pension information, the process of logging in to view your plan details, and common questions individuals have about their Wells Fargo pensions.

Accessing your Wells Fargo pension details online empowers you to track your retirement savings progress, understand your benefit options, and plan for a secure financial future. Regularly checking your pension information allows you to stay informed about any changes to your plan and ensure your details are accurate.

Navigating the online portal to access your Wells Fargo pension can sometimes seem daunting. This guide aims to simplify the process, providing clear and concise information to help you confidently manage your pension.

Whether you're nearing retirement or just starting your career, understanding your Wells Fargo pension is a vital step in securing your financial well-being. This guide will equip you with the knowledge and resources you need to make the most of your pension benefits.

Wells Fargo acts as a trustee or administrator for many pension plans. These plans are established by employers to provide retirement benefits to their employees. Wells Fargo's role is to manage these funds and ensure participants can access their information.

Historically, accessing pension information often involved contacting plan administrators or receiving paper statements. The online portal offered by Wells Fargo streamlines this process, providing convenient and secure access to your pension details.

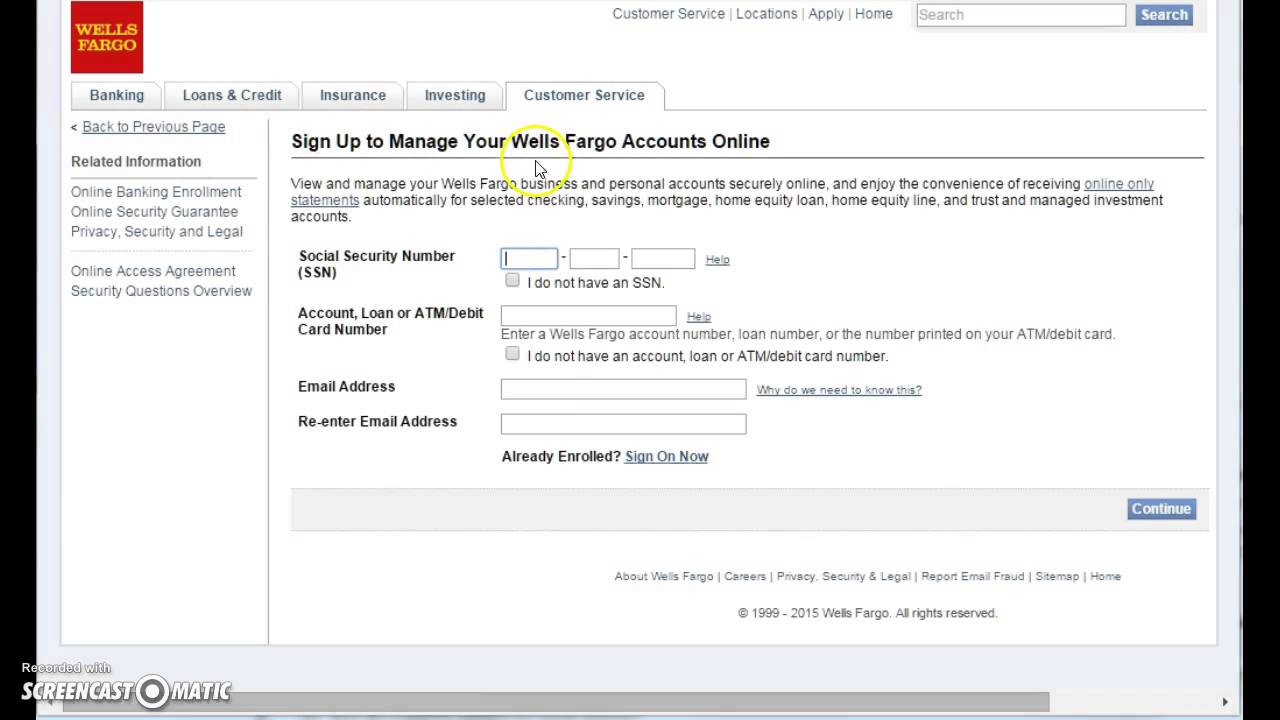

Logging in to view your Wells Fargo pension involves visiting the designated website and entering your credentials, typically a username and password. Once logged in, you can access various details, such as your vested balance, estimated benefit payments, and beneficiary information.

One benefit of accessing your Wells Fargo pension online is the convenience. You can view your information anytime, anywhere, without waiting for paper statements or contacting customer service.

Another advantage is the ability to track your pension growth over time. This allows you to monitor your progress towards your retirement goals and make adjustments to your savings strategy as needed.

Having access to your pension details online also empowers you to stay informed about any changes to your plan, ensuring you're always aware of your benefits.

Start by gathering your login credentials, typically a username and password provided by Wells Fargo. Then, navigate to the Wells Fargo pension portal website. Enter your login information and access your pension details.

Advantages and Disadvantages of Online Pension Access

| Advantages | Disadvantages |

|---|---|

| 24/7 Access | Requires internet access |

| Convenient and easy to use | Potential security risks |

| Up-to-date information | Technical issues may arise |

Best Practices:

1. Regularly review your pension information.

2. Keep your login credentials secure.

3. Update your beneficiary information as needed.

4. Contact Wells Fargo customer service if you have any questions.

5. Familiarize yourself with the online portal's features.

FAQ:

1. How do I access my Wells Fargo pension online? - Visit the designated website and enter your login credentials.

2. What if I forget my password? - Use the password recovery option on the website.

3. How often should I review my pension information? - At least annually.

4. Can I update my beneficiary information online? - Typically, yes.

5. Where can I find more information about my Wells Fargo pension? - Contact Wells Fargo customer service or consult your plan documents.

6. What if I encounter technical difficulties? - Contact Wells Fargo technical support.

7. How can I ensure the security of my pension information? - Use strong passwords and avoid accessing your account on public Wi-Fi.

8. What if my employer changes pension administrators? - Your access process may change, so contact your HR department for updated information.

Tips for accessing your Wells Fargo pension online: Ensure you have your correct login credentials, use a secure internet connection, and contact customer service if you experience any difficulties.

In conclusion, accessing your Wells Fargo pension plan online is crucial for effective retirement planning. By regularly reviewing your pension details, you can stay informed about your benefits, track your progress, and make informed financial decisions. Understanding your pension plan is an important step in securing your financial future. Take advantage of the online resources provided by Wells Fargo and contact customer service if you need assistance. Actively managing your pension can contribute significantly to a comfortable and secure retirement. It empowers you to take control of your financial well-being and plan for the future with confidence. Begin by accessing your Wells Fargo pension plan online today to gain a clearer picture of your retirement savings.

Matrix cto water filters purifying your water for a healthier life

Remembering harold rollins the end of an era

Unveiling the secrets a deep dive into anyas family